We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Betterment / Wealthfront

banthecar

Posts: 44 Forumite

Is there a Uk alternative to the betterment and Wealthfront apps in the US.

I've heard some mention of Nutmeg but others have said its a different type of model and charges more than the the US alternatives.

Any thoughts?

After recently getting divorced I'm looking at downsizing , but would still like to save for retirement in some way - and heard betterment mentioned on a podcast.

I've heard some mention of Nutmeg but others have said its a different type of model and charges more than the the US alternatives.

Any thoughts?

After recently getting divorced I'm looking at downsizing , but would still like to save for retirement in some way - and heard betterment mentioned on a podcast.

Work Less - Spend Less - Consume Less.

Every turn of the pedal is an act of revolution!

Go by Bike!

Every turn of the pedal is an act of revolution!

Go by Bike!

0

Comments

-

Regulations are different in the UK in respect of advice. Most of the robo-advice offerings in the UK dont give advice. They give model portfolios which you effectively self select from a selection of risk questions.

The problem with that is that for the extra cost, you may as well go with multi-asset fund as you neither get the low cost of DIY or the advice option.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Most contemporary robo-advisors will perform a rudimentary risk analysis and then assign you to model portfolio based on academic portfolio theory that gives you the best portfolio for that risk, should long historical trends continue.

So the ingredients are

- basic risk analysis. You can perform this yourself, or involve an advisor.

- mapping risk to a long term portfolio. Oodles of literature

- purchase the funds on a platform with the lowest fees attainable. Plethora of options.

In other words you can do it yourself, cheaper, and without much effort.

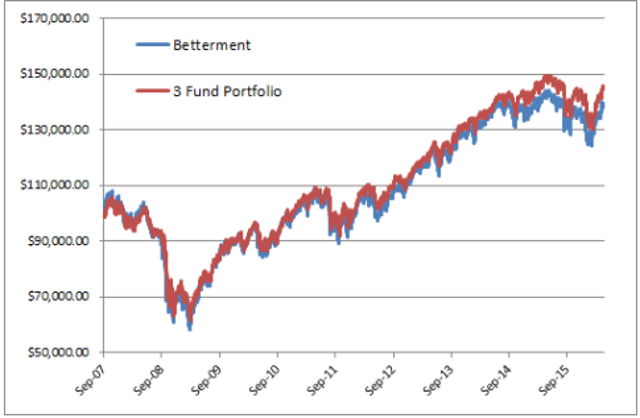

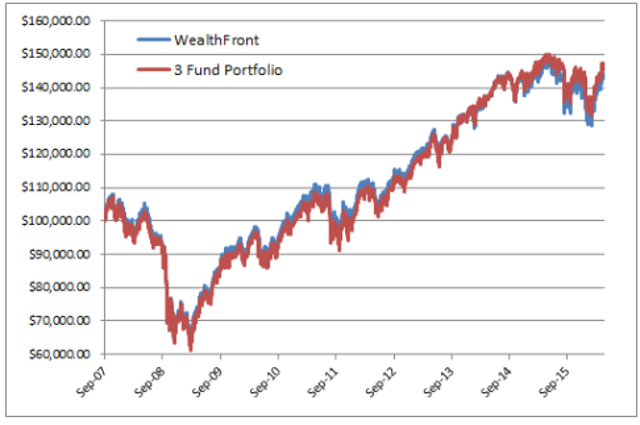

To demonstrate here is betterment and wealthfront versus a '3 fund portfolio', which in the US means US equities plus Rest of World Equities plus US bonds.

Suddenly the magic of a robot advisor doesn't look so magic. Thats because betterment, wealth front, nutmeg, etc charge a lot more to manage this for you than you could have achieved yourself. Thats not to say they are making a bundle out of it, but you are paying for that shiny app and all those billboards.

I'd not use this to say an IFA is attractive, because IFAs don't do much dissimilar, as long you're a healthy investor with a solid income expectation and are some way from retirement and have no peculiar situations such as illness, vast wealth, or are changing circumstances.

So,

- determine your risk level. How much of a drop could you take?

- find a model portfolio of asset classes. e.g., 60& equities, 40% bonds,

- find funds for the asset classes in the portfolio (e.g. vanguard life strategy 60, or individual trackers)

- find where to buy the funds, which is usually a tax wrapper and size of fund influenced question.

- see an IFA if you freak out at the prospect of deterring your own risk level and finding a few funds to match it, then freak out at the IFA fees.

- invest with whichever freaks you out less

- save money.0 -

Thanks guys, think I've got a lot more reading to do.

CheersWork Less - Spend Less - Consume Less.

Every turn of the pedal is an act of revolution!

Go by Bike!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards