We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Boast / weep about your recent investment decisions HERE

Comments

-

Thrugelmir wrote: »Could be simply that buyers are outweighing sellers currently. Causing the price to rise. When the news is negative or sentiment changes. Will you top up with further purchases or exit the stocks entirely.

Every situation is different, and my response would vary accordingly. If I think the fundamentals are still intact, and there is still a good outlook for a particular sector, then I would top up if I was not already too overweight.

I have been burned in the past whilst trying to make a total exit (HOT lost me 9k/3% of my main portfolio around a year ago), so I'm weary of making that mistake again, and would like to think that I wouldn't do it again.

Since then I've modified my strategy so as I'm always holding at least some cash, and in a falling market I would buy low (not necessarily a sector which I already hold) to help offset paper losses of the riskier assets I hold. I figure, if I must do something, at least this way I'm more tempted to buy than to sell in a falling market.

As part of this strategy, I'm constantly looking for new sectors to invest in that I think could offer significant potential upside, so if an opportunity comes along I've already got a few potential candidate funds lined up that I've researched. Last year I missed out on at least one good opportunity because I had no cash to hand, so I don't want to get caught short again.

What has really encouraged me is that last year's performance (of my main portfolio) was very good despite clocking up a frightening number of trades (my platform is very expensive at £60 per trade), although I now have a portfolio that I like the look of mostly, so it should be much less of an issue going forward, and the relative under-performance of the biotech was a bit of a drag on the portfolio due to the heavy over-weighting, but it now looks as though that is reversing.

Despite these head winds (and missing a good opportunity that would have been easy pickings) the performance has been surprisingly good, and if I extrapolate the performance backwards 5 years, even though oil and biotech (the two largest single components of my main portfolio - 11% and 31% respectively) had very erratic performance, my portfolio still performed well in comparison to AFI example portfolios.

I've also been surprised how much I've gained in the last two weeks, since I went from holding 10% cash to 20%, when I sold HOT after using it to make back more than half my losses from the previous time I held it. With a decent profit made, markets so high, and my wish to invest in some different sectors, a high cash weighting seems appropriate to me right now.

Clearly there has been a surge in biotech in the recent days/weeks which has been the main force pushing my portfolio higher, and whilst that could reverse again, I think it's only a matter of time before it breaks out. It's been teetering on the verge for a few days now.0 -

george4064 wrote: »I have just reviewed my figures, and it is correct. In 2016 I have added £2k to my portfolio, and in total it has only risen by £2.2k!

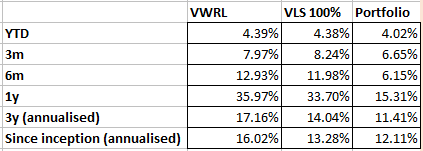

January (-4.31%) and February (-3.31%) were bad months, as was June (-4.32%) however the rebound in July (5.39%) more than made up for June's drop.

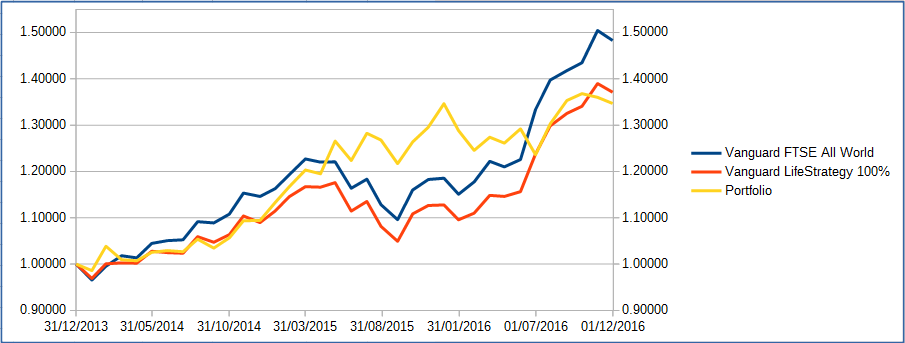

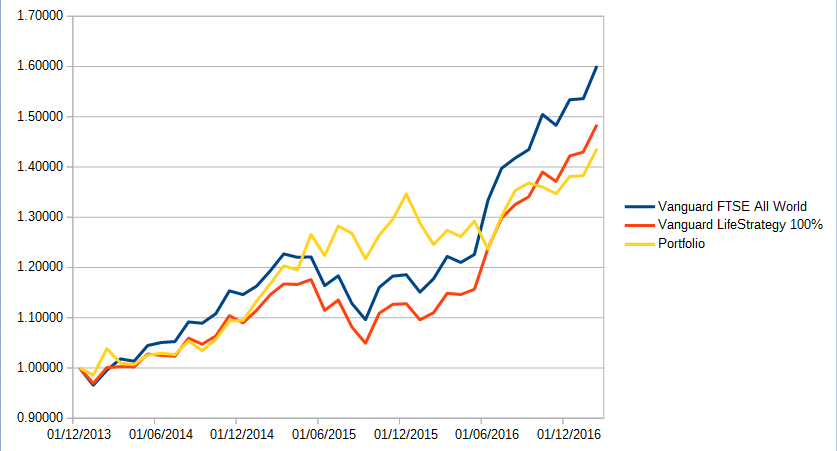

Looking at that graph does tempt me to sell everything and buy either VWRL or VLS 100%. Thing is, I quite enjoy managing my own portfolio

Hard to keep up with VWRL and VLS 100%! Saw a nice rise during Santa's rally and a strong push in February too.

Thanks to Glen Clark for pointing CSP1 out to me! I finally got round to selling some UK shares and with the proceeds bought CSP1, I had been wanting to do this for a while (reduce UK exposure and up US exposure). I know the US market is high and currency fluctuations have increased the price further, but I still feel its a good place to be in.

As normal dividends keep rolling in, re-investing buying more and more shares. Snowballing 100%!

*Inception Date: 31/12/2013"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards