We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Not a time to be a buy-to-let landlord

Comments

-

westernpromise wrote: »The fact that I have.

Legal and General, sum assured £300k, monthly premium about £20.

there's another one knocking around for £50 somewhere that I've had for decades and is about £4 a month.

You have life assurance, not insurance. You can't insure yourself for living, that's cell's £300k for £300k life INsurance joke.0 -

a £1m investment property sold now bought for £100k, will give you £648k after 28% CGT (yes you then run the risk of dieing within 7 years and being taxed twice)

a £1m investment property left at death with no mortgage (above the IHT free pot as you left other valuable things) will give your kids £1m minus 40% IHT = £600k

If transaction costs are zero you would have more left in the first option but the two are close. basically the government isn't stupid if they want a pound of flesh they are going to get more or less a pound of flesh

the idea about life insurance is neither here nor there. You cant buy £350k of life insurance for anything less than £350k. More likely it costs maybe £1,000,000 to buy £350k of life insurance and the difference pays for nice expensive offices taxes bonuses and actuaries. If people could buy £350k of life insurance for £20 a month then we would all be quite rich very quickly

But the point is that selling the flat crystallises the CGT at 28%, and leaves you with cash that will then attract IHT unless I give it away and survive.

Why would I even risk that? I just take out life insurance to fund the IHT. For £20 a month my estate escapes IHT for the next five years. IF I wanted to lock that in for the next 20 years that would rise to about £70 a month but that's still only £1,600 over 20 years.0 -

-

Due to soaring house prices in the SE (I moved from the North 15 years ago) I have never been able to pay down my mortgage and gone interest only. Been effectively renting half of it from the building society, albeit with improving equity due again to those increasingly soaring prices. No scope to downsize though as anything I could downsize to keeps rising too.

So those who think that all people with their names on the Land Registry have it all sorted for retirement, had better check their facts first.

Does it not worry you that you can only a afford an interest only mortgage rather than repayment at these times of historically low interest/mortgage rates. Would you be screwed if rates rose?

Not a dig, just a genuine question. I would imagine there are a fair few people in your boat which makes me think the BOE will do everything in their power to keep interest rates low as otherwise there could be complete carnage.0 -

westernpromise wrote: »But the point is that selling the flat crystallises the CGT at 28%, and leaves you with cash that will then attract IHT unless I give it away and survive.

Why would I even risk that? I just take out life insurance to fund the IHT. For £20 a month my estate escapes IHT for the next five years. IF I wanted to lock that in for the next 20 years that would rise to about £70 a month but that's still only £1,600 over 20 years.

Yes if you die within 7 years its a double tax. If you don't then holding on to death is about the same as selling

You can't buy life insurance of x for any less than x

Put it this way. I want to buy from you £1m worth of life insurance for £100,000. Will you sell it to me? Are you willing to give me £900,000 for free?

Your £20/month to cover £350k is because on average people buying that do not die over your quoted 5 years. Try getting £350k of life insurance covering out to age 120 and see what it costs you. Try getting £350k life insurance out to 10 years if you have 6 months to live and see what they charge you. Buying life insurance is not free money.

If a large number of people followed your advice overall they would probably find that they paid maybe a million pounds for £350k of life insurance0 -

westernpromise wrote: »But the point is that selling the flat crystallises the CGT at 28%, and leaves you with cash that will then attract IHT unless I give it away and survive.

Why would I even risk that? I just take out life insurance to fund the IHT. For £20 a month my estate escapes IHT for the next five years. IF I wanted to lock that in for the next 20 years that would rise to about £70 a month but that's still only £1,600 over 20 years.

And how much would it cost you if you wanted to buy £350k life insurance until death?0 -

Yes if you die within 7 years its a double tax. If you don't then holding on to death is about the same as selling

You can't buy life insurance of x for any less than x

Put it this way. I want to buy from you £1m worth of life insurance for £100,000. Will you sell it to me? Are you willing to give me £900,000 for free?

Your £20/month to cover £350k is because on average people buying that do not die over your quoted 5 years. Try getting £350k of life insurance covering out to age 120 and see what it costs you. Try getting £350k life insurance out to 10 years if you have 6 months to live and see what they charge you. Buying life insurance is not free money.

If a large number of people followed your advice overall they would probably find that they paid maybe a million pounds for £350k of life insurance

The bit you're missing is 'float'. Life assurance companies generally make an underwriting loss but as they get to sit on vast amounts of cash given to them by people who have failed to die they get to invest that money and make a profit on it.

I work for the investment arm of an insurance company so have a fair amount of knowledge on the matter!0 -

The bit you're missing is 'float'. Life assurance companies generally make an underwriting loss but as they get to sit on vast amounts of cash given to them by people who have failed to die they get to invest that money and make a profit on it.

I work for the investment arm of an insurance company so have a fair amount of knowledge on the matter!

are you suggesting buying life insurance is possibly a good way of investing? note im not saying it is or isnt Ive just not thought of it that way before0 -

And how much would it cost you if you wanted to buy £350k life insurance until death?

No idea but £70 a month sees me through to age 72.

The point is that I'm exposed to IHT regardless so it's irrelevant to the calculation. What's relevant is that I can in effect choose between selling now, incurring costs of probably 3%, 28% CGT, IHT on what's left, followed by stamp duty should my inheritors decide to re-enter the market. If the property started out at a million quid then the costs and tax bill from the sale are £300k, the IHT takes another £280k and the £420k left will buy a £398 investment property with £22k stamp duty.

Or I leave them the property with £350 to fund the IHT.

Which sounds like a better deal to you?0 -

it is cherry picking

a lot (more than half) the country is well below 4.5x full time local male wages. Some places like stoke-on-trent its less than 2 x full time male wage

Rents too in a lot (more than half) the country are very reasonable. eg £500-600 to a month to rent a 3 bed terrace which of course includes maintenance which imo is on a long run average ~£200pm so the property side they are only paying ~£300-400pm

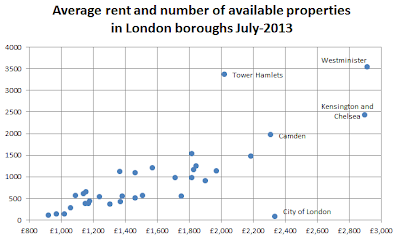

Of course inner London is crazy at £3,000 per month for a terrace but then poor people dont need to live within walking distance of buckinham palace

I thought they were V high all over London, this is back in 2013, so they will be a lot higher now. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards