We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

ESA Support Group Cont/IR Confusion And Savings Limits

Digital_2012

Posts: 111 Forumite

Hi Guys

I need some help I had my Atos medical in July 2013 and got awarded ESA (Support Group) in September 2013, it been now two years since i am getting ESA.

I also applied for DLA and receiving low rate mobility. I am really struggling to find out if i am on contribution based ESA or IR.

The last ESA award letter which i received in March 2015, i have checked all previous letters as well but i am confused if its contribution based or income related.

There is no information on the first page if its cont or ir. All i can find on the last page of the award notice where it says on the top of the page

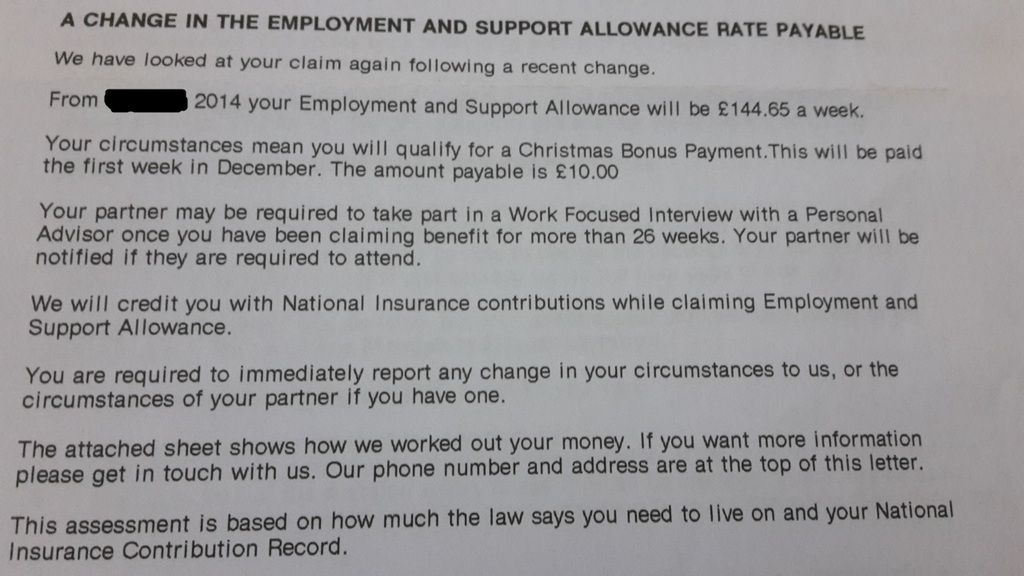

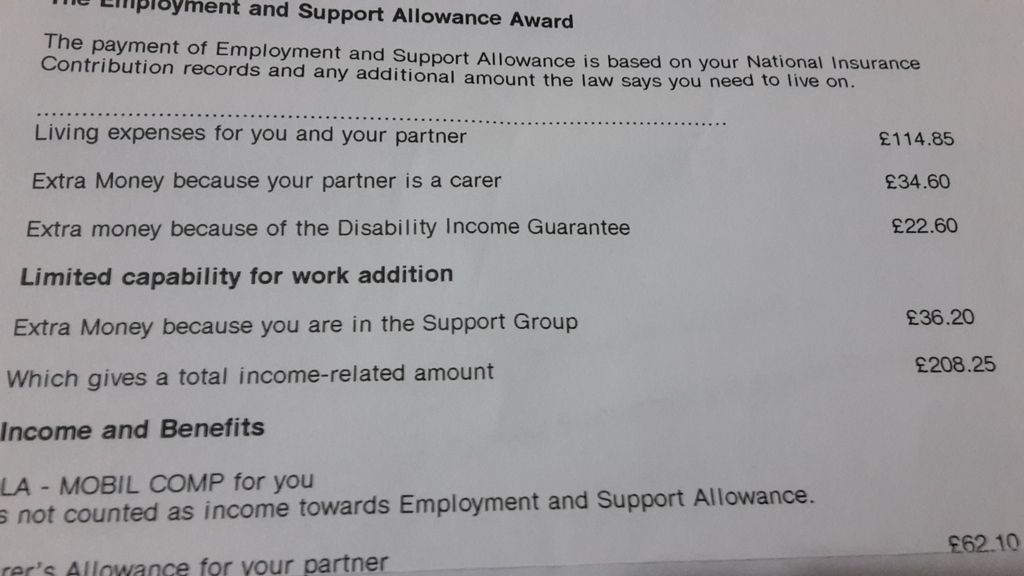

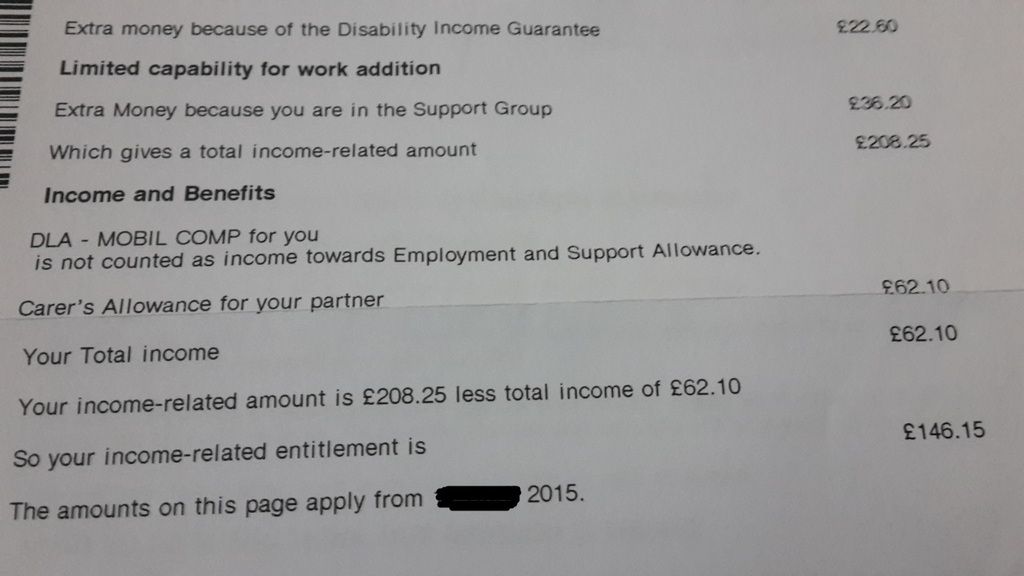

'' The payment of Employment Support Allowance is based on your National Insurance Contribution records and any additional amount the law says you need to live on ''

..........................................................................................

Living expenses for you and your partner £114.85

Extra money because your partner is carer £34.60

Extra money because of the Disability Income Guarantee £22.60

Limited capability for work addition

Extra Money because you are in Support Group £36.20

Which gives a total income-related amount £208.25

Income and Benefits

DLA- MOBIL COMP for you

is not counted as income toward Employment and Support Allowance

Carer's Allowance for your partner £62.10

Your total income £62.10

Your income-related amount is £208.25 less total income of £62.10

So your income related entitlement is £146.15

..........................................................................................

I am really confused on this can anybody shed some light on this if this is Contribution based or Income Related.

I want to save some money for my kids so i don't know how much i can save.

Many Thanks

I need some help I had my Atos medical in July 2013 and got awarded ESA (Support Group) in September 2013, it been now two years since i am getting ESA.

I also applied for DLA and receiving low rate mobility. I am really struggling to find out if i am on contribution based ESA or IR.

The last ESA award letter which i received in March 2015, i have checked all previous letters as well but i am confused if its contribution based or income related.

There is no information on the first page if its cont or ir. All i can find on the last page of the award notice where it says on the top of the page

'' The payment of Employment Support Allowance is based on your National Insurance Contribution records and any additional amount the law says you need to live on ''

..........................................................................................

Living expenses for you and your partner £114.85

Extra money because your partner is carer £34.60

Extra money because of the Disability Income Guarantee £22.60

Limited capability for work addition

Extra Money because you are in Support Group £36.20

Which gives a total income-related amount £208.25

Income and Benefits

DLA- MOBIL COMP for you

is not counted as income toward Employment and Support Allowance

Carer's Allowance for your partner £62.10

Your total income £62.10

Your income-related amount is £208.25 less total income of £62.10

So your income related entitlement is £146.15

..........................................................................................

I am really confused on this can anybody shed some light on this if this is Contribution based or Income Related.

I want to save some money for my kids so i don't know how much i can save.

Many Thanks

0

Comments

-

Digital_2012 wrote: »Hi Guys

I need some help I had my Atos medical in July 2013 and got awarded ESA (Support Group) in September 2013, it been now two years since i am getting ESA.

I also applied for DLA and receiving low rate mobility. I am really struggling to find out if i am on contribution based ESA or IR.

The last ESA award letter which i received in March 2015, i have checked all previous letters as well but i am confused if its contribution based or income related.

There is no information on the first page if its cont or ir. All i can find on the last page of the award notice where it says on the top of the page

'' The payment of Employment Support Allowance is based on your National Insurance Contribution records and any additional amount the law says you need to live on ''

..........................................................................................

Living expenses for you and your partner £114.85

Extra money because your partner is carer £34.60 Carer's premium

Extra money because of the Disability Income Guarantee £22.60

Enhanced disability premium because you are in the support group

Limited capability for work addition

Extra Money because you are in Support Group £36.20 Support group component

Which gives a total income-related amount £208.25

Income and Benefits

DLA- MOBIL COMP for you

is not counted as income toward Employment and Support Allowance

Carer's Allowance for your partner £62.10

Your total income £62.10

Your income-related amount is £208.25 less total income of £62.10

The Carer's allowance is counted as income and deucted from your ESA

So your income related entitlement is £146.15

..........................................................................................

I am really confused on this can anybody shed some light on this if this is Contribution based or Income Related.

I want to save some money for my kids so i don't know how much i can save.

Many Thanks

As far as I can tell you are on contribution based ESA (because you had been working before you claimed ESA?) with an income based 'top up' as you are claiming as a couple and so that your enhanced disability premium and the carer's premium can be added. (these cannot be added to a single contribution claim)

How is your partner claiming Carer's Allowance for you when you are not receiving mid rate care of DLA? Or is she claiming for a child who is receiving the correct level of DLA?0 -

pmlindyloo wrote: »

As far as I can tell you are on contribution based ESA (because you had been working before you claimed ESA?) with an income based 'top up' as you are claiming as a couple and so that your enhanced disability premium and the carer's premium can be added. (these cannot be added to a single contribution claim)

How is your partner claiming Carer's Allowance for you when you are not receiving mid rate care of DLA? Or is she claiming for a child who is receiving the correct level of DLA?

Yes i was working before i claimed ESA , I worked 2 years from 2011 to 2013. Yes my partner claiming Carer's Allowance for my kids. So how much i can save and any limits apply while on ESA? Also it means i am receiving both Cont and IR ESA?0 -

I thought you could only get the Disability Income Guarantee if you had an award of mid/high rate care?.0

-

-

Hi Guys

Please see the pics of my award notice which they issued me in 2014. Although it does say 'We will credit you with National Insurance Contributions while claiming Employment and Support Allowance'

The only confusion is about income related money on the last page where they done the full calculation

0

0 -

I thought you could only get the Disability Income Guarantee if you had an award of mid/high rate care?.

this is because the OP is in the support group and receives an income related amount.

any income related amount and the carers premium will be affected by savings over 6k and both would stop completely with savings over 16k.

but withno income related top up, your partner would receive the full amount of carers allowance0 -

OP according to your payment letter you are on income related ESA only. You are receiving the couples allowance which is only payable with ESA(IR) and you are receiving premiums for the SG and CA and there is no deduction for any contribution based ESA.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards