We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Quarter of a million reasons to be Mortgage Free!

Comments

-

I thought I would do my Q1 review of my financial goals for 2016 to ensure I am still on track, so here goes!

1. Overpay £23,000 on my mortgage. I have overpaid £6,985.19 in 2016 which is 34.93% of my target. I have £13,014 left to overpay in 2016 which equates to £1,446 over the next 9 months, which means I am on track

2. Increase emergency fund to £6,000. This one isn't going so well in the traditional sense of keeping a cash buffer. All spare money that has not gone towards the mortgage has been diverted towards medium to long term investments that deserves it's own post. I will expand more on this at another time

3. Increase my pension pot to £33,000. My pension pot is sitting at £26k due to a subdued market and I will have employer contributions of £625 per month going into the pension from this month onwards which will take me to ~ £31,625 so will need some recovery on my equity holdings to achieve this figure

4. Increase my wife's pension pot to £5,000. My wife's pension is currently in the process of being set up and she will also have £625 per month going in as an employer contribution. This will take her to ~ £5,625 by the year end if I ignore any potential growth so we are on track with this one

5. Increase my personal share holding to £1,500. I have £2,000 currently sitting in my personal share save scheme but this resulted in a rash decision to top up some shares that were deemed undervalued.

6. Pay for a new drive. I am expecting this to come in around £3,000 This is my big bug bear as my estimate was way off. We have had a number of quotes and the cheapest has come in at £8,000 for what we want doing. We are either going to have to tone down what we want doing or simply wait longer to save the extra money :mad:

7. Pay off my 0% credit card in full. There is currently around £3,900 remaining on this credit card so I would like this to be gone by the end of the year. This has been re-paid in full

This is my Q3 review of my financial goals for 2016.

1. Overpay £23,000 on my mortgage. I have overpaid £11,617.95 in 2016 which is 50.51% of my target. I would have to pay another £11,382 in 2016 which equates to £3,794 per month over the next 3 months! I won't hit this goal

2. Increase emergency fund to £6,000. I still don't have any spare cash lying around in bank accounts but I have kept up payments to my ISA. My ISA is now sitting at around £4.2k so although I won't be at £6k by the year end I shouldn't be a million miles off

3. Increase my pension pot to £33,000. My pension pot is sitting at just over £33k which has been helped by the employer contribution of £625 per month. I should therefore achieve this goal

4. Increase my wife's pension pot to £5,000. My wife's pension is sitting at £4k, again helped by the £625 employer contribution. Again this should be a goal that is achieved.

5. Increase my personal share holding to £1,500. I have sold all my personal share holdings and have decided through the year that it doesn't make financial sense to hold individual shares so this is not something I will be striving towards.

6. Pay for a new drive. I am expecting this to come in around £3,000 We had our drive done earlier in the year and it was a lot closer to the £8k figure I was quoted than the £3k figure that I hoped for!

7. Pay off my 0% credit card in full. There is currently around £3,900 remaining on this credit card so I would like this to be gone by the end of the year. This was repaid in full early in the year :T

Conclusion

I think overall I have had a good year in terms of working towards the targets that I set back in Jan 2016. I still have 3 months to go so would really like to get as close to the mortgage overpayment total as possible.

The biggest disappointment is the shortfall on the mortgage overpayments. After all, this was the purpose of the diary! The indecision regarding the kitchen renovations and some extra holidays certainly diverted funds that would have otherwise gone against the mortgage.

We did however, have a fantastic summer and managed to spend some real quality time as a family travelling around Europe so although it was pricey we did make memories that will last a life time Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I have received £8.44 in interest from my Nationwide account so I have sent this across to the mortgage today.

Sep 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £2,908.44

(Shortfall) / Surplus . . . . . . . . . . . . £1,158.44

Cumulative Targets to date

Cumulative overpayment target . . . £15,750.00

Cumulative actual overpayments . . . £15,276.39

(Shortfall) / Surplus . . . . . . . . . . . . . (£473.61)

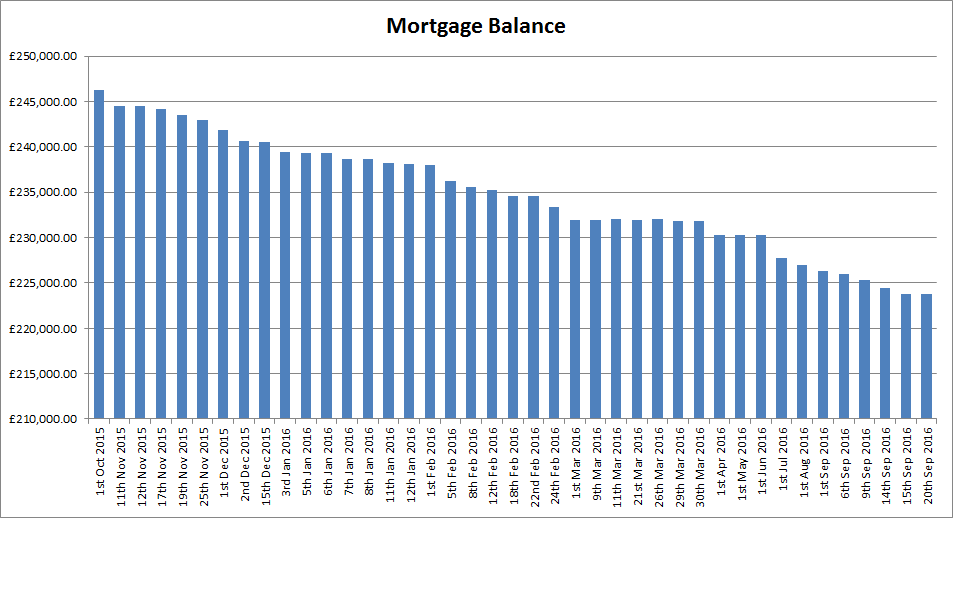

I haven't put a graph up for a while so thought it would be nice to see the mortgage balance one :rotfl: Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I'm loving the bar charts! Definitely going to have to create one for my own, just so I can see the progress as sometimes its easy to lose track of the impact you're making!!! Great stuff!0

-

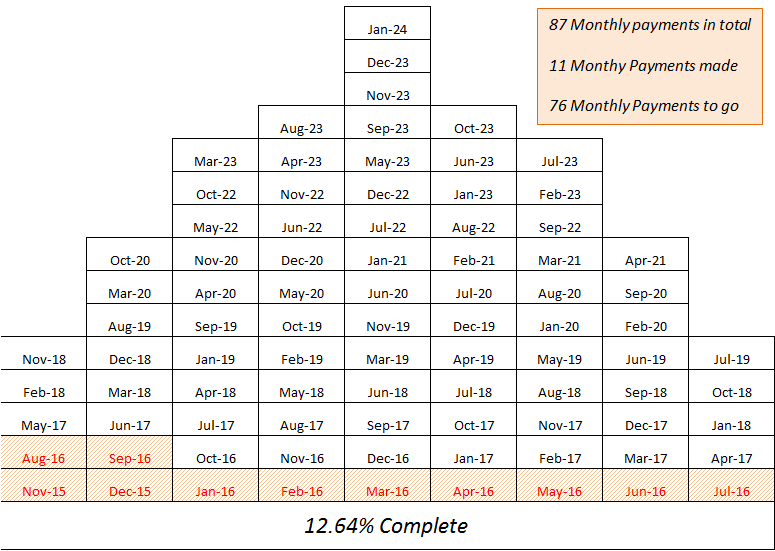

I first posted on this diary in November 2015 and made a plan to pay off my mortgage by Jan 2024 which would be my 47th birthday!

That equated to 87 monthly payments so I thought it would be fun to represent this with an excel chart representing my house. 11 payments down and only 76 to go :T

Excuse the funny looking house but Excel has it's limitations!

In other news I have 2 iphones that are being sold tomorrow so I should collect around £500 which will hopefully find it's way to the mortgage Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

Cool diagram - where did you get it from?0

-

I've received my monthly interest from my 123 account today plus the cashback on the utility direct debits so £44.41 has been overpaid to the mortgage.

I'ts a shame that they are cutting the interest rate on the 123 account from 3% to 1.5% Cool diagram - where did you get it from?

Cool diagram - where did you get it from?

I created it in Microsoft Excel. I may have another play with it to see if I can get it resembling a house!Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

The money from the sale of my phones came through today. It ended up being £414 so I have sent £300 to my S&S ISA and £114 towards the mortgage.

Here are the updated September figures against targets:-

Sep 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £3,066.85

(Shortfall) / Surplus . . . . . . . . . . . . £1,316.85

Cumulative Targets to date

Cumulative overpayment target . . . £15,750.00

Cumulative actual overpayments . . . £15,434.80

(Shortfall) / Surplus . . . . . . . . . . . . . (£315.20)Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

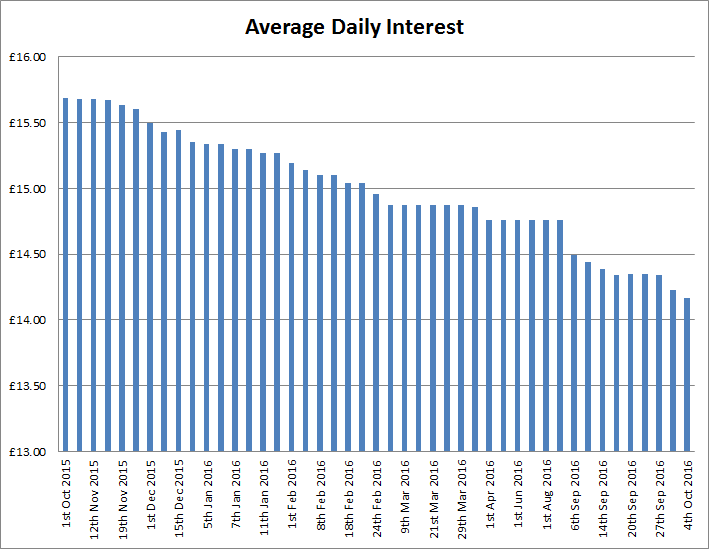

My normal direct debit for £1,045 has left my account plus a standing order for an overpayment of £750. I can see that my daily interest has dropped to £14.23 so I can't be too far away from seeing this dip into the £13.xx per day which will be another small milestone. My balance is standing at £222,027 so I would love it if I could get below £220k by the end of the month :T

I also realised when looking at my spreadsheets that my figures were wrong for my annual and cumulative targets! Updated figures are below which paint a different picture! I've got some catching up to do!

Oct 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £750.00

(Shortfall) / Surplus . . . . . . . . . . . . (£1,000.00)

2016 Target to date

Cumulative overpayment target . . . £17,500.00

Cumulative actual overpayments . . . £12,534.80

(Shortfall) / Surplus . . . . . . . . . . . . . (£4,965.20)

Cumulative Targets since Nov-15

Cumulative overpayment target . . . £21,000.00

Cumulative actual overpayments . . . £16,184.80

(Shortfall) / Surplus . . . . . . . . . . . . . (£4,815.20) Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I've had my expenses from work today so I have topped these up and made an over payment of £975 to the mortgage. I have also sent £500 to my S&S ISA so this has had a healthy boost over the past month or so.

Oct 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £1,725.00

(Shortfall) / Surplus . . . . . . . . . . (£25.00)

2016 Target to date

2016 overpayment target . . . £17,500.00

2016 actual overpayments . . . £13,509.80

(Shortfall) / Surplus . . . . . . . . (£3,990.20)

Cumulative Targets since Nov-15

Cumulative overpayment target . . . £21,000.00

Cumulative actual overpayments . . . £17,159.80

(Shortfall) / Surplus . . . . . . . . . . . . (£3,840.20)

Here is a graph of my daily interest and it is so nice to see this coming down

Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I've received £8.13 in bank interest today on my Nationwide account so I have paid this off the mortgage. I have also had a play with my excel spreadsheet to come up with a better representation of my house so that I can colour it in each month!Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards