We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Quarter of a million reasons to be Mortgage Free!

Comments

-

I've received £3.76 interest from my new Santander account so I have paid overpaid this against the mortgage. It will take a lot of these small payments to make any noticeable dent in my mortgage!

I have also gone through the process of transferring the child investment funds for my 3 daughters to a JISA with Charles Stanley. The charges are much lower and it gives some choice as to where to invest their funds. I have gone for the Vanguard Lifestrategy 80% Equity accumulation fund for the 2 eldest daughters (12 & 10 years old) and the Vanguard FTSE All Share Index Fund for my youngest daughter with super low charges (5 years old). I will probably realign the asset allocation for this fund to have a more diversified plan to include global index funds, emerging market funds and some defensive assets such as bonds over the course of the next few years.

With my own investments I have invested a further £300 into p2p lending including £100 into a green energy loan backed by a provision fund paying 7% interest. Ethical investing kudos to me :T

I now have £3,400 invested in p2p lending spread across 28 loans at an average rate of 11.24%. The rate is slightly skewed as I am including a £100 cashback bonus in this figure. It would be 8.3% without this but all but 1 of the loans are either backed by a provision fund or are secured loans with first charges against bricks and mortar with a maximum 70% LTV exposure.

I also have £2,500 in my S&S ISA which is split across the following funds:-

- AXA FRAMLINGTON UN BIOTECH Z ACC (£500)

- BAILLIE GIFFORD GBL DISCOVERY B NET ACC NAV (£500)

- CAPITA FINANCIAL MITON UK VALUE OPPS B INSTL (£500)

- FUNDSMITH LLP EQUITY I INSTL ACC NAV (£500)

- LEGG MASON INV FDS IF JAPAN EQUITY X ACC (£500)

I will be looking to add some bonds to this ISA before the closure date and have identified the Vanguard Global Short Term Bond Index Fund as a potential with a Total Expense Ratio of 0.15% and an Annual management charge of 0.15%.

Next year's ISA will probably be directed towards the Vanguard Lifestrategy 80% Equity Accumulation Fund.

In a not so MSE moment we ended up having the drive done, new drains put in and the grass area re-turfed. It looks fantastic and we are really pleased with it but at a cost of £8.5k it has wiped out the emergency fund I was building up and put the brakes on any big overpayments for the next month or 2 whilst we rebalance the books Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

Hello :wave:

Liking your energy and big plans (as shanghaijimmy said).. Have subscribed and look forward to cheering you on your way

BrizzleMFiT-T4 Member No. 96 - 2022 is my MF goal

Winter 17/18 Savings Rate Goal: 25% [October 30%] :T

Declutter 60 items before 31.03.18 9/60 ** LSDs Target 10 for March 03/10 **AFDs 10/15 ** Sales/TCB Target 2018 £25/£500 NSDs Target 10 for March 02/10 Trying to be a Frugalista:rotfl::T0 -

I reluctantly sold my PlayStation 4 yesterday as it hasn't been used for a while and was just sitting there so I have paid the cash into the bank today and have just made an overpayment of £170 against the mortgage.

Mar 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £985.76

(Shortfall) / Surplus . . . . . . . . . . (£764.24)

Cumulative Targets to date

Cumulative overpayment target . . . £8,750.00

Cumulative actual overpayments . . . £10,933.95

(Shortfall) / Surplus . . . . . . . . . . . . . £2,183.95

Other stats

Cumulative interest saved. . . . . . £9,072.00

New estimated daily interest . . . . . £14.87

New mortgage balance . . . . . . . . . . £231,873

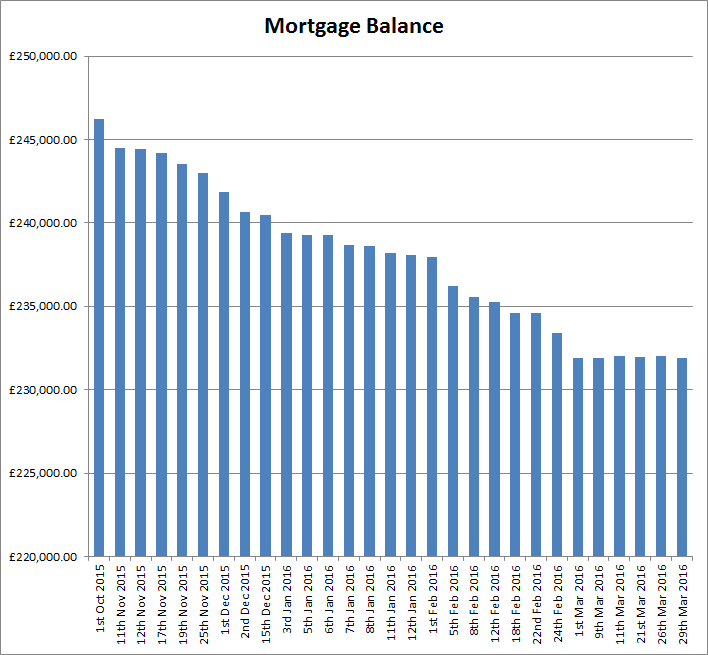

I like seeing the trend of this graph :T Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I have raided my tin and bagged up some coins to pay in the bank today which has resulted in a £42 overpayment to the mortgage.

In other news we have decided to look into getting our kitchen done as this is the last job that needs doing in our house. I'm not sure of what the cost will be yet as we are looking to put an extension on the side of the house and open up the existing kitchen and utility to create a big family kitchen area with an island in the middle so I'm guessing it's not going to be cheap

We have an architect coming round next week with our builder so we will see what is feasible and start costing things out. I better dig out those 0% credit cards :eek:Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I'm mega busy at work at the moment so will only post a quick update seeing as we have moved into the new month. My normal direct debit for £1,045 has gone out plus my regular standing order of £546.

Apr 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £546.00

(Shortfall) / Surplus . . . . . . . . . . (£1,204.00)

Cumulative Targets to date

Cumulative overpayment target . . . £10,500.00

Cumulative actual overpayments . . . £11,521.95

(Shortfall) / Surplus . . . . . . . . . . . . . £1,021.95

Other stats

Cumulative interest saved. . . . . . £9,563.00

New estimated daily interest . . . . . £14.76

New mortgage balance . . . . . . . . . . £230,297Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

It's been a while since I have updated my blog so I figured it was time to start updating a little more regularly. I have been in limbo over the past few months deciding whether to extend our house again for a new kitchen. We have eventually settled on a decision to have a new kitchen but not extend the house so the cost has been reduced greatly.

I now have enough funds for the new kitchen without having to borrow anything from the mortgage so the regular updates and overpayments can start again from now. Therefore I have just made an overpayment of £450 to kick things off again.

My updated figures are below:-

Sep 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £550.00

(Shortfall) / Surplus . . . . . . . . . . . . (£1200.00)

Cumulative Targets to date

Cumulative overpayment target . . . £15,750.00

Cumulative actual overpayments . . . £12,917.95

(Shortfall) / Surplus . . . . . . . . . . . . . (£2,832.05)

Other stats

Cumulative interest saved. . . . . . £10,696

New estimated daily interest . . . . . £14.49

New mortgage balance . . . . . . . . . . £225,969Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

Good to see you back!0

-

I've made another over payment today of £750 to bring me closer to my target for the month. I think I can still meet my annual target if I focus for the next few months.

I've also started training again so have joined the gym closest to my work. I am going to try and mix up my training with some running, swimming and weights. Yesterday's gym session consisted of a 30 minute swim which was refreshing but I can definitely feel it in my shoulders!

Sep 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £1,300.00

(Shortfall) / Surplus . . . . . . . . . . . . (£450.00)

Cumulative Targets to date

Cumulative overpayment target . . . £15,750.00

Cumulative actual overpayments . . . £13,667.95

(Shortfall) / Surplus . . . . . . . . . . . . . (£2,082.05)Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I've made another over payment today of £950 which means I have exceeded my monthly target for this first time in a while!

I also managed to go to the gym 4 times last week so that was a good start and also managed to lose 3lbs on my weekly weigh in. I haven't been too good this week yet as it was my wife's birthday on Monday!

Sep 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £2,250.00

(Shortfall) / Surplus . . . . . . . . . . . . £500.00

Cumulative Targets to date

Cumulative overpayment target . . . £15,750.00

Cumulative actual overpayments . . . £14,617.95

(Shortfall) / Surplus . . . . . . . . . . . . . (£1,132.05)Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

All of my current accounts have been reconciled and squared off and I've managed to find another £650 which I have sent as an overpayment against the mortgage today.

I've also been to the gym today and did a 2km run but I guess I've got to build up slowly before I can tackle bigger distances or I will just end up getting injured.

I also need to look at the quarterly review of my annual financial goals to see where I am so will aim to do that within the next few days.

Sep 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £2,900.00

(Shortfall) / Surplus . . . . . . . . . . . . £1,150.00

Cumulative Targets to date

Cumulative overpayment target . . . £15,750.00

Cumulative actual overpayments . . . £15,267.95

(Shortfall) / Surplus . . . . . . . . . . . . . (£482.05)Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards