We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Credit arrangement - does this affect score?

funkysi

Posts: 37 Forumite

I have a Barclaycard that is now paid off, but is in full use with a healthy limit.

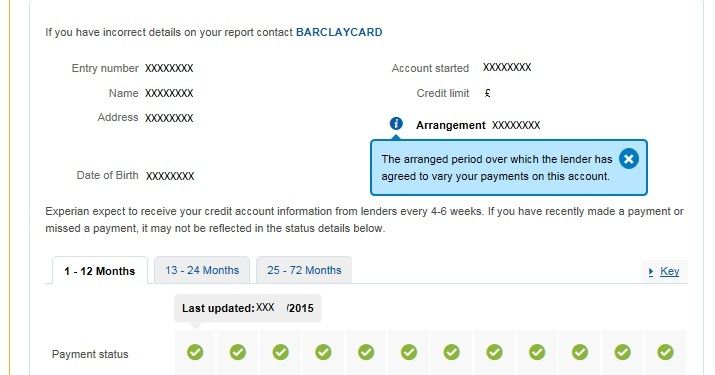

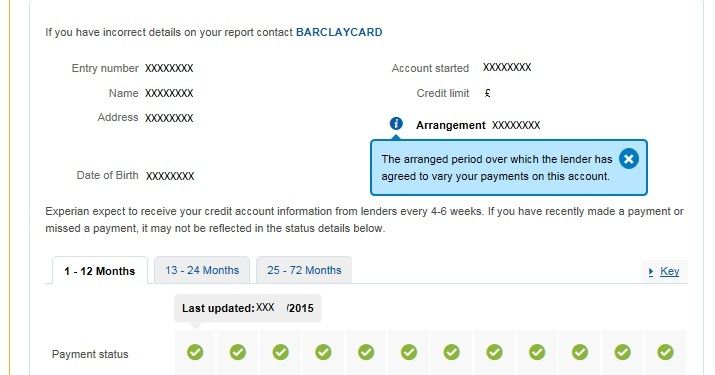

On checking Experian, there's an 'i' tab (information) against that card which states that I had an arrangement with this card to vary the amount that I paid off between 2008 and 2013. I didn't go default on it either.

It doesn't appear to be affecting my credit score as it's not listed as a 'negative'.

BUT....are lenders able to view this? I don't think they do see this.

Any mortgage/financial advisors know whether this could damage my chances of obtaining a mortgage?

Just checking!!

On checking Experian, there's an 'i' tab (information) against that card which states that I had an arrangement with this card to vary the amount that I paid off between 2008 and 2013. I didn't go default on it either.

It doesn't appear to be affecting my credit score as it's not listed as a 'negative'.

BUT....are lenders able to view this? I don't think they do see this.

Any mortgage/financial advisors know whether this could damage my chances of obtaining a mortgage?

Just checking!!

0

Comments

-

What does it show for the previous years ? An AP marker will affect your credit but as it is 2 years or more ago it should now have little effect.0

-

Since between 2008 and 2013 I paid an agreed sum which remained unbroken, they gave me the card back and told me to go and spend! After 6 month they increased the limit! I have not missed any payments and now the balance is £0. Is that the information you're looking for?0

-

-

From what I can see, there are no bad markers on that card what so ever, just that small notice. Is this something lenders will see?0

-

Have you checked your free credit report with Noddle and Clearscore?

When I had Arrangement to Pay markers on my credit file it was shown as AP with Equifax and a red dot (I think) with Noddle.It's not your credit score that counts, it's your credit history. Any replies are my own personal opinion and not a representation of my employer.0 -

I would suggest looking at your files on Callcredit and Equifax as they do record things differently from Experian I have found. You can view your statutory report online instantly with them both for £2 each.

I have recently got Barclaycard to agree that AP markers showing on my file for 10 years puts me at a disadvantage compared to someone who did not pay their debt and who would presumably have got a default meaning the record would no longer be visible after 6 years. They did not agree to a backdated default but did agree to ask Cabot who bought the debt 5 years ago to remove the record from my files. I did have to put up quite a fight to get this as initially when i spoke with them they just said an Arrangement to Pay showing is much better than a default. I did not accept this so they escalated my complaint to level 2. After 6 weeks they responded saying the same thing. I called them up and said that my point is not that i don't think they should have marked my file as in an Arrangement to Pay but that this is showing for longer than 6 years because they did not default me. They reopened my complaint and a week later wrote and agreed I am in a worse position for paying my debt and so they will ask Cabot to remove the record from my credit files. I have a letter from Cabot saying they will do this in 4-6 weeks. As it went on for so long i done a lot of research into AP markers and defaults etc. I even phoned up Barclaycard /Woolwich and spoke to one of their mortgage advisers to enquire about getting a mortgage with an Arrangement to Pay on my credit file as I wanted to know what their own mortgage brokers opinion on AP markers was. I was told it would be automatically declined. I asked if i paid it off so it was shown as settled would it still be a problem and he didn't seem to think it would make a difference and would still be declined. Your situation is a bit different as they reinstated your use of the card but if i was you i would still speak with them and try to get them to remove the AP reference from your files. There are probably other mortgage providers who would not see it as a problem but why limit yourself if you can possibly get rid of it. You should post on the Mortgages and Endowments page if you would like the view of a mortgage broker as I have seen a couple of them replying to posts over there.0 -

It doesn't appear on my Noddle report, the only negative is the old default which expires in 2 weeks. I've yet to get my head around the Noddle report and can't seem to see much detail?

My score with Noddle is not great, but the only negative is the default. It doesn't list anything else.Movingon5464 wrote: »I would suggest looking at your files on Callcredit and Equifax as they do record things differently from Experian I have found. You can view your statutory report online instantly with them both for £2 each.

I have recently got Barclaycard to agree that AP markers showing on my file for 10 years puts me at a disadvantage compared to someone who did not pay their debt and who would presumably have got a default meaning the record would no longer be visible after 6 years. They did not agree to a backdated default but did agree to ask Cabot who bought the debt 5 years ago to remove the record from my files. I did have to put up quite a fight to get this as initially when i spoke with them they just said an Arrangement to Pay showing is much better than a default. I did not accept this so they escalated my complaint to level 2. After 6 weeks they responded saying the same thing. I called them up and said that my point is not that i don't think they should have marked my file as in an Arrangement to Pay but that this is showing for longer than 6 years because they did not default me. They reopened my complaint and a week later wrote and agreed I am in a worse position for paying my debt and so they will ask Cabot to remove the rccord from my crdit files. I have a letter from Cabot saying they will do this in 4-6 weeks. As it went on for so long i done a lot of research into AP markers and defaults etc. I even phoned up Barclaycard /Woolwich and spoke to one of their mortgage advisers to enquire about getting a mortgage with an Arrangement to Pay on my credit file as I wanted to know what their own mortgage brokers opinion on AP markers was. I was told it would be automatically declined. I asked if i paid it off so it was shown as settled would it still be a problem and he didn't seem to think it would make a difference and would still be declined. Your situation is a bit different as they reinstated your use of the card but if i was you i would still speak with them and try to get them to remove the AP reference from your files. There are probably other mortgage providers who would not see it as a problem but why limit yourself if you can possibly get rid of it. You should post on the Mortgages and Endowments page if you would like the view of a mortgage broker as I have a seen a couple of them replying to posts over there.

So yours went to debt collectors? Mine didn't.....not sure if they record things differently.0 -

I have seen other posts where people say Noddle is not up to date so I would not trust it myself. As it is the free version of Callcredit it might not contain all the information. Ditto for Clearscore and Equifax. Splash the cash and get the real deal for £2 each. Very simple and quick to do online.

Yes Barclaycard gave up on me after 5 years and sold me on. I am hoping that will be to my advantage when it comes to making a settlement offer as i have read Barclaycard are quite difficult to negotiate with and I remember you got a good deal with Cabot.0 -

There is no AP marker at all on my Experian report for the Barclaycard. Just the reference I stated in the screen shot which I don't thing lenders would see.

From what I have read, Experian record 3 years, whereas Equifax and Callcredit record for 4? I am almost at threshold!0 -

.....Halifax who I will be applying for the Mortgage with only use Experian I think?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards