We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Investment fees?

Comments

-

The situation with the SIPP.

https://forums.moneysavingexpert.com/discussion/5244566On MSE I found references to 'drawing down' funds from a SIPP, if over the age of 55. I faced and face a very uncertain time between my mother's sudden passing and the eventual & hopeful granting of probate. With funds dwindling fast I went for the draw down option. I stipulated that the draw down was to be a one-off withdrawal with 'nil' payments afterwards, so there's no formal 'change in circumstances', no regular income. In other words, I am not drawing the pension and I have not retired, I'm 59. The draw down got me a tax free 25% sum of 2.5k which was transferred directly to my shrinking bank account. The rest of the draw down amount remains in the SIPP because of the 'nil income' option which I chose.0 -

This makes no sense at all.

Do see that IFA as soon as you can.

Thanks. Oh my goodness, I really am up the creek without a paddle by the sound of it :eek: I presume it will be in order to open my HL page at the IFA office so they can see what's what please?

I stipulated that the remaining balance of the drawdown account was to remain invested, not come to me as a pension payout. I only took the tax free lump sum, and that was to tide me over the months immediately following my mother's death.

The IFA is now booked and confirmed for the week after next, and I will submit everything I have on paper to them, including holdings, AVC, SIPP and so forth. There's no initial fee and 'no obligation' but I'm hoping their charges are reasonable and that my finances can be tidied up as soon as possible, giving me some window onto the future. At the moment all is basically controlled panic, & sometimes leaving out the word 'controlled' :-o0 -

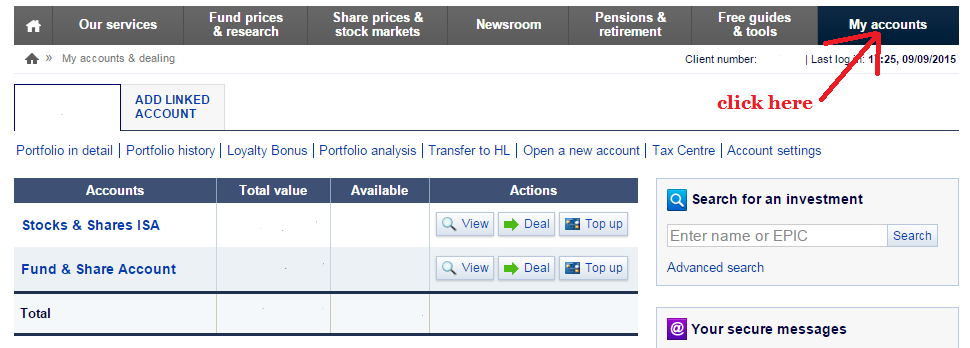

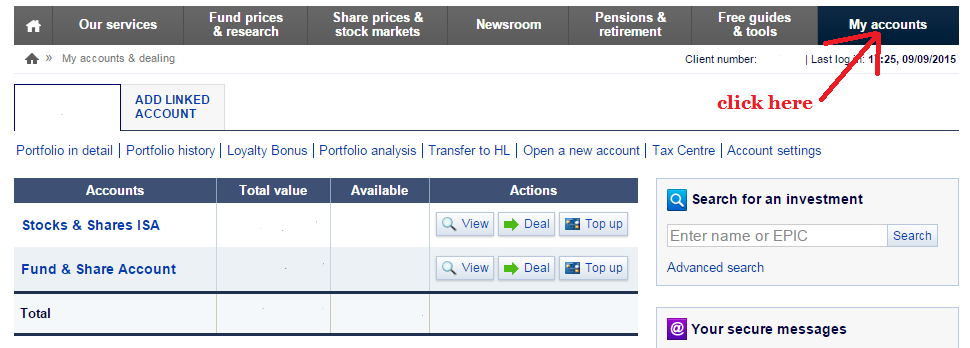

r_i_c, if you login to your HL account and click 'My accounts' what accounts can you see listed there?

Here's a screenshot of what mine looks like (with the figures blocked out): "If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

george4064 wrote: »r_i_c, if you login to your HL account and click 'My accounts' what accounts can you see listed there?

Here's a screenshot of what mine looks like (with the figures blocked out):

Stocks & Shares ISA

SIPP

SIPP Income Drawdown

Fund & Share Account0 -

OK, so your SIPP has been split into two bits (based on xylophone's quote of your other thread).Stocks & Shares ISA

SIPP

SIPP Income Drawdown

Fund & Share Account

You had one big SIPP and you told them you wanted to take £10k over to one side and take the tax free lump sum from it. So, they moved £10k into the "SIPP Income Drawdown account" put 10k into it and then immediately gave you 25% of it tax free leaving a value of £7.5k.

This £7.5k of value is split off from the rest of the SIPP, because on the rest of the SIPP you are still able to take a tax-free slice, and on the £7.5k you are not, because you've already had it.

The £7.5k can be invested in investment funds, to hopefully turn into a bigger number over time (while having the risk of turning into a smaller number), or it can be left as cash. As mentioned before, we don't know whether it is in cash or it is in funds. I assumed it was just in cash because you said yesterday at 12.11 AM it was "doing basically nothing I think" and later at 2.41 PM "This amount doesn't seem to be doing anything" ; but then at 5.58PM you said "and seems to be doing quite well", so perhaps you mean it is invested into funds. You could find out by clicking through on the £7k-odd account total to see what is in there.

But either way, when you take money out of this drawdown account from now on, that count as taxable income to you, from HMRC's perspective. What tax you actually pay on that taxable income depends on what other income you have in that tax year. If your taxable income from all sources (including what you take out of drawdown, other than the 25% that was tax free) is less than your personal allowance, you won't have any tax to pay; you're not a taxpayer. If your income is higher than all your allowances, you will have tax to pay at your normal tax rates.

The SIPP drawdown account can basically hold the same investments as your fund and share account and your main, untouched SIPP account and your ISA account. You can hold the same multi-manager funds which you have in all those accounts, or you can use different funds for different pots, or you could have all of it in cash to ensure you don't suffer a 20% crash in value while you wait to see the IFA.

So, now you have some fees to pay in your main Fund & Share account. You can get the money to pay those fees by either selling something in your main fund and share account, or selling something in your drawdown account, or making a top-up from your own personal bank account.

If you choose to take money from your drawdown account, tax is a consideration. If you're a taxpayer in this tax year and don't expect to be a taxpayer later, would make sense to leave the drawdown account invested and take the money out of it later, meanwhile getting the cash to pay the fees from your Fund & Share account or your own bank account. Whereas if you're not a taxpayer now but you do expect to be a taxpayer later, it would make sense to pull money out of the drawdown account now to avoid future taxes.

As it is, you say you have "made a direct top-up" to cover the fees. I'm guessing you mean you have made a direct top-up to your F&S account from your personal bank account to cover fees, but for all we know, you might mean you have made a top up to your F&S account directly from your drawdown account.

But as it is done now, you can wait until you see the IFA before taking any other steps or deciding what to do next time. There may not really be a next time, as it's quite likely the IFA will suggest moving all the funds to a cheaper platform rather than keeping them on an expensive DIY platform, given you don't want the headache of DIY.0 -

bowlhead99 wrote: »What tax you actually pay on that taxable income depends on what other income you have in that tax year. If your taxable income from all sources (including what you take out of drawdown, other than the 25% that was tax free) is less than your personal allowance, you won't have any tax to pay; you're not a taxpayer.

OP is currently not a taxpayer but if he were to withdraw the whole £7k in one lot then he would pay tax due to it being taxed on a Month1 basis. Some or all of it would be able to be reclaimed but with the Teachers' Pension starting around March the reclaim would probably have to be left till the end of the tax year till the tax picture is clearer.0 -

Thanks Bowlhead99, I topped up double the fee amount from my bank, to cover me for next month as well. I am not currently employed so am not paying tax through an employer. When I clicked on the Drawdown Account up popped the name of its investment 'Invesco Perpetual UK Equity Pension Fund Inclusive - Class 4A - [Acc]'. I didn't realise the amount was still actively invested - it is; that fund looks quite healthy at the moment. The fee cover has gone to the right account, I just checked.

The fact that I am not currently employed presumably means that withdrawing anything form HL is cheaper for me now, because if I were earning that would be taken into consideration? However, I intend to do very little until I have seen the IFA.0 -

OP is currently not a taxpayer but if he were to withdraw the whole £7k in one lot then he would pay tax due to it being taxed on a Month1 basis. Some or all of it would be able to be reclaimed but with the Teachers' Pension starting around March the reclaim would probably have to be left till the end of the tax year till the tax picture is clearer.

Thanks, I will also hope to begin buying NICs towards my state pension next tax year, my SP will be due to begin in seven years so there is time to improve it. I am fully paid up for NICs but the pension can be improved I have been advised.0 -

Thanks, I will also hope to begin buying NICs towards my state pension next tax year, my SP will be due to begin in seven years so there is time to improve it. I am fully paid up for NICs but the pension can be improved I have been advised.

That depends on what is offered after April 2016 for voluntary NICs and whether or not it will be worthwhile.0 -

That depends on what is offered after April 2016 for voluntary NICs and whether or not it will be worthwhile.

Hopefully it will: pensions are reliable, investments not so. If I can improve my state pension in succeeding years I will make every effort to do so. The DWP seemed to think there would be no problem here ~ tax year 2016-17 ~ CAB kindly phoned them on my behalf.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards