We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Investment fees?

Comments

-

grey_gym_sock wrote: »whether the dividends will usually be greater than HL's charges isn't the main point. though it might be more convenient if they were - so you wouldn't have to add some cash to cover charges every so often (or manually sell a small part of the fund to raise some cash, for which there's no charge; or let HL automatically sell something, for which they'll charge £1.50 extra).

the main point is the total return you'll get from the fund after all charges - i.e. any dividends paid + eventual capital growth in value of your holding (the latter includes the effect of deducting the fund manger's charges, so you don't see those charges separately) - HL's charges.

so if you are losing on the divendends (if any) minus HL's charges, you still may end up ahead if the value of the fund goes up (and if you do have accumulation units, this is more likely to happen).

it's unlikely that HL's 0.45% per year charge will tip the whole investment into being unprofitable, though it could happen if the fund is doing badly ...

Many thanks, wow I had no idea there was so much philosophy involved in stocks and shares: so even though I am aghast at the (shock of the) fees, I might still come out ahead. That makes me feel a bit easier. It's just a nuisance these fees have come in ahead of the dividend. The multi-manager funds look as though they are doing comparatively well, I saw graphs going up and up recently - as an overall trend. Still, I think it's going to be down to the IFA to help me decide what to do next - all this information is going to be very helpful in discussions with the advisor I should think.

All my holdings are income as opposed to accumulation. And if the worst came to the worst I could just sell this fund and move the money into a high interest current account I imagine?0 -

Thanks, but forgive my ignorance - it is genuine - why do people invest in such funds, charging such fees please?

Unless the funds make it all , at length, worthwhile.

In the long term you might be expecting returns from say 5-8% a year, compounded, from the funds you invest in. They are "collective investment schemes", in other words you and me and thousands of other people throw their money into a pot, and the fund managers go and buy a load of shares in companies or loans to companies or governments, or properties, and share the results with you and me and the other investors in the pool.

This means your money is invested far and wide, better diversified than what you could do yourself, and perhaps with fund managers using their skills to identify what shares to buy and sell when, or perhaps using a computer to make their choices more simply and cheaply. The costs from the fund manager will hopefully only be a small fraction of the total return (capital and interest) you get from investing in the fund.

However, the fund managers can't usually afford to deal with lots of little customers here and there, accommodating their day-to-day customer service needs, buys, sells, deposits, withdrawals, tax reporting. So they just produce very general periodic reports about what has gone on and what the units are worth, and you need to access them via a "platform" through which you hold your investments, and you pay a fee for that access.

Generally the returns from the funds do make it worthwhile over time, but you should try to minimise how much you pay to access the platform to avoid wasting money on an expensive broker or platform (fund supermarket) provider.0 -

Thanks for that link, it makes the situation more understandable. OP - sorry to hear of your loss, that must make unpicking the costs even more difficult.

There are certainly cheaper platforms but I think the most sensible option as suggested is to see an IFA who will hopefully be able to give some clarity to what is in place.

Thanks, it's a difficult time and I fall flat on my face every now and then. I was cautious but am now eager to see an IFA, applying for probate wasn't exactly easy but at least it was finite - stocks & shares are a kaleidoscope by comparison, but they served my folks well and so I am endeavouring to follow their example - but goodness, what a learning curve. IFA coming up 0

0 -

R_i_c, how many funds do you hold in your HL ISA?"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

bowlhead99 wrote: »In the long term you might be expecting returns from say 5-8% a year, compounded, from the funds you invest in...Generally the returns from the funds do make it worthwhile over time, but you should try to minimise how much you pay to access the platform to avoid wasting money on an expensive broker or platform (fund supermarket) provider.

Sorry, it was just the shock value; and I do understand the wisdom of the multi-fund, I just overlooked the cost. I wasn't with mum long, I only just had time to get her over her spouse passing away and do the best I could going through our statements to make sure we were going in the right direction. Unfortunately, the fees she must have been paying for her HL funds were not immediately apparent, and so I missed out on that aspect of the equation, and hence my shock at receiving the fee request. Also, my long-standing HL SIPP doesn't incur fees, so I was unprepared. I will report back on what the IFA suggests, that may take a little time though, I have to have a preliminary meeting first I think, before detailed discussions take place. Anyway, better now than later!

Thanks again 0

0 -

george4064 wrote: »R_i_c, how many funds do you hold in your HL ISA?

Thanks. Stocks & Shares ISA 14.8K

Made up of trusts it seems, split 50:50 between a

Multi Manager Equity & Bond Trust, Class A Income

& a

Multi Manager Income & Growth Trust, Class A Income holding.

How does this sound please?0 -

Also, my long-standing HL SIPP doesn't incur fees, so I was unprepared.

Are you sure about that?

http://www.hl.co.uk/pensions/sipp/charges-and-interest-rates0 -

Thanks - again, I find the links confusing: I see for example "Account inactivity - No charge", but then the percentages appear beneath this. I have received no HL requests for SIPP fees as far as I am aware.0 -

Thanks. Stocks & Shares ISA 14.8K

Made up of trusts it seems, split 50:50 between a

Multi Manager Equity & Bond Trust, Class A Income

& a

Multi Manager Income & Growth Trust, Class A Income holding.

How does this sound please?

Right so here's your situation so far:

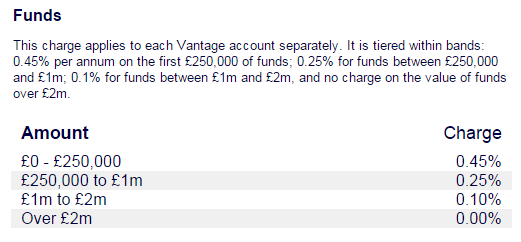

Charges applicable to your HL ISA and HL SIPP, this is a standard admin charge just for holding the investments:

So, if you have ~£198k in your HL ISA and HL SIPP combined, you're paying 0.45% per annum in fees for those investments.

Thanks £891 per annum, charged monthly is a monthly charge of £74.25.

You would considerably save on fees if you were to transfer to a fixed fee platform, an example is Halifax ISA, who charge a flat fee of £12.50 per annum. If you transferred your ISA, it would cost you about £100 in exit fees payable to HL. If your ISA is £14,800, you are paying £66 per annum in fees @ HL, so you'd save about £53.50 per annum if you switch to Halifax ISA, and it would only take you two years to earn back the money lost in exit fees.

You should consider transferring your SIPP too, but thats a bit more expensive process but you would save considerably there too switching from a % fee to a flat fee.

In terms of the funds that Halifax offer vs funds that HL offer, there isn't much difference except that HL has its 'in-house' multi-manager funds as well as access to special cheaper share classes for certain funds (they are always more expensive if you take into account HL's 0.45% fee). 99% of funds on HL you'll find at Halifax ISA available funds list."If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

I don't understand how the SIPP doesn't incur fees - relatives' HL SIPPS certainly do!

And it appears that the OP had a Vantage Fund and Share Account of his own https://forums.moneysavingexpert.com/discussion/5244566 post 140the holdings have been transferred to my own Vantage Fund & Share Account which was set up when my SIPP was, long time ago.

before his late mother's holdings were added to it - he must have been paying fees?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards