We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What do you class as a successful investment?

Keeping

Posts: 83 Forumite

Greetings. Some of you might argue that as long as your investment returns a profit, then you're investment is successful but if you got a pass or an E on an exam, you'd probably see that as a fail, despite the fact you passed.

I look at some funds and stocks and compare them to mine and even though I've only been doing it for 6 months, 3% gain on each of my two funds seems like a fail, or at least a bad investment choice, would you agree?

I know hindsight is a wonderful thing and we can all sit and say "but if I did this instead of that" etc but for the experienced / lengthy investors here, do you ever think "why didn't I put it in this fund or that fund" for example?

Example Biotech Fund

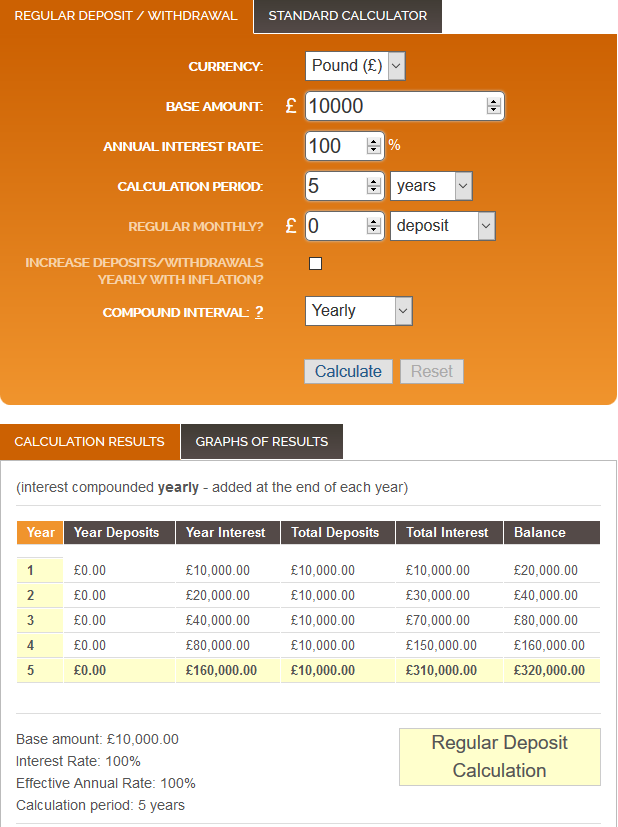

and this isn't just one particular fund, they're all generated about 80% to 100% returns a year. £10,000 5 years ago and you'd be sitting on a cool £320,000 and that's without even adding in extra money over time. It's just insane!

I guess it's too late to get on the train now and it's probably pop at some point soon but I bet the majority of private investors invested in that fund out of luck instead of foreseeing the biotech industry blowing up.

I look at some funds and stocks and compare them to mine and even though I've only been doing it for 6 months, 3% gain on each of my two funds seems like a fail, or at least a bad investment choice, would you agree?

I know hindsight is a wonderful thing and we can all sit and say "but if I did this instead of that" etc but for the experienced / lengthy investors here, do you ever think "why didn't I put it in this fund or that fund" for example?

Example Biotech Fund

and this isn't just one particular fund, they're all generated about 80% to 100% returns a year. £10,000 5 years ago and you'd be sitting on a cool £320,000 and that's without even adding in extra money over time. It's just insane!

I guess it's too late to get on the train now and it's probably pop at some point soon but I bet the majority of private investors invested in that fund out of luck instead of foreseeing the biotech industry blowing up.

0

Comments

-

I suspect most people invested in several funds, so they may have losses elsewhere that offset the gains.0

-

Also the funds you have highlighted has gone up 400% in 5 years, so £10k would be worth about £40k and not £320k. To get those kind of returns you would need to pick the hottest sector for 5 years in a row. I wish you well with that!0

-

Radiantsoul wrote: »Also the funds you have highlighted has gone up 400% in 5 years, so £10k would be worth about £40k and not £320k. To get those kind of returns you would need to pick the hottest sector for 5 years in a row. I wish you well with that!

£10,000 investment with 100% returns per year is not £40,000

Year 1 - £20,000

Year 2 - £40,000

Year 3 - £80,000

Year 4 - £160,000

Year 5 - £320,000

or am I missing something?0 -

My best performing individual share is at today up 60% and the worst down 37%. In total I have 89 holdings.

If I only picked winners I wouldn't be writing this now. 0

0 -

a positive return can be too low. if you don't expect to get a significantly higher return from volatile investments than you'd get from cash, then it isn't worth putting up with the uncertainties of investing.

it's also possible to make a poor choice of investments - too expensive, not diversified enough, no clear strategy, and so on. however, that shouldn't be conflated with "return envy" - i.e. worrying that some other investment has done much better. something else will always do better. you can't know what will.

and often the very high returns are from something higher risk, or less diversified. e.g. biotech funds are a single sector, so they're always going to be more volatile than diversified funds covering many sectors. in any period, you can be confident that some sectors will do brilliantly, others appallingly - but you probably can't tell which in advance.

i'm a bit puzzled why ppl buy single-sector funds at all. it seems like gambling, or fashion investing. for many sectors, there are no sector funds available - and, if anything, that's more likely to be where the better, and perhaps less erratic, returns will be found - with what's out of fashion.

there is also some research suggesting that "lottery ticket" shares tend to be overvalued - i.e. shares which have a small chance of going up massively, and a bigger chance of doing poorly. small biotech companies would often fit in this category.

BTW, your compounded returns calculation is a bit out. the graph shows a gain a bit over 400% in 5 years, implying that £10,000 would turn into a bit over £50,000 in 5 years, not £320,000. note that, if the graph rises in the last year from 300% to 400%, that is only a gain of only 25% in that year (because that would be the value rising from £40,000 to £50,000).

(IMHO, a possible exception to avoiding single-sector funds would be when the sector represents a different asset class. e.g. the property sector.)0 -

£10,000 investment with 100% returns per year is not £40,000

Year 1 - £20,000

Year 2 - £40,000

Year 3 - £80,000

Year 4 - £160,000

Year 5 - £320,000

or am I missing something?

This would be, roughly, correct if the annual growth would have been 100%. That's not the case in the example. The fund is now worth approximately 4 times more than it was in 2010, so it grew, on average, by at loss than 100% in each of the last 4-5 years.

You'd also have to subtract annual charges from your calculations.0 -

I look at some funds and stocks and compare them to mine and even though I've only been doing it for 6 months, 3% gain on each of my two funds seems like a fail, or at least a bad investment choice, would you agree?

I certainly wouldn't agree that you can make any judgement at all on performance based on 6 months. But if you have gained 3% in 6 months, so equivalent to 6% over 12 months then that's still 6x the return you'd get on a cash ISA so seems like a reasonable return.

Any portfolio should be balanced so that you have different elements and it's unlikely that all would do well at the same time.Remember the saying: if it looks too good to be true it almost certainly is.0 -

grey_gym_sock wrote: »BTW, your compounded returns calculation is a bit out. the graph shows a gain a bit over 400% in 5 years, implying that £10,000 would turn into a bit over £50,000 in 5 years, not £320,000. note that, if the graph rises in the last year from 300% to 400%, that is only a gain of only 25% in that year (because that would be the value rising from £40,000 to £50,000).

This is not how compounding works though? And it did peak at 500% if you look closely.

Why is it only £50,000?

**EDIT** Ah I see how the dips in the market affects the actual %return but it's still much much more than £50,000. 500% isn't the same as 5 times your investment...0 -

if you have 100% annual return, compounded, you do turn £10,000 into £320,000 after 5 years. or to put it another way, your total return is 3100%.

what the graph is showing is the total return from the start to any point, and that only reaches about 500%, not 3100%.

500% total return after 5 years implies an average annual return of about 43% compounded. (or 400% implies about 38% compounded.)0 -

ok I understand thanks0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards