We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Dent means write-off - do insurers HAVE to label it Cat C / D?

Eejit put a tiny dent in our ancient hatchback, he and his insurers admitted responsibility and will pay, without having to involve our insurers.

Dent means won't be economic to repair, so we're waiting to hear if Cat C or D (when repair is more than a given % of the car's value).

Just wondering, do other party's insurers HAVE to label it Cat C / D write-off for you to get your offer? We want to keep the car, with them deducting salvage cost from claim value. So it would just be nice to avoid the hassle of us dealing with our insurer to reclassify it a Cat C/D, assuming they're still willing to cover it as such. (And I believe Aviva require a new MOT after Cat D).

Do insurers ever offer an ex-gratia payout to withdraw all claims against them? Or must it be written-off?

Dent means won't be economic to repair, so we're waiting to hear if Cat C or D (when repair is more than a given % of the car's value).

Just wondering, do other party's insurers HAVE to label it Cat C / D write-off for you to get your offer? We want to keep the car, with them deducting salvage cost from claim value. So it would just be nice to avoid the hassle of us dealing with our insurer to reclassify it a Cat C/D, assuming they're still willing to cover it as such. (And I believe Aviva require a new MOT after Cat D).

Do insurers ever offer an ex-gratia payout to withdraw all claims against them? Or must it be written-off?

0

Comments

-

A small dent and you went through insurance? I'd have got a quote from a garage, asked said person for the cash and either fixed it or left as is and put the money towards a holiday or something.0

-

I would argue for a full and final settlement for a similar figure and ignore the dent / car in full settlement of the claim. As far as I am concerned a Third Parties insurance company cannot put a category marker on your car as they are not party to it.

Had this discussion previously with a third party and told them to go do one. Its a scare tactic I believe used by third parties.0 -

A small dent and you went through insurance? I'd have got a quote from a garage, asked said person for the cash...

So would we. First we heard of the damage was a call from his insurer admitting liability!

Keeping our insurer well out of it, if poss, hence my question.

Thanks caprikid; was planning to try to swing it that way when they call. Think I'll use your wording. :beer:

Maybe not the 'Do one!' ::D0 -

I have handled two claims in this manner.

One settled for £1000 one settled for £2000.

Both clearly the other parties fault, both open to a serious compensation claim. Second insurer barely paused to settle the claim. Obviously car park dinks are a little different.0 -

ID1F, what I did was took clear photo's of the damage and got an estimate for the repair sent it all with a politely worded letter stating full and final settlement of x amount.

Don't forget this is not about the value of your car , it is about putting you back in the same position prior to the incident occurred without betterment. So you may need to Justify the value of your car, IE Full Service history immaculate high spec.0 -

By this do you mean you hope not to have this incident on your record?

Keeping our insurer well out of it, if poss, hence my question. ....

If so it's too late (as the third party insurer is involved)

You need to inform your insurer of this incident and any others you approach for quotes over the next 3/5 years depending on how long a history they ask for.0 -

If they total loss the vehicle then they do have to load what category total loss it is.

You could try and negotiate a cash in lieu settlement saying you are prepared to retain the vehicle as is and not repair and thus just want £X for loss of value rather than repair. £X clearly has to be less than the net total loss settlement and realistic if you are going to be able to get them to accept it instead0 -

By this do you mean you hope not to have this incident on your record?

If so it's too late (as the third party insurer is involved)

You need to inform your insurer of this incident and any others you approach for quotes over the next 3/5 years depending on how long a history they ask for.

I really don't know whether it goes on the CUE database if a direct non write-off cash settlement is agreed. Their insurer specifically told us they will not inform our insurers themselves, it was up to us if we did. (We may, depending on the outcome, not yet resolved.) Maybe they put it on CUE though.

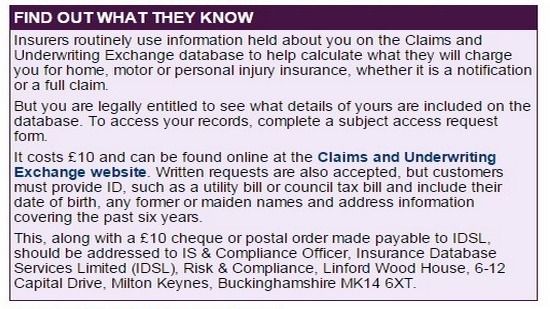

Wonder if anyone here has used their access rights to check what is held on them? Maybe insurers know more than we think they do. This from the Mail in April:

[IMG][/img] 0

0 -

Their insurers doesnt really care if you commit fraud against your own insurers as long as you arent committing fraud against them.

The chances are is the claim would be registered on CUE and so it depends purely on if your own insurers ever check CUE or you inadvertently decide to switch to insurer to one that does or to a sister brand of this insurer.

Even if you made no claim you are still contractually obliged to notify your insurers and future insurers of any incidents you've been involved in claimed or not. If you are ever discovered to have intentionally lied then you're potentially looking at void insurance, a 1st party Fraud marker going on your CIFAS file (that will be passed to your bank/ lenders etc) and massively inflated insurance premiums for life.0 -

...Their insurer specifically told us they will not inform our insurers themselves, it was up to us if we did. (We may, depending on the outcome, not yet resolved.) Maybe they put it on CUE though.

Yes, CUE is your issue.

So if you don't disclose this now and to future insurers expect it to come to light (if not by way of a routine check, then worse only when you are involved in a claim and are checked up on - your failure to disclose breach could lead to them voiding your policy )0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards