We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Greece - what a pickle - what would YOU do?

Comments

-

Glen_Clark wrote: »Thats assuming the future Greek Government is going to follow the British Government's example by doing everything it can to pump up house prices over the next 40 years. Its about as big an assumption as saying Fire Engines and Post Boxes are the same colour so you can post your letters in a Fire Engine.:D

You have to "assume" something to take a course of action.

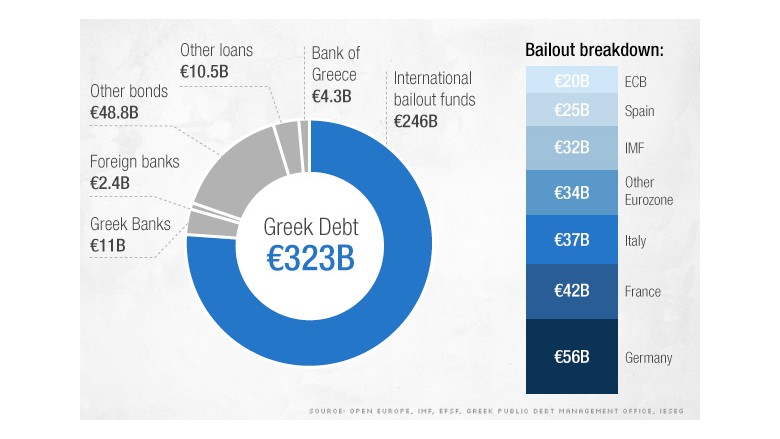

There was a discussion on the BBC, where a guy was saying most of the bail-out money went straight back into German and French banks, who are the major debtors. If you take the view that the whole point of this exercise is to steal from European tax payers to pay interest to German banks, at a profitable interest rate, an interesting approach is to buy shares in German banks.

I cannot imagine the EU allowing Greece to actually become a failed state. Without a coast guard and police, the human traffickers will land with impunity. Eventually, ISIS will establish a beach head, and the EU will have to pay for military bases and coastal patrol anyway.0 -

There was a discussion on the BBC, where a guy was saying most of the bail-out money went straight back into German and French banks, who are the major debtors.

That's vastly over-simplifying things as it is putting undue focus on French and German banks whose combined loans are less than a third of the total greek debt mountain.

It also ignores the fact that without continued ongoing injection of vast amounts of money, Greece will not be able to function. The IMF estimate that even if all the outstanding debt was waived, Greece would still require some €50bn further loans over the next three years.

Money alone is neither the root cause nor the solution to the Greek crisis. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards