We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Emerging market investing

El_Selb

Posts: 111 Forumite

I bought shares in the Lazard Emerging Market fund 6 months ago and since then the share price has gone done and the fund has underperformed the market by about 5%.

I know this shouldn't necessarily be a trigger to sell and there could easily be a bounce coming, but is there a better emerging market fund/tracker out there in people's opinion?

I have since bought shares in JPM India and I wonder whether buying in one or two other specific markets is a better way to gain EM exposure.

I know this shouldn't necessarily be a trigger to sell and there could easily be a bounce coming, but is there a better emerging market fund/tracker out there in people's opinion?

I have since bought shares in JPM India and I wonder whether buying in one or two other specific markets is a better way to gain EM exposure.

0

Comments

-

I just use an EM index tracker to get my main exposure to emerging markets. However I did spend a lot of time considering this, there are some strong arguments for using an active fund in this area and some good performances from some of them. In the end I just went with the index tracker as I couldn't find an active fund that fitted my criteria 100% (not a closet index fund, outperformance very likely due to skill rather than luck, long manager/fund history and the likelihood the manager is staying for the long term plus reasonable fees for all of that)

Anything can happen in 6 months in the market. At least you can say your fund is not a closet index fund. What were your reasons for going with this fund? If you thought it through carefully and did proper research then you should stick to your long term plans. Chopping and changing funds just because of 6 months is going to be a long term headache/nightmare. On the other hand, if you did not research properly then maybe you SHOULD research and consider now, then stick with whatever you come up with that best suits your needs.

I don't mean this badly but I think you have to harden up to short term movements whatever you decide to do in the end. Make choices for rational, logical reasons with your own goals and tolerances in mind. Don't make them because of emotional reactions to seeing losses or another fund you don't have outperforming.0 -

hi- sorry for butting in, but InvestInPoker - what tracker did you use? was it an ETF? and if so - which one?

thanks.0 -

Vanguard EM stock index fund.

I realise many would disagree with this choice - it gave me a bit of a headache. Just went for lose the least points w a good index fund at the end of the day.0 -

The Lazard fund outperformed the Vanguard one and the ima sector average over the last five years. Reviewing 6-monthly performance and hopping in, hopping out seems a bit bonkers. I generally prefer actively managed funds or ITs for emerging and developing markets. By their nature, the markets are imperfect and there can be a lot of crap in the index being bought on basis of size vs merits.0

-

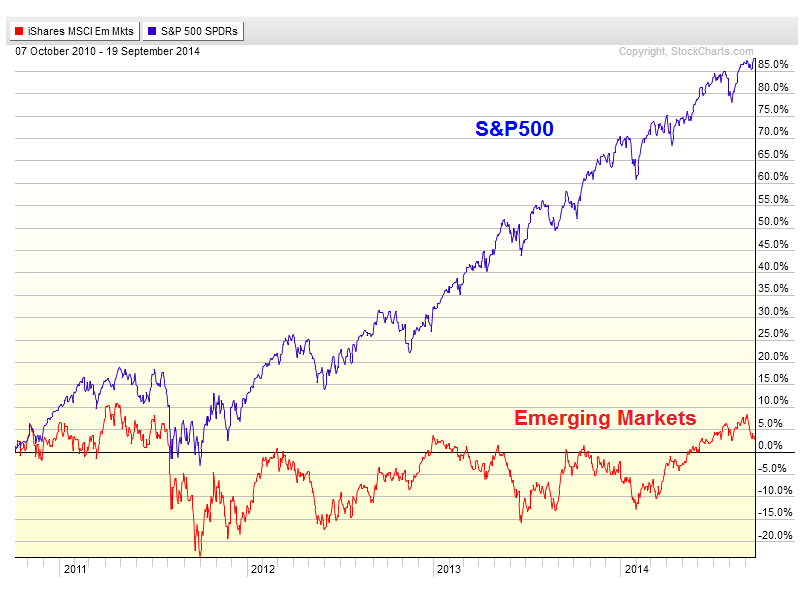

Why invest in emerging in markets? The S&P 500 has outperformed emerging markets by quite an amount every year in recent history...

The only people that make any serious money from the emerging market funds are the fund managersWe’ve had to remove your signature. Please check the Forum Rules if you’re unsure why it’s been removed and, if still unsure, email forumteam@moneysavingexpert.com0 -

I the share price has gone done and the fund has underperformed the market by about 5%.

Get out of stocks. Now. You don't have the cojones. Remember Rudyard Kipling

Seriously. If 5% worries you, you aren't hard enough. You need to be in a market that's 50% down. And know why you are there. Otherwise you can't shake the money tree...

If you can't take the down, you'll never see the up. Why are you in EMs? Do you have a good reason? Did you ever have a good reason? What is the timescale you expect EMs to outperform? If it's six months and you're in EMs you're in the wrong place looking in the wrong direction.0 -

That's why you diversify. Over the last 5 years, the US has been where the best returns have been found. Over the next 5 years, it will no doubt be somewhere else (quite possibly EM). When something has been delivering stellar returns, it is usually better to rebalance into other things that have not done so well, rather than selling those things and piling in to the current star performer.DaveTheMus wrote: »Why invest in emerging in markets? The S&P 500 has outperformed emerging markets by quite an amount every year in recent history...

The only people that make any serious money from the emerging market funds are the fund managers

If you look over longer periods, you'll see both emerging markets and the US have gone through periods of over/under performance...

In the years to 2000, the US market was steaming ahead (similar to the situation we find ourselves in now). The dotcom crash brought it down, but emerging markets were relatively unaffected. Then it was the turn of EM to boom between 2003 and 2008, ended by the credit crunch, which affected EM relatively more than the US, but EM bounced back much more significantly and faster, yet the US has gradually picked up steam and overtook this EM fund recently (although TEM has underperformed the index recently). Could we be moving into another period of EM outperformance and US declines? Who knows, but someone who held both markets and rebalanced between them would have done better than if they held either alone.0 -

Good reply. I was going to have a quick go at showing the effect of holding the two and rebalancing but for some reason when trying to pull data from Trustnet, it's not allowing me to add S&P500 as an index onto the graphs in the chart tool. I can see all the FTSE ones and Nikkei etc...but then the alphabetical list of indices goes Phillipines Singapore Swiss Taiwan Thailand and then on to the UK CPIs etc. I'll pick a random US fund and have a go!0

-

I bought shares in the Lazard Emerging Market fund 6 months ago and since then the share price has gone done and the fund has underperformed the market by about 5%.

I know this shouldn't necessarily be a trigger to sell and there could easily be a bounce coming, but is there a better emerging market fund/tracker out there in people's opinion?

Why the negative outlook? What were the fundamental reasons you choose to invest 6 months ago. Perhaps this actually offer a buying opportunity. What are the funds main investment holdings, how are they performing.

Churning funds isn't the way to make money. If a 5% fall concerns you. Then never invest in single company shares. As the movements are far more volatile than you would seem to realise.0 -

bowlhead99 wrote: »but for some reason when trying to pull data from Trustnet, it's not allowing me to add S&P500 as an index onto the graphs in the chart tool

I've never found a way to do that either - a potentially very useful bit of functionality that seems to be missing for some reason.

Still, TN is otherwise a terrific resource...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards