We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Hope is not an Effective Financial Strategy

Comments

-

shangaijimmy said:

Indeed, this forum is full of new figures to aim for for motivation. I am currently just TTing daily but it all helps keep me focused forwardThat for me is the great thing about data, and numbers. There's literally something else to count or to use for motivation and setting targets. As as we achieve one thing we quickly move onto another set of data.DON'T BUY STUFF (from Frugalwoods)

No seriously, just don’t buy things. 99% of our success with our savings rate is attributed to the fact that we don’t buy things... You can and should take advantage of discounts.... But at the end of the day, the only way to truly save money is to not buy stuff. Money doesn’t walk out of your wallet on its own accord.

https://forums.moneysavingexpert.com/discussion/6289577/future-proofing-my-life-deposit-saving-then-mfw-journey-in-under-13-years#latest4 -

Following your lead I TT'd to the mortgage 87p yesterday and £1.01 this morning. Onwards and downwardsLadyWithAPlan said:Indeed, this forum is full of new figures to aim for for motivation. I am currently just TTing daily but it all helps keep me focused forward MFW: Was: £136,000.......Now: £47,736.58......6

MFW: Was: £136,000.......Now: £47,736.58......6 -

Homes & Mortgages Journey

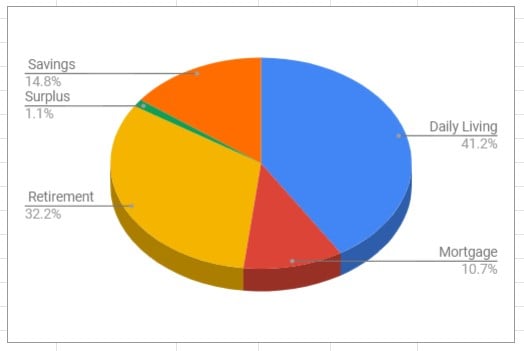

So taking 1 segment at a time, I thought I would start with the 'Mortgage' section and throw a timeline/journey over the last 2 decades or so...

First Forages into home ownership- 2002 - 2004 - First home bought for £83,000 (mortgage was approximately £72k), and sold 2 years later for £133,000.

- 2004 - 2006 - Bought a new build apartment for £105,000 and sold for the same amount (profits banked from previous house and into savings whilst waiting for next move)

- Intention was to keep the apartment for rental, but I decided I didn't have the time, energy, discipline, temperament or patience to be a landlord. So we jumped an extra rung on the ladder and stretched ourselves to the home we're still in now.

- 2006 - Purchased a 4 bed detached for £220,000 and a mortgage of £163,000 (the amount frightened the life out of me).

- Interest only mortgage over 30yrs

- The first 3yrs were a struggle, and in hindsight we were one of the examples of people being given mortgages that they could barely afford. Fortunately I was disciplined with money due to the education given by my parents. Mrs SJ was the polar opposite, but very self aware. She refused to have a debit card (envelopes of cash for spend, food, petrol etc...), stuck completely to budget and I suppose self taught financial awareness.

- 2009 - we were now in a position to tackle the mortgage by taking advantage of the financial crash and the slashed interest rates. Major motivator that resonated with Mrs SJ was the £16+ a day interest being added!

- 2010 - 2014 - I kept our payments at the highest level they'd reached to of £900. We had a oneaccount so cash was always readily accessible into savings pots, and we did use some for our wedding, towards a conservatory and for a new boiler.

- 2015 - Managed to finally get onto a repayment mortgage and fixed for 2yrs at 1.99%.

- £136,000 mortgaged, paying £687.26 a month.

- Daily Interest now £7.41.

- Idea was to attack the overpayments for 2 years and see where we would be at. I was still uncomfortable with our high mortgage amount.

- Total Overpayments - £13,923.24

- I started this diary to help with discipline, motivation and accountability.

- 2017 - Remortgaged, 2yr fix at 1.64%

- £113,000, paying £621.65. Daily Interest now £4.97

- Total Overpayments - £14,315.60

- Again we attacked the overpayments, whilst I wanted to spend some time learning more about investments, pensions for that phase following this mortgage deal.

- 2019 - Remortgaged, 5yr fix at 1.99%

- £86,500, paying £526.59. Daily Interest now £4.61

- We had a big first year of overpayments with a focus of getting the balance below £75,000

- Year 1 Over Payments - £4,284.42

- Overpayments so far - £5,924.63

- Since then there has been a complete switch to retirement focus. I'm completely comfortable now with our mortgage debt.

- At various points I've knocked a few years off the end date. Barring any major catastrophes we'll be mortgage free before ages 53 & 50, so no hold on our lump sums (more about retirement provisions to come in a different segment).

- Our current fix ends March 2024. Lots of thinking to do, but I'm very conscious of the current climate including our own political traumas!

- Potential options - offset mortgage, 2yr fix, 5yr fix...

- Directional plans - we may keep onto 2030 with current direction of small OP's that try to give us 1 extra payments a year, and then when we get to £20k left take a slight pause on retirement focus and attack the mortgage again.

- Extra thoughts - we do seem to have 3 very intelligent children and if they all opted for lets say a standard 3yr degree then from 2027 we could have 9 consecutive years of University to help with!!

MFW: Was: £136,000.......Now: £47,736.58......9 -

Not traumatic at all, it was very interesting! I love reading detailed breakdowns of people's finances, and what an interesting journey.

You've inspired me to work out our daily interest rate, which is currently £10.76 (on an outstanding balance of just under £174k), which is 22p a month more than when we took it out (because of a slightly more expensive fix after the initial cheap rate). Frightening indeed 😮

Looking forward to your next installment!6 -

I enjoyed the breakdown too. Fascinating...Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.3K Net savings after CCs 16/1/26 (but owed £1.1K) so £2.4K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/263 -

Uni costs are hellish - numbers 1 and 2 of ours both went to uni for 4 years each - with an overlap of 2 years in the middle. Number 3 will undoubtedly also go - and probably for 4 years I suspect - although we now have a 2 year gap to build our uni fund back up (likely to be a physics based degree). Number 4 is 3 years younger than Number 3 - and I have no idea if he will go or not (also intelligent but I can possibly see him doing a degree apprenticeship - don't rule these out as an option!) If our #4 does go to uni we are looking to possibly be retired by then.... argh!I am the master of my fate; I am the captain of my soulRepaid mtge early (orig 11/25) 01/09 £124616 01/11 £89873 01/13 £52546 01/15 £12133 07/15 £NILNet sales 2024: £204

-

Thanks for compounding my Uni fears... :'( I do need to be better prepared for 'overlap' years, and will definitely add it to my list of thinking/planning/stress testing. Like you I'm hoping for degree apprenticeship routesgreent said:Uni costs are hellish - numbers 1 and 2 of ours both went to uni for 4 years each - with an overlap of 2 years in the middle. Number 3 will undoubtedly also go - and probably for 4 years I suspect - although we now have a 2 year gap to build our uni fund back up (likely to be a physics based degree). Number 4 is 3 years younger than Number 3 - and I have no idea if he will go or not (also intelligent but I can possibly see him doing a degree apprenticeship - don't rule these out as an option!) If our #4 does go to uni we are looking to possibly be retired by then.... argh! . My niece has just been given a place at medical school, which ends up being 5yrs

. My niece has just been given a place at medical school, which ends up being 5yrs

What I'm really hoping for is for education to be a big pawn in the next general election campaign...although lets be fair they're not trustworthy enough to actually implement what they campaign on MFW: Was: £136,000.......Now: £47,736.58......7

MFW: Was: £136,000.......Now: £47,736.58......7 -

Definitely encourage apprenticeships. DS came out with masses of debt despite some help from us. DD in contrast is earning her way through an apprenticeship.Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.3K Net savings after CCs 16/1/26 (but owed £1.1K) so £2.4K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/264 -

Yep - my eldest 2 have approx 65k and 55k each in student debt - and that figure is rising, as interest is charged from day 1

I am the master of my fate; I am the captain of my soulRepaid mtge early (orig 11/25) 01/09 £124616 01/11 £89873 01/13 £52546 01/15 £12133 07/15 £NILNet sales 2024: £205

I am the master of my fate; I am the captain of my soulRepaid mtge early (orig 11/25) 01/09 £124616 01/11 £89873 01/13 £52546 01/15 £12133 07/15 £NILNet sales 2024: £205 -

Right...enough of this University talk, as its too upsetting to think about for my poor spreadsheet... for now anyway. I'l keep on with my current plan for the next 18 months and then look again when I reassess our budget at re-mortgage time (I should have about £18k put to one side by then).

I OP'd our payment round up pot this morning which was a chunky (and bizarrely) £7.77. A bit higher than usual which was inevitable due to a week in the Lake District.

A huge positive to report though is primary school uniforms. Our school have informed us that as of next year we aren't required to have the fully badged up jumpers, cardigans and pe kits. That'll be a sizeable saving for us, especially when DS1 lost his hoody after 3 weeks and brought home one from a kid 2 years below MFW: Was: £136,000.......Now: £47,736.58......5

MFW: Was: £136,000.......Now: £47,736.58......5

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards