We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Best way to save?

Mike12421

Posts: 97 Forumite

Hello all,

I've been saving £150/month now for around a year however this is in just a standard savings account with my work union which does not provide any real benefits. My goal is to continue saving this amount each month.

My question is where and how is the best method to save when I want the highest interest return. This however is with no risk and a guarantee that I will get back what I put in, so no stock options for me. I have no issue with being locked into a savings account for several years, as a matter of fact the longer the better.

Ideally I would like to set it up online and I don't want to have to take out any other product with the provider, or change my current account. I would just like your advice on the best way to save.

Thanks in advance.

I've been saving £150/month now for around a year however this is in just a standard savings account with my work union which does not provide any real benefits. My goal is to continue saving this amount each month.

My question is where and how is the best method to save when I want the highest interest return. This however is with no risk and a guarantee that I will get back what I put in, so no stock options for me. I have no issue with being locked into a savings account for several years, as a matter of fact the longer the better.

Ideally I would like to set it up online and I don't want to have to take out any other product with the provider, or change my current account. I would just like your advice on the best way to save.

Thanks in advance.

0

Comments

-

Hello all,

I've been saving £150/month now for around a year however this is in just a standard savings account with my work union which does not provide any real benefits. My goal is to continue saving this amount each month.

My question is where and how is the best method to save when I want the highest interest return. This however is with no risk and a guarantee that I will get back what I put in, so no stock options for me. I have no issue with being locked into a savings account for several years, as a matter of fact the longer the better.

Ideally I would like to set it up online and I don't want to have to take out any other product with the provider, or change my current account. I would just like your advice on the best way to save.

Thanks in advance.

First Direct will do you just fine: http://www2.firstdirect.com/1/2/bankingWhat happens if you push this button?0 -

Hello all,

I've been saving £150/month now for around a year however this is in just a standard savings account with my work union which does not provide any real benefits. My goal is to continue saving this amount each month.

My question is where and how is the best method to save when I want the highest interest return. This however is with no risk and a guarantee that I will get back what I put in, so no stock options for me. I have no issue with being locked into a savings account for several years, as a matter of fact the longer the better.

Ideally I would like to set it up online and I don't want to have to take out any other product with the provider, or change my current account. I would just like your advice on the best way to save.

Thanks in advance.

What's the money for and how long are you saving it for? Is there a reason why you won't consider any investment products?

Best interest at the moment is either regular saver or current accounts. Open a TSB and you'll get 5% on £2000.Remember the saying: if it looks too good to be true it almost certainly is.0 -

Thanks for the suggestion of First Direct however they want me to transfer my current account to them which I don't want to do.

The money will be saved over the next 20 years, which is online worth when I can retire. The only reason I didn't like the idea of investments is the risk of losing the money saved. If the risk was solely confined to the amount of interest returned then that would be ok.0 -

You don't have to if you don't want the switching bonus, just open it in addition to your existing account. There are loads of threads about this account you can readThanks for the suggestion of First Direct however they want me to transfer my current account to them which I don't want to do0 -

The OP already has £2000 - he cannot just deposit this in FD regular savings and carry on from there!

Indeed, if he wants the FD RS, he needs to open a FD current account and (unless he wants to credit that with £1000 each month, which he could do on a cycle in and out basis), open an additional product with them. This need be no inconvenience and in fact is handy as a repository for the matured FD RS funds- not that he would wish to leave the matured funds there earning peanuts!

So the OP needs to do a little work.

He might open a TSB Classic Plus and deposit the £2000.

He might then open FD current account with £1, FD E-saver ( fund with £1), and FD RS.

He sets up a SO from his existing current account to credit FD current with £150 a month and for the £150 to go from this to the RS.

He remembers to move the matured funds elsewhere on maturity.

This will probably mean setting up another current account.

He sets up an SO from his existing current account to credit the TSB with £500 a month and to send it plus the monthly interest back again and so on.....https://forums.moneysavingexpert.com/discussion/comment/67672481#Comment_676724810 -

OP, had you considered saving the money into a pension? Or even part of it?

It is true this would be invested through the stock market but might well increase your retirement resources.

Are you able to increase your contributions to an existing pension?

Would this garner additional contributions from your employer?

You might consider a simple stakeholder or PP through Cavendish?

http://www.cavendishonline.co.uk/pensions/stakeholder-and-personal-pensions/

https://www.standardlife.co.uk/c1/guides-and-calculators/pensions-are-changing.page

Are you a higher rate tax payer?

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief0 -

If it's money for 20 years then personally I think it's crazy to use cash.Thanks for the suggestion of First Direct however they want me to transfer my current account to them which I don't want to do.

The money will be saved over the next 20 years, which is online worth when I can retire. The only reason I didn't like the idea of investments is the risk of losing the money saved. If the risk was solely confined to the amount of interest returned then that would be ok.

Do you understand investment and risk? Even if markets drop as they did in 2008/9 they can bounce back equally quickly and had recovered all the drop by 2010. If you're buying then you actually would want them to drop now so you get more for your money.Remember the saying: if it looks too good to be true it almost certainly is.0 -

Thanks for all of your suggestions.

Regarding increasing my pension contributions, unfortunately that is not possible as my provider won't allow it.

In regards to investing, I hadn't really given it much thought. I have had a look round and round this;

http://www.fairinvestment.co.uk/investec_FTSE_100_defensive_kick_out_Plan_affiliate.aspx?affid=226826405

However I think I can only make a one time deposit, and not a monthly contribution. Does anyone have any suggestions for investing as I haven't got a clue. Ideally I would like to continue paying £150 each month. I don't mind being locked in, longer the better as a matter of fact.

Thanks again.0 -

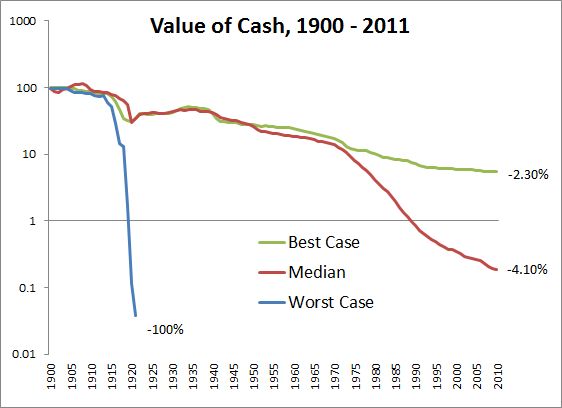

Well risk is a funny thing ... In one sense the greatest risk is having too much in cash, because then (thanks to inflation) you're pretty much guaranteed to lose wealth over the long-term

With stocks and shares, while there will be significant ups and downs, over the long-term this has proven the least risky way to maintain wealth (as it's always outgrown everything else)

So what you might want to look into is a 'risk parity' or 'permanent portfolio', which would split your savings evenly across various assets, perhaps including cash - these are balanced against each other in terms of risk and return:

And these portfolios can be tailored to your risk appetite, but the simple aim is to beat inflation

By contrast this is what cash does over the longer-term

So that can put risk in a slightly different perspective0 -

Regarding increasing my pension contributions, unfortunately that is not possible as my provider won't allow it.

Open another pension? You don't have to confine yourself to one! A stakeholder might well suit.

You are permitted to pay up to your earned income or £40000 a year, whichever is less, into a pension each year and receive tax relief.

http://www.cavendishonline.co.uk/pensions/stakeholder-and-personal-pensions/

http://www.thepensionsregulator.gov.uk/employers/about-stakeholder-pensions.aspx

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief

You might split your monthly savings between a stakeholder pension and using a high interest current account as above.

Re new state pension https://www.gov.uk/new-state-pension/overview0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards