We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Rubbish BBC article - "Pensioners could run out of cash"

Options

Comments

-

You used a 50% equities, 50% gilts mixture. That's way too low on equities for the time periods you're considering, since it's believed the the ideal equity proportion increases as the time in retirement increases, reaching close to 90% at the sort of range you're considering. You're using a low life expectancy investment mixture and then apparently being surprised that it doesn't last a long time.

Other research suggests that a gradually increasing equity mixture may do better than fixed higher level, with a US maximum historic sustainable rate of 4.3-4.4% for initial equity percentages in the 30-60% range and final in the 50-100% range. Fixed 50:50 delivered 4.3%. All these with a 10% failure rate which would require reducing income in the most adverse scenarios.

It doesn't help that you're using gilts initially at a time when those are expensive, though at least you try global. But you don't try higher paying alternatives like P2P, say.

4% is likely to be too low for normal investment conditions and sensible asset mixes since it's based on the worst case US situation, not normal investment returns.

Rising equity mixtures doing better shouldn't be surprising once sequence risk is understood, since the worst adverse cases start with a large drop in value at the start of retirement. Reduced initial equity mixtures reduce this risk, though there are other ways of reducing the risk.

I didn't pick the mix - Wade Pfau did. As a person chasing very early financial independence I merely used it as a basis for some thoughts on the topic because UK based data is pretty thin on the ground.

Interesting thoughts from yourself on different allocation weighting methods and drawdown amounts, thanks. Here's where I'm personally at:

- from a weighting methodology I am using (Age in Bonds - 10). Within "bonds" I include cash, P2P, bonds and half of my property allocation. Within "equities" I include all my country equities, some gold as well as the other half of the property. I then move a portion between equities and cash depending on an equity valuation metric that I've built. This methodology has given me an average return over the last 7 years of 6.4%.

- from a draw down methodology I have no backstop - no DB pension and certainly no inheritance to come. Therefore I'm trying to get "100%" success as a sequence of returns failure (you mentioned 10% failure rates) means I'm living in a cardboard box by the side of the motorway. With this in mind I'm happier with 2.5%.0 -

gadgetmind wrote: »Out of interest, what was the ASF's yield at the start of your study and just after the big crash?

The real killer during the financial crisis seems to be a few complete losses (or massive dilutions) for big institutions, and dividend cancellations for many that survived.

Sorry gadget, having a slow day, ASF?0 -

GenghisKhan wrote: »Sorry gadget, having a slow day, ASF?

Naaa, it's me conflating the FTSE All share index (ASX) with the FTSE 100 ETF you used in the portfolio (ISF). Sorry!I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

gadgetmind wrote: »Naaa, it's me conflating the FTSE All share index (ASX) with the FTSE 100 ETF you used in the portfolio (ISF). Sorry!

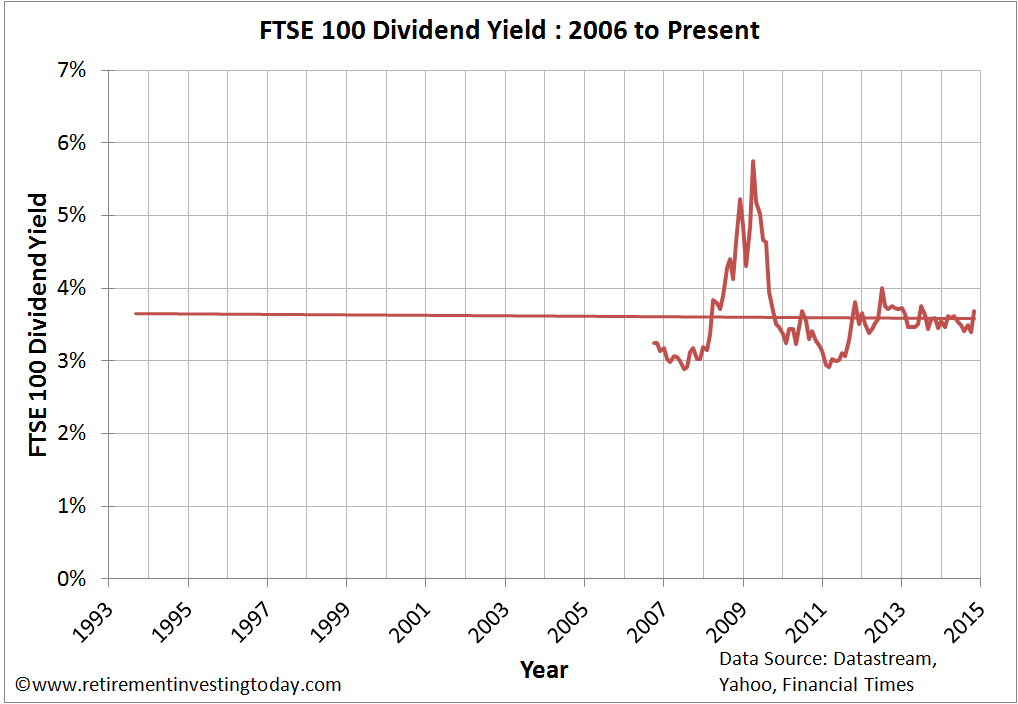

If it helps I grab divi yield data for the FTSE100 on the first possible day of every month. At the start of Jan 2007 the divi yield was 3.02%. It peaked at 5.75% in March 2009.

Chart of yield:

Actual dividend amount is possibly more important though:

These images are grabbed from my reasonably regular analysis which I freely publish. Does that help answer your question?0 -

Yes, it does.

I must say, I'm a little surprised by how a 4% (initial) drawdown that's not much more than the (initial!) natural yield of the portfolio turns into such a large loss over the following years. I guess that's you get from bad timing, no cash buffer, and no way to tighten the belt.I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

gadgetmind wrote: »Yes, it does.

I must say, I'm a little surprised by how a 4% (initial) drawdown that's not much more than the (initial!) natural yield of the portfolio turns into such a large loss over the following years. I guess that's you get from bad timing, no cash buffer, and no way to tighten the belt.

I deliberately picked a start period just before the down turn as this is a worst case example. I would have liked to go back to the dot com crash but I just couldn't get the data. The work is all for my own personal retirement planning so I always try and work to worst case - I then just choose to publish it freely.

Additionally my thinking was that we're all going to see plenty of downturns in our retirements and I was also thinking whether people who are going to draw down are naturally more likely to reach their retirement number in a rising market because their wealth is rising more quickly due to both contributions plus increase in capital value as opposed to a bear market where they could be losing more capital value than contributions.

Good point about no cash buffer and no belt tightening. I freely admit it's a fairly simplistic analysis. In reality I personally will carry a year or two of cash to ride out a down turn. Belt tightening will be difficult for my family, so I didn't simulate it, as we opted out of consumerism a long time ago and so don't spend much on non-essentials.0 -

gadgetmind wrote: »With only £29k in there, and assuming a 45 year working life, that's only around £50 a month even assuming close to zero growth.

Haven't even been at work 45 years and my £50 was over half my starting monthly salary. So £29k may not be far off the mark.0 -

Thrugelmir wrote: ȣ50 was over half my starting monthly salary.

Well, you do need to allow for at least indexation if not growth, so that's £50 in today's terms.I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

GenghisKhan wrote: »I deliberately picked a start period just before the down turn as this is a worst case example.

Yes, and this is what you need to plan for. If things go south on the run up to my retirement, then I'll just hold off giving notice. To cover it happening in the few years afterwards, I'll be using a decent buffer of cash and bonds. Absolute worst case, we could comfortably live in a house worth 1/3rd of our current one (which would also save on repairs and utilities!) which would free up a sum equivalent to 1/3rd of our pension investments.

I've also got a number of hobbies which could easily generate a lot of income, but they'd then cease to be hobbies!I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

Anyone see that really really low bit in the graph - that is when I intended my pension to start. Gave that up as a bad job very quickly. So all you experts - what should I do now. 68, pension sitting there now (small) nowhere much to go. I have plenty to live on, still saving as much as when I first retired, better off than I have been for years. I'm thinking leave it there, they say until I am 75 I will be able to get one based on my health, after that then no, and let my son inherit. I think his need may be greater than mine. I will not, however, let him inherit if it is to my detriment. However, as I am still saving I obviously don't need it.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.2K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.2K Work, Benefits & Business

- 599.3K Mortgages, Homes & Bills

- 177K Life & Family

- 257.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards