We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

2015 Frugal Living Challenge

Comments

-

Hi all, doing ok so far this year, grocery is within allocated spends. All other bills are pretty much the same except the house insurance has gone up about £5 per month. Need to get a quote for car breakdown cover!Grocery Challenge 2024

Feb £419.82 Mar £599.53 Apr £405.69 May £531.37 Jun

Declutter challenge 2024 0 items0 -

Mrs_Cheshire wrote: »Need to get a quote for car breakdown cover!

If you have a means of paying for a breakdown (eg credit card / savings) and waiting for it to be paid back, AutoAid is fantastic - they are quick to pay out so realistically you could put on a credit card & be paid before you had to pay the billGrocery Challenge £211/£455 (01/01-31/03)

2016 Sell: £125/£250

£1,000 Emergency Fund Challenge #78 £3.96 / £1,000Vet Fund: £410.93 / £1,000

Debt free & determined to stay that way!0 -

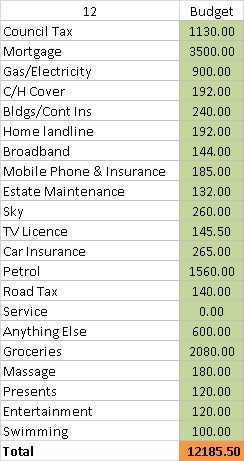

Budget so far:

It does allow for small increases in some budgets eg to mortgage payments should interests rates rise (which they will do at some point) but static in others

I am restricted with some things eg landline / broadband as I'm in one of 'those' areas which can only get BT / Plusnet and also we don't have anything like Virgin / other cable providers so stuck with Sky also!

Groceries is really high as I have a specialised diet but does also include all toiletries & cleaning stuff and pharmacy type stuff (painkillers, cold stuff etc)

Anything else covers things like the new toaster I had to get last week, clothes etcGrocery Challenge £211/£455 (01/01-31/03)

2016 Sell: £125/£250

£1,000 Emergency Fund Challenge #78 £3.96 / £1,000Vet Fund: £410.93 / £1,000

Debt free & determined to stay that way!0 -

Please feel free to comment or please point out anything you think I might have missed.

I noticed you had travel insurance in but nothing for a holiday - just wondering why you would need the insurance if you don't go away?? (and if you do, then you've missed it from the budget - sorry)

How many in the family as food / wine seems high if just 2 of you (again sorry) - does it include other things?Grocery Challenge £211/£455 (01/01-31/03)

2016 Sell: £125/£250

£1,000 Emergency Fund Challenge #78 £3.96 / £1,000Vet Fund: £410.93 / £1,000

Debt free & determined to stay that way!0 -

Does anybody sell a lot on eBay or etsy? I'm planning to declutter and sell a few bits on eBay but after that would like to make it a regular thing and have a bit of a brainstorm of something to sell on a regular basis to have a bit extra cash. What are the 'laws' on this? Would I need to become self employed and declare profit made? I receive some benefits so wouldn't want to get in trouble or knock out my entitlement etc. any advice would be gratefully received

thanks Managed to save 20% of house deposit target0

thanks Managed to save 20% of house deposit target0 -

Does anybody sell a lot on eBay or etsy? I'm planning to declutter and sell a few bits on eBay but after that would like to make it a regular thing and have a bit of a brainstorm of something to sell on a regular basis to have a bit extra cash. What are the 'laws' on this? Would I need to become self employed and declare profit made? I receive some benefits so wouldn't want to get in trouble or knock out my entitlement etc. any advice would be gratefully received

thanks

thanks

Can't help re benefits I am afraid, but if you want to buy (or make) items specifically to sell, then yes, you would need to register as self employed and do a tax self assessment annually. If on the other hand you just want to sell items that belong to you personally that you don't want any more (ie if you are decluttering your loft, or want to sell a collection of something you are no longer interested in, then there is no need to do this.

OH and I are both registered as self employed on this basis - I buy and sell antiques and vintage items, mainly via a space in a local antiques centre, and OH makes and sells craft items. Since our businesses are very small and neither of us is getting rich from them, the tax implications are pretty negligible to be honest :rotfl: If you decide to go ahead, remember to claim the appropriate tax allowances. We both keep our own records (ie what comes in and what is spent out), but employ a local accountant to help sort our self assessment form out once a year - her fees are modest, tax deductable and her knowledge saves us money quite legally.

HTH.0 -

Well this week has been a frugal bust. For starters, the very cold, damp weather has shown up just how bad our badly double glazed windows, and the very few single glazed windows and wooden front door (all inherited from when we bought the house a year ago) are, as it looked like it was raining on the inside due to the condensation. So we now need to get quotes to sort it all out and then save like hell to be able to afford it.

Then I got a letter yesterday notifying me that my photo card driving licence is due for renewal at a minimum cost of £14. This isn't going to break the bank, I know, but when it is an un-budgeted expense, it's a pain to have to fork out for.

Finally, my DH got a letter from the tax office advising he owes them £162.00 in underpaid tax for the tax year up to April 2014. Bearing in mind that he has never been self-employed nor has he ever had a second job, am I being thick, but isn't it their responsibility to ensure that his tax code is correct, and his employer's job to ensure that they deduct the correct amount of tax from his salary? Or have I got it completely wrong? I just don't get it. And considering that I'm having a baby on Monday, firstly the timing of all this couldn't have been any worse, and secondly, when will he get the time to sort it out?

I'm sorry for the rant. I'm just feeling super stressed with a lot going on anyway without all of this nonsense (the only polite way I could think of to put it), and I just needed to vent. I hope everyone else's frugal efforts are going well.2016 MFW no. 47 £0/£3,000

MFiT T4 no 26 Start bal £149,294, Current bal £149,294, Target bal £134,294

Make £2,016 in 2016 £1180.550 -

The only reason I can see someone with only one job and that being PAYE would owe tax is if they have enough interest coming in from savings (or dividends on shares) to push them into the higher tax bracket. As everything would have been taxed at basic rate the person would owe the difference.

Other than that, a swift letter to Inland Revenue asking for calculations is called for.Cheryl0 -

Sorry you're having a rough time of it Wombatchops!

Just re the letter from the tax office - it might be that his employer has messed up and has used the wrong tax code for the year meaning he has not had the correct amount deducted from his wages - if this is the case then as much as a pain as it is, your OH will have to pay it (as he's inadvertently underpaid tax). My OH had this situation a few years ago - it was the finance office that messed up but he was still liable

Hopefully this isn't the case though - as cw18 says, definitely give them a call and get an explanation as to the charge - hopefully it's just the tax office sending a letter to the wrong person (had that before too!!)

Hopefully the weather will start to pick up again soon!Blogger, crafter & general moneysaver!

£2,015 in 2015 challenge : £20.65 / £2,0150 -

Thank you cw18 and thefrugalflirter. He definitely doesn't earn huge amounts of interest, so it must be the tax code. And if he owes it then he owes it, and that's the end of it. It's just a hassle we don't need (although, to be fair, does anybody?), but he will be calling for an explanation, just not tomorrow.

On a less pessimistic, woe-is-me note, did anybody watch the Watchd0g special on Thursday night about how to save £1,000 this year on your bills? We recorded it and watched it last night (we know how to have fun on a Saturday night). Although we do much of that stuff already, the thing that I think will really help me is the petrol consumption. I've been driving for 10 years and have picked up some bad habits, which don't help my petrol usage, but some of the stuff mentioned was news to me, and when I can drive again after the caesarean I really want to change my ways and use those tips. I just wondered if anyone else saw it, and what they thought of it.2016 MFW no. 47 £0/£3,000

MFiT T4 no 26 Start bal £149,294, Current bal £149,294, Target bal £134,294

Make £2,016 in 2016 £1180.550

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards