We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Naive question regarding contributions....

Comments

-

somethingcorporate wrote: »Yes, your contribution is £69.57 (from the first image) over your gross salary of £2,824 - I make that 2.5%.

Has your salary changed recently?

Thank you!

Not since last April, I believe, when we had a pay rise?0 -

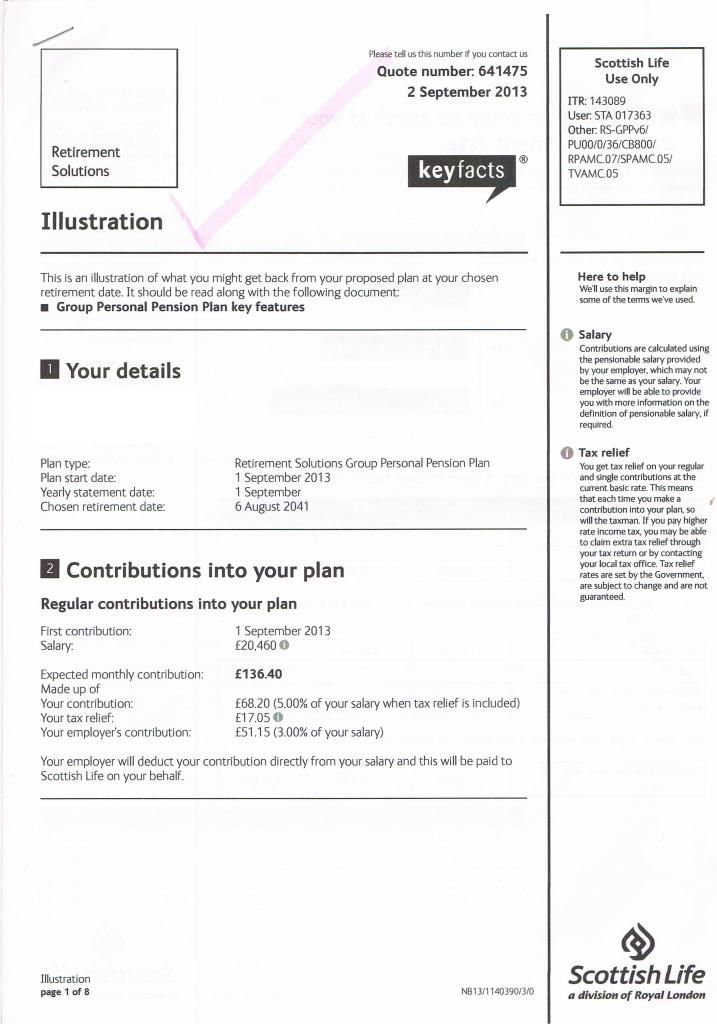

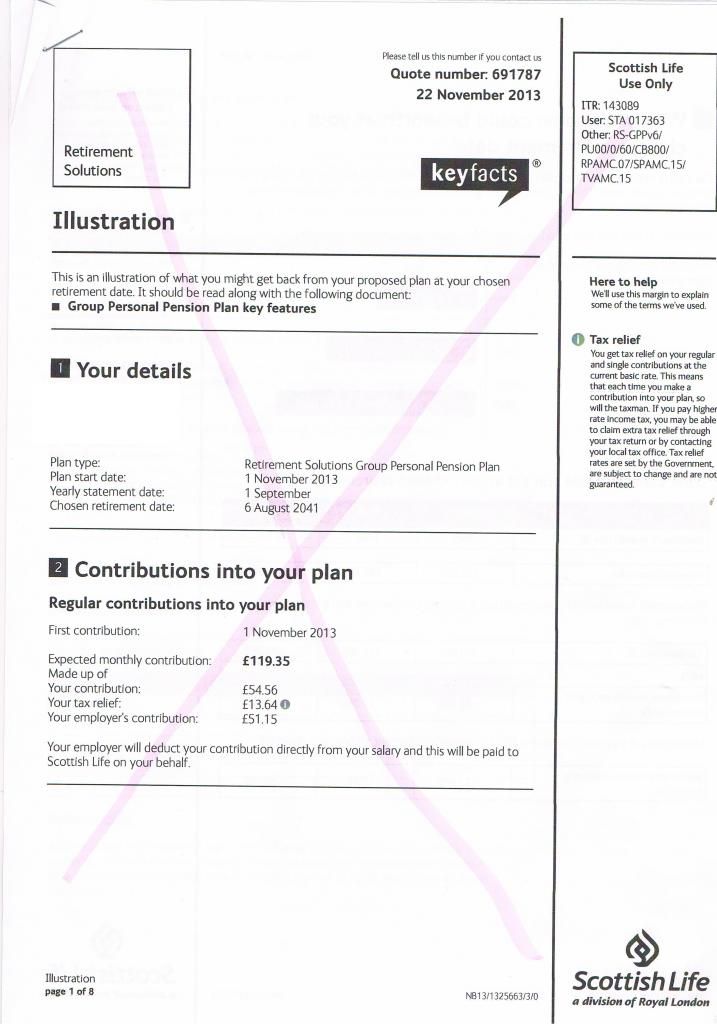

Perhaps these will help, two different illustrations I was given when the pension started, one for 3% and one for 5%:

0

0 -

0

0 -

They don't help as it doesn't say what counts as pensionable salary.

However looking at your contributions 3% seems more than likely as it's nowhere near 5%.0 -

Thank you, (Sorry they are of no use)I just wondered why somethingcorporate got 2.5%, that's all.

Could I ask, wouldn't it be beneficial if my employer took my contribution from my gross pay?0 -

From the first "Illustration" you have shown, I would say your contributions are 5% of Pensionable Pay (before deduction of tax and national insurance).

The calculation is:

Pensionable Pay = £20460

Contribution per year = 5% X £20460 = £1023.00

Contribution per month = £1023.00/12 = £85.25

Tax Relief = 20% X £85.25 = £17.05

Amount paid in NET = £85.25 - £17.05 = £68.20

This matches what is on the Illustration.

In the right margin for the little "i" it explains how you get Tax Relief: "Each time you pay into your plan so will the tax man".

So you pay in 5% (4% of NET pay) and your employer pays in 3% (GROSS).

You get the tax relief on your contributions added by your pension provider (in the above example they will add £17.05 per month).

Jem16: Doesn't it say the illustration is based on Pensionable Salary in the margin?

To answer your last Question:

If you are a basic rate tax payer (depends on your total income), it makes no difference whether the pension is funded from Gross pay (tax relief at source) or from Net pay (tax relief added by Pension provider).

If you pay higher rate tax, you have to claim the additional tax relief you are entitled to from HMRC (again see "i" in right margin).0 -

Thank you, (Sorry they are of no use)I just wondered why somethingcorporate got 2.5%, that's all.

2.5% was obtained as that is the percentage of your gross pay for that month that was paid into your pension.

However the reason is that in your gross pay that month you had some extra bonuses which added to your pay but were probably not pensionable - ie your pension deductions are always based on pensionable salary.

Without knowing which bonuses are not included we couldn't be sure.Could I ask, wouldn't it be beneficial if my employer took my contribution from my gross pay?

It's a Group Personal Pension which always pays from net pay so no I doubt very much you could ask your employer to do that. It wouldn't be practical for your employer to run a separate pay system just to accommodate you and then for your pension provider not to apply tax relief only to your contributions and not everyone else.

Why do you think it would be beneficial anyway? You are getting the tax relief you should be getting. It would only matter if you were a higher rate taxpayer as you would have to claim the extra 20% but you're not.0 -

Jem16: Doesn't it say the illustration is based on Pensionable Salary in the margin?

Yes but what I meant is that I don't know what pensionable salary is. In the month concerned the OP had overtime and a Christmas bonus on top of his gross pay. Some of that or none of that may be included in pensionable salary.

As the first set of figures were removed as they contained too much personal detail I don't have the figures now to check over which pension contribution could be correct.0 -

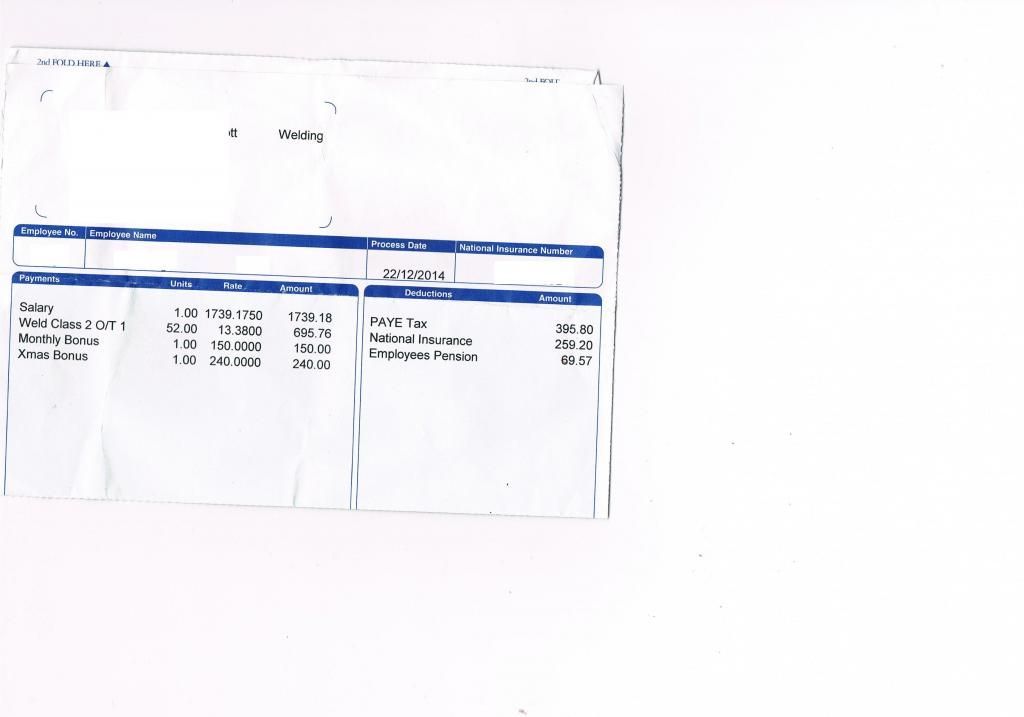

Apologies jem16, here is the scan with the personal details removed but the financial details included:

Does this help?0 -

Apologies jem16, here is the scan with the personal details removed but the financial details included:

Does this help?

Yes it does. You are paying 5% of your gross salary and your employer is paying 3% of your gross salary. Your pensionable salary does not include any bonuses or overtime.

So £1739.18 at 5% gross = £86.96. You pay the net amount minus the 20% tax relief which is £69.57 which is what you see on your payslip. The pension provider takes that £69.57 and adds on the basic rate tax relief taking it back to £86.96.

The £1739.18 at 3% = £52.18 which is on your payslip.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards