We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Naive question regarding contributions....

Comments

-

I think my confusion comes from the fact that my contributions obviously come from my gross pay but I still see that tax relief is added on my pension statement? (Sorry for the naivity, I am trying to learn)

Now that would be an odd thing.

Tax relief is either dealt with by paying from gross pay and getting immediate tax relief as it reduces your taxable pay. Or it is added on by the pension provider if you pay from net pay. What won't happen is that you get tax relief via your payslip and it gets added on by the pension provider.

So you need to check your payslip. Is your gross taxable pay less than your gross pay?

Is the amount that you actually see coming off your pay for your pension the exact same amount that's contributed on your pension statement?0 -

Or it is added on by the pension provider if you pay from net pay

Doh! I'll bet it's that, I shall go and find my payslips and Pension statement and find out.

Apologies for the stupid questions, I now feel foolish for posting what I did.

I will report back later.

Thank you for the education. 0

0 -

-

Hi,

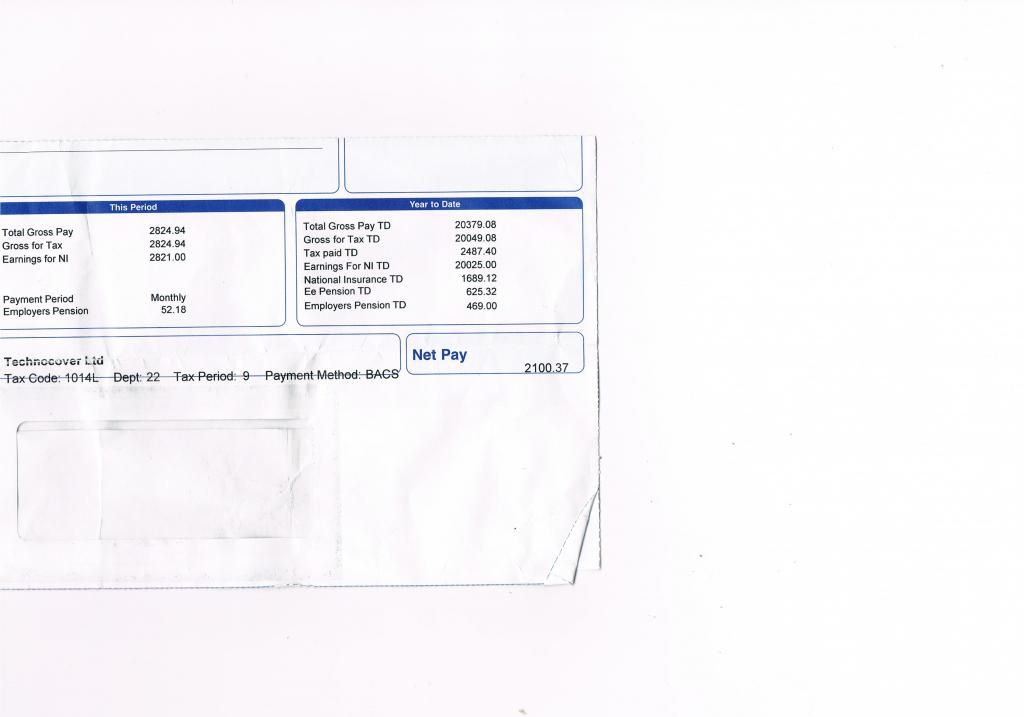

Apologies for the delay. Unfortunately I can't seem to get this scan any larger.

I hope you're able to view it and help determine whether the contribution is taken from gross or net?

I do not have the pension statement available as yet.0 -

What is your gross pay on that payslip? (excluding bonus and any other adjustment).

Otherwise it is impossible to say.

My gross pension adjustment is listed just below my gross salary (to get to a taxable salary) and not listed in my net salary adjustments.Thinking critically since 1996....0 -

And:

0

0 -

Ok if you look at the second image you will see that the gross pay and gross for tax are the same. This means that your pension contributions are coming from net pay and not gross pay. Your tax has been calculated on the gross pay.

By the way I would delete that first image - too much personal info.0 -

Ok if you look at the second image you will see that the gross pay and gross for tax are the same. This means that your pension contributions are coming from net pay and not gross pay.

By the way I would delete that first image - too much personal info.

Brilliant! Thank you so much. One final (hopefully) question - From that info, should I be able to work out whether I'm paying 3% or 5% of my income?0 -

Brilliant! Thank you so much. One final (hopefully) question - From that info, should I be able to work out whether I'm paying 3% or 5% of my income?

I would say it was 3%.

The figures didn't work out properly but I suspect it's because some of those bonuses or overtime isn't counted for pensionable purposes.0 -

Yes, your contribution is £69.57 (from the first image) over your gross salary of £2,824 - I make that 2.5%.

Has your salary changed recently?

Edit: Jem has the right answer I suspect. That will include bonus and anything else that would impact your pay. Your pension contribution would be based on your basic salary only so this would work out at £2,319 per month or around £28k pa.

About right?Thinking critically since 1996....0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards