We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

why are all shares generally tanking? FTSE was 6800+ now 6500

Comments

-

Thrugelmir wrote: »See my previous comment. That sums up the Dot Com boom of the late 90's.

What you are failing to take account of is the index is a changing beast. Every quarter shares are relegated and promoted in and out of the index. In addition to which companies disappear when taken over, delisted, get floated or go bust. So the constituents regularly change.

I would it had to believe that serious property investors never buy a dud. However much due diligence is applied.

I don't believe I am failing to take it into account.

For those that are doing well and are promoted into the index, they are the winners, equally, there are the companies which are relegated, disappear, delisted, floated go bust etc as you put it which are the losers.

I am certainly not a good place to give any advise on shares from, but I am a good example of one of the losers from share investments.

In my opinion, the only real winners are the brokers.

(This made me think of the Wolf of Wall Street, which incidentally was a cracking film):wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

IveSeenTheLight wrote: »(This made me think of the Wolf of Wall Street, which incidentally was a cracking film)

A rare occasion when I strongly disagree with you, I thought that movie has hard work, although I didn't really like it, it had a strange compelling draw that ensured I watched the full movie before denouncing it.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

IveSeenTheLight wrote: »I'm sure it is, but I am one of those that was burned by share investments with no dividend returns

BTL on the other hand is more tangible and lower risk in my experience.

If invested right, a very decent profit can be made, without the need to consider any capital appreciation which becomes a bonus at the end of the investment.

£ per £ investment, I can't see how investing in the FTSE 100 can give a better more stable return than BTL unless you are one of the lucky ones, to the detriment of those that have lost value.

I could pay over the odds for a house in an area where there is little rental demand and lose loads of money into the bargain.

At the same time I could invest in a FTSE tracker every month over the same period, make decent returns, then come to this thread and write completely the opposite.

You would tell me I just screwed up the BTL but and if I had known what I was doing then it would be a different story...0 -

IveSeenTheLight wrote: »I have shares from 20 years ago that are worth a fraction that I invested in.

That's not short termism.

Clearly the FTSE 100 has not grown in 15 years, merely recovered and the question is whether a 3.6% dividend return is an acceptable investment.

There have been examples where you could have made a very tidy profit, but equally (if not more) investments where your share value has reduced.

The FTSE is below the level it was 15 years ago - true. However during that 15 year period it was also below its current level for almost the entire time (significantly below for a large chunk of the time, falling below 4000 at points), so if you had invested every month you would be sitting on a significant capital gain to add to your dividend stream (and the compounding effect of reinvesting those dividends).

Anyone can come up with a specific example of how you would lose money if you bought a specific asset at time A and sold it at time B. If you bought a BTL somewhere in the East Midlands in 2007 and sold it in 2012 it wouldn't look a very clever investment but that doesn't help you to work out whether BTL in general is a good way of investing if you know what you're doing.0 -

IveSeenTheLight wrote: »I have shares from 20 years ago that are worth a fraction that I invested in.

That's not short termism.

What did you buy that's diminished in value?

What did you do with the dividend income?0 -

Thrugelmir wrote: »What did you buy that's diminished in value?

What did you do with the dividend income?

He bought BTL.

He invested it in BTL. :rotfl:0 -

Oil is in deflation as well as the stock market and commodities.

In deflation like this all debt is going up in value in relation to the things that are in deflation.

Cash is king.

Looking at the stockmarket the last few years, (and even go back further) it really looks like a long way to fall.0 -

Oil is in deflation as well as the stock market and commodities.

In deflation like this all debt is going up in value in relation to the things that are in deflation.

Cash is king.

Looking at the stockmarket the last few years, (and even go back further) it really looks like a long way to fall.

Obviously I can't predict the future, stocks might continue to fall below today's level. But I fancy them to be higher in a few years time, so I would rather invest further than sell at today's level.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

IveSeenTheLight wrote: »This is what I don't understand and hence I am fearful of shares (My fingers have been burn't before)

Let's take the Royal Mail Shares as an example.

They opened at £4.5500 a share and rose to £6.1551 with the current price being £3.9370.

If you bought at £4.55 and sold at £6.15 then you have made a nice 35% profit (minus fees)

However, If you bought at £4.55, bought more at £5.00, more again at £5.50 & £6.00, then it doesn't matter how much you buy at £3.9370 as you are only reducing the loss per share.

Anyone who has bought and still holds shares in the Royal Mail has made a loss

Now, you then wonder about if this is a timing game, but I read today that Warren Buffet warns against trying to time the market and invest in something you believe will be profitable at some point, citing a coca cola investment of $40 ($540 in inflation terms) in 1914 would be worth about $11 Million now.

Now I do understand that the likes of Trump capitalised investing when the market is falling, I also understand that buying in a falling market means you need a lower return to finally make a profit, however you are gamboling / pinning your hopes in investing further shares in a falling market that there will be a return to overcome losses. Sometimes this does not happen.

Most people here will be talking about buying into trackers or funds, so highly probable they will go higher in the future unless you buy in at absurd valuations.

Individual stocks sometimes don't recover yes, its up to the individual stock picker to decide what a stock is worth and whether they're buying below that or not.Faith, hope, charity, these three; but the greatest of these is charity.0 -

chewmylegoff wrote: »The FTSE is below the level it was 15 years ago - true. However during that 15 year period it was also below its current level for almost the entire time (significantly below for a large chunk of the time, falling below 4000 at points), so if you had invested every month you would be sitting on a significant capital gain to add to your dividend stream (and the compounding effect of reinvesting those dividends).

I understand what you are referring to, but surely it's dependent on the amounts invested and when

Essentially you are saying that if you bought when the price is lower, then you have a paper value increase because the rate has recovered.

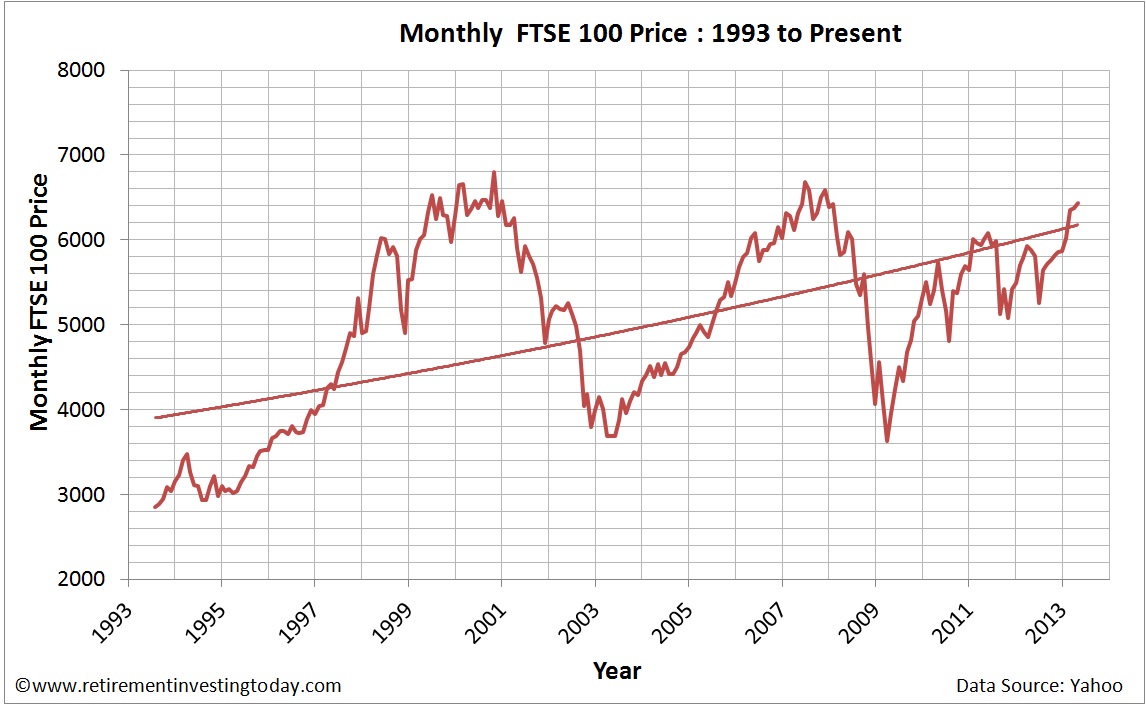

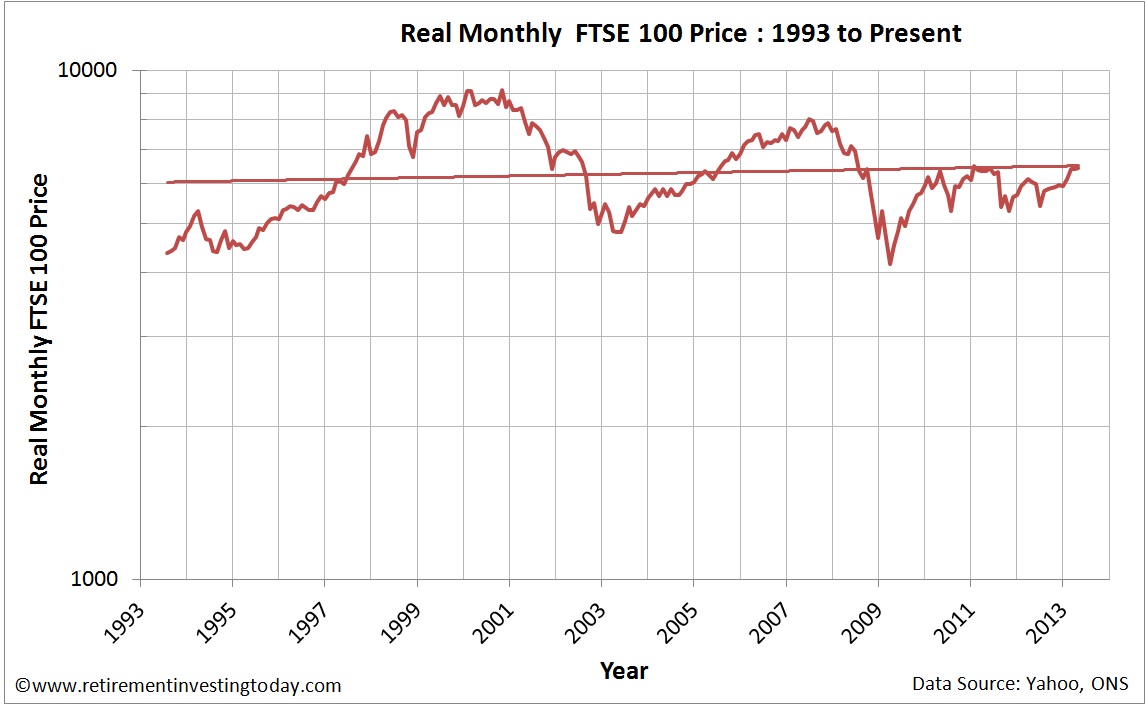

Looking at this graph paints a slightly different picture Looking at the chart this way reveals the FTSE 100 in a very different light. That light shows that the compound annual growth rate (CAGR) in today’s £’s has only been 2.0%. Correct it by the Retail Prices Index (RPI) and that falls to 1.2%.Dividends matter. Today annual dividends for the FTSE 100 are 226. The Real inflation adjusted growth of FTSE 100 Dividends,

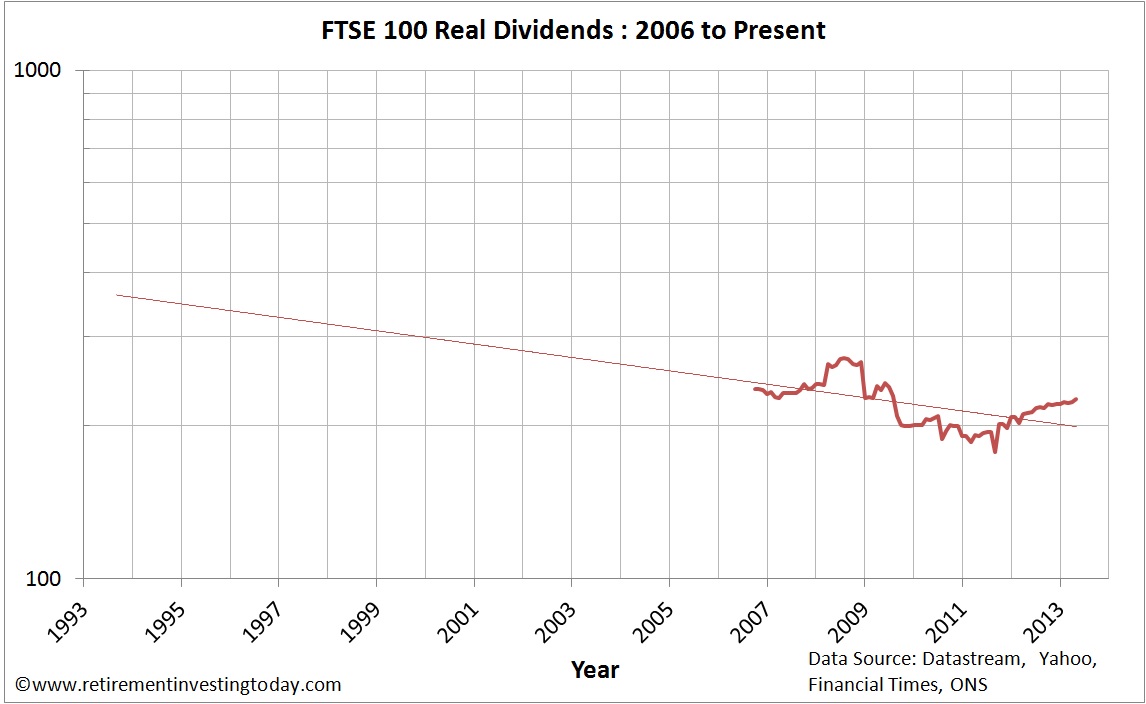

Looking at the chart this way reveals the FTSE 100 in a very different light. That light shows that the compound annual growth rate (CAGR) in today’s £’s has only been 2.0%. Correct it by the Retail Prices Index (RPI) and that falls to 1.2%.Dividends matter. Today annual dividends for the FTSE 100 are 226. The Real inflation adjusted growth of FTSE 100 Dividends, If we divide Dividends by Price we get the Dividend Yield which is currently 3.5% and can be compared with history below.

If we divide Dividends by Price we get the Dividend Yield which is currently 3.5% and can be compared with history below.

/quote]

I reiterate, arguably, you could have had a better return in a long term ISA :wall:

:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards