We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Young unable to buy as rents soar

Comments

-

You are not stuck to the mortgage you started out with. Why on earth would you stay on the same rate when you can just renew it to a new one. You don't depend on a remortgage, it is normal! If you fix for 2 years you then go and refix it after that period is up. If you fix for 5 years you do the same! This is what pretty much everyone already does that have fixed rate mortgages.Of course they are, they are there to trap people into a mortgage. Here's the small print from the top 3 mortgages on compare the market.

It's a dangerous assumption that house prices will forever increase, you should only buy a house if you can afford the repayments, not if you depend on house price increases and a remortgage in 2 years.

House prices don't forever increase in the short term, they are slightly volatile. Over the long term, you can use historical information to give you high confidence of the trend.0 -

Sorry but no-one buys a house for a few years. Need to widen that period significantly. If you pick tiny data ranges, then they effect tiny proportions of people that bought and sold in that period having never owned before or after again.Graham_Devon wrote: »Really?

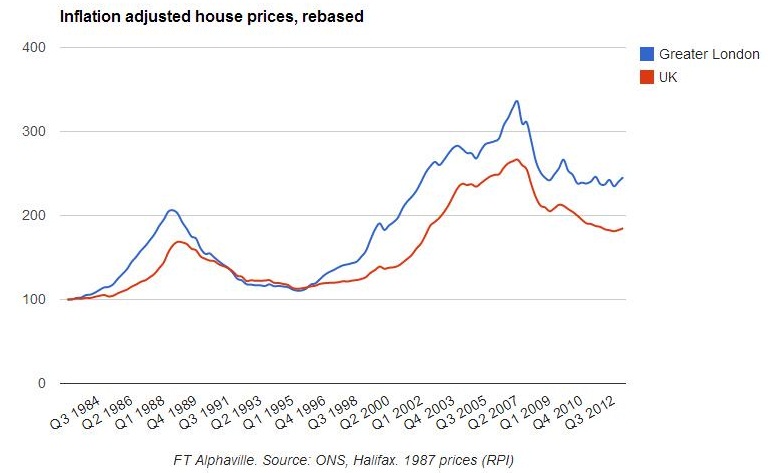

Chart wrong, considering they "always" go up?

And looking at nominal prices, we get another chart that is apparently wrong?

You would have shot yourself in the foot with your assumptions in both 2006-8 and 2009-10.

Your assumptions could have, indeed, had you trapped if you bought anywhere after 2005.0 -

Sorry but no-one buys a house for a few years. Need to widen that period significantly. If you pick tiny data ranges, then they effect tiny proportions of people that bought and sold in that period having never owned before or after again.

Yet another assumption I've bolded. LOADS of people buy and then move after a few years. What planet are you on?!

However, ignoring that for a minute..... YOU specifically talk about remortgaging after 2 years. That's the whole premise of your other assumptions.

How would you remortgage to your benefit in the cases of the years I pointed out? The years that you told us didn't exist a couple of posts previousy.... You will be in a worse position, with less equity and possibly a higher LTV.

I don't care how long you live in the house, your whole premise was to remortgage every 2 years.

What you appear to be saying now is, so long as house prices always increase, so long as you remortgage each year, so long as you don't ever need to move and so long as you pick introductory rates on every mortgage, things will work out very much slightly cheaper.0 -

You can always rely on the Mail for satire, even if it's unintentional!

0

0 -

Over the long term, you can use historical information to give you high confidence of the trend.

Yet we are living in the most uncertain of times. Where the past 40 years of credit expansion hit the buffers in 2006-08. So I would question the validity of historical data. Given that it's now debt that is the problem, not so much asset prices. Which are merely a by product of a range of measures that have merely plastered over the holes. Not fixed them.0 -

Graham_Devon wrote: »Yet another assumption I've bolded. LOADS of people buy and then move after a few years. What planet are you on?!

However, ignoring that for a minute..... YOU specifically talk about remortgaging after 2 years. That's the whole premise of your other assumptions.

How would you remortgage to your benefit in the cases of the years I pointed out? The years that you told us didn't exist a couple of posts previousy.... You will be in a worse position, with less equity and possibly a higher LTV.

I don't care how long you live in the house, your whole premise was to remortgage every 2 years.

What you appear to be saying now is, so long as house prices always increase, so long as you remortgage each year, so long as you don't ever need to move and so long as you pick introductory rates on every mortgage, things will work out very much slightly cheaper.

Read the post. Buy and move to another bought property. Therefore widen the data range looked at. A minute amount of people bought in that period, sold and didn't buy again. If you buy a house expect there to be at least a few downturns during ownership. Overall they go up, that is the trend.0 -

Thrugelmir wrote: »Yet we are living in the most uncertain of times. Where the past 40 years of credit expansion hit the buffers in 2006-08. So I would question the validity of historical data. Given that it's now debt that is the problem, not so much asset prices. Which are merely a by product of a range of measures that have merely plastered over the holes. Not fixed them.

Absolutely normal to question the data as historically people have done so during previous down turns.0 -

HAMISH_MCTAVISH wrote: »As do I....

why the endless violin playing for the poor poor young?We’ve had to remove your signature. Please check the Forum Rules if you’re unsure why it’s been removed and, if still unsure, email forumteam@moneysavingexpert.com0 -

Lol teaser mortgage rates..... I've just gone from 4.9% 90%LTV fix down to 4%SVR and now down to 3.1% 85%LTV.

Plus if you stay with the same lender and just change deals after the fix ends they don't even question the value of the property they just assume the original purchase price is still valid. So as long as you've paid the mortgage each month you're virtually guaranteed to drop down a LTV bracket every 3 yrs. Never needing to go on a SVR.

I'd guess that Graham 's scenario of cheaper to rent is correct in less than 1% of house purchases.0 -

Fears for millions of mortgage prisoners trapped by loans taken out during boom yearsTypically, they have a small deposit, have an interest-only deal, or are in negative equity, which means their loan is larger than the value of their home.

And, as everyone knows, the vast majority of people who take interest-only mortgages do so to lower the payments on an overpriced house that they would otherwise be unable to "afford"The proposed changes could mean an end to the vast majority of interest only loans, which during the peak of the housing boom accounted for a third of all residential mortgages.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards