We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Young unable to buy as rents soar

Comments

-

I thought you were joking...Of course it is, teasers on mortgages typically last 1-2 years, after which interest rates frequently double. But I guess that's tomorrows problem right? Or you'll be able to refinance your mortgage at 1.5% interest rates in two years?

Let's take the £425k example again. Let's assume a very modest 8% HPI (it tends to average more)

Remortgage for remaining 23 years, fixed for 24 months - £1363 pcm again with the Post Office.

10% HPI - £1335 PCM this time with HSBC.0 -

I thought you were joking...

Let's take the £425k example again. Let's assume a very modest 8% HPI (it tends to average more)

Remortgage for remaining 23 years, fixed for 24 months - £1363 pcm again with the Post Office.

10% HPI - £1335 PCM this time with HSBC.

These are all assumptions though.

You can't claim it's cheaper to pay the mortgage than rent, with the use of introductory rates and assumptions regarding the future.

Especially in todays climate where so many of those who assumed now find themselves stuck unable to re-mortgage.0 -

A 2 year fix is not an introductory rate and you can just refix it after 2 years.Graham_Devon wrote: »These are all assumptions though.

You can't claim it's cheaper to pay the mortgage than rent, with the use of introductory rates and assumptions regarding the future.

Especially in todays climate where so many of those who assumed now find themselves stuck unable to re-mortgage.

1. It is cheaper because I have just shown it is using a few examples (literally the first two I picked out).

2. You build equity through repayments.

3. You build equity through HPI.0 -

A 2 year fix is not an introductory rate and you can just refix it after 2 years.

Another assumption.

Followed by errr.. assumptions.

1. Based on assumptions and introductory rates.

2. Assumption that property prices always go up and prices won't reduce faster than your repayments (happened in the very recent past).

3. Assumption that HPI will always be positive.0 -

You aren't stuck to one mortgage for the entire period. Reassess the mortgage especially if you are fixed and go to another fix after the fixed period is up or you can consider a tracker.0

-

Graham_Devon wrote: »These are all assumptions though.

You can't claim it's cheaper to pay the mortgage than rent, with the use of introductory rates and assumptions regarding the future.

Especially in todays climate where so many of those who assumed now find themselves stuck unable to re-mortgage.

I'm glad someone understands!

So its cheaper to buy than rent as long as house prices always increase at 5 times the rate of inflation and you constantly remortgage every 2 years onto teaser rates....Faith, hope, charity, these three; but the greatest of these is charity.0 -

Graham_Devon wrote: »Another assumption.

Followed by errr.. assumptions.

1. Based on assumptions and introductory rates.

2. Assumption that property prices always go up and prices won't reduce faster than your repayments (happened in the very recent past).

3. Assumption that HPI will always be positive.

You only need to look at historical figures for London to see all three are true.

"1. It is cheaper because I have just shown it is using a few examples (literally the first two I picked out).

2. You build equity through repayments.

3. You build equity through HPI."0 -

Fixed rate mortgages aren't there to just "tease" people into a product with an ultra high interest rate after the fixed period. Just chop and change after the period, fix for longer or a get a tracker. One day you won't pay anything as the mortgage will be paid off.I'm glad someone understands!

So its cheaper to buy than rent as long as house prices always increase at 5 times the rate of inflation and you constantly remortgage every 2 years onto teaser rates....0 -

You only need to look at historical figures for London to see all three are true.

Really?

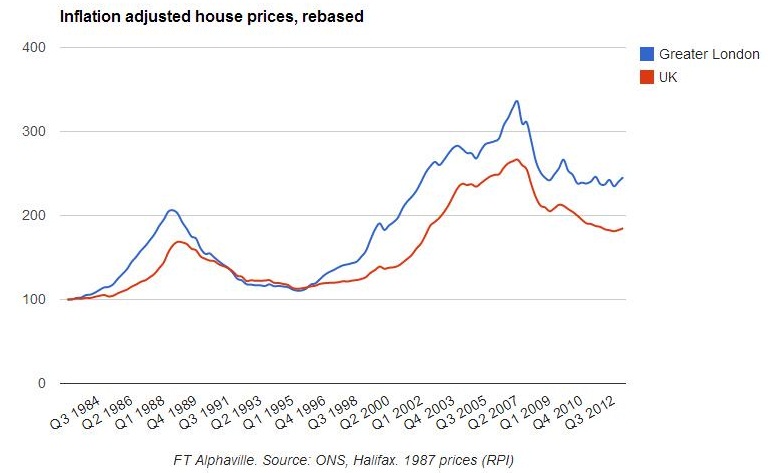

Chart wrong, considering they "always" go up?

And looking at nominal prices, we get another chart that is apparently wrong?

You would have shot yourself in the foot with your assumptions in both 2006-8 and 2009-10.

Your assumptions could have, indeed, had you trapped if you bought anywhere after 2005.0 -

Fixed rate mortgages aren't there to just "tease" people into a product with an ultra high interest rate after the fixed period. Just chop and change after the period, fix for longer or a get a tracker. One day you won't pay anything as the mortgage will be paid off.

Of course they are, they are there to trap people into a mortgage. Here's the small print from the top 3 mortgages on compare the market.After the offer period charging an initial rate of 1.48%, this mortgage will revert to the Standard Variable Rate (SVR), currently at 3.99%. Early repayment charges apply.After the offer period charging an initial rate of 1.49%, this mortgage will revert to the Standard Variable Rate (SVR), currently at 3.94%. Early repayment charges apply.After the offer period charging an initial rate of 1.74%, this mortgage will revert to the Standard Variable Rate (SVR), currently at 4.49%. Early repayment charges apply.

It's a dangerous assumption that house prices will forever increase, you should only buy a house if you can afford the repayments, not if you depend on house price increases and a remortgage in 2 years.Faith, hope, charity, these three; but the greatest of these is charity.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards