We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Got Halifax reward account (£100 offer) but planning on moving to First Direct...

markjam82

Posts: 6 Forumite

I moved to Halifax last year in November and took advantage of their Reward account and £100 switching offer. I currently get £5 a month for 'staying in credit', paying £750+ in and having 2+ DDs coming out. I've decided I'd like to move to First Direct as they have good reviews for just about ever aspect of their banking services.

Does anyone know if Halifax have any conditions of the switching cashback offer that will mean they can ask me for the £100 back if I switch again within the first 12 months of opening the account?

Thanks in advance.

Does anyone know if Halifax have any conditions of the switching cashback offer that will mean they can ask me for the £100 back if I switch again within the first 12 months of opening the account?

Thanks in advance.

0

Comments

-

Why throw away £60 a year? Simply open a 2nd Halifax account (or one with another provider) and switch that one to FD (after first creating a couple of SOs). Then manually move over whatever DDs/SOs/Bill Payments you like yourself.0

-

I agree so you can experience First Direct.

I believed the hype but glad I never switched my main account.

Whilst they are very polite over the phone, everything else is not so great including their 90s inspired internet banking,YorkshireBoy wrote: »Why throw away £60 a year? Simply open a 2nd Halifax account (or one with another provider) and switch that one to FD (after first creating a couple of SOs). Then manually move over whatever DDs/SOs/Bill Payments you like yourself.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

Halifax wont take the money back if you switch, but I agree, open a dummy account if you want to switch to FD. Also, you do not need any standing orders/direct debits to get the FD bonus, I switched a dummy Natwest account with just £100 in it and got my £125 bonus within a week.0

-

everything else is not so great including their 90s inspired internet banking,

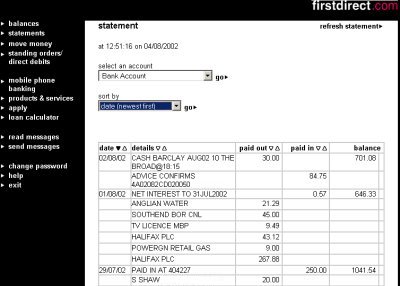

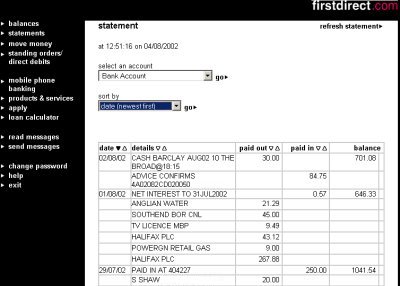

I was intrigued at what you meant by 90s inspired internet banking, so I did a google search and found a screen shot:

I see what you mean."Always fulfil your needs, only fulfil your wants when your needs are no longer a concern" - citricsquid0 -

Smithers37 wrote: »I was intrigued at what you meant by 90s inspired internet banking, so I did a google search and found a screen shot:

I see what you mean.

That screenshot is from 2002, only 2 or 3 years after the 90's ended.0 -

Thanks for the replies and yes (haha) i agree with the 90s online banking theme that 1D have adopted.

I'm told that FistDirect will close down my Hlifax account if I go ahead with the switch. I do have an old natwest account which I no longer use. Maybe I could move one or two DDs to that account and switch from the Natwest account? Do you think First Direct would run checks to see the recent activity on the Natwest account if I did that?

Thanks for the assurance that they will not ask for their £100 switching fee back.0 -

You don't need to have any DD's on the old account to switch. First Direct wouldn't be able to see any activity on your Natwest account.0

-

Meer53. Great, thanks. I'm going to give FD a call to ask them if I can switch from my Natwest account. I'll let you know how I get on. Thanks again everyone. Muchly appreciated

0

0 -

Ok, I rang FD and explained that I want to switch from a different account. They were happy to facilitate and I agreed a switching date with them of the 30th of August.0

-

ffacoffipawb wrote: »That screenshot is from 2002, only 2 or 3 years after the 90's ended.

Two or three years?

Not exactly hard math to work out if it was 2 or 3 :P0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards