We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Really need to clear my debts but debt charity cant help. What next?

Comments

-

Hi, I don't know if this is helpful but could you work out how much you would be spending at home while you are due to be on holiday? I know it won't be £700+ but you could add up cost of gas/elec/groceries that you won't be buying, in my mind I would be veering towards doing that and mentally knocking that off the price of the holiday.

Can you figure out how much longer your debt will take to pay off and how much it will cost you in interest as opposed to how much it would save you in interest if you threw the possible holiday money at the debt? Many apologies if I'm stating the obvious that's what I would be looking at and how much paying the holiday would prolong your debt? Do you have stuff you can sell to make a dent in it? Or 'pay yourself back' after? I've been eBaying exactly 12 months and have only sold stuff we are no longer using, this has added up to just over £1,100, in case that's helpful to know.

that's what I would be looking at and how much paying the holiday would prolong your debt? Do you have stuff you can sell to make a dent in it? Or 'pay yourself back' after? I've been eBaying exactly 12 months and have only sold stuff we are no longer using, this has added up to just over £1,100, in case that's helpful to know.

Good luck whatever you decide, if you don't take this holiday, would you plan one not until all the debt has gone or when you've made a big dent in it??

Plus I suspect if my children had been led to believe they're going on holiday then I think I would most probably come down on the side of taking them -- so long as I was fully aware of how much this was holding up being debt-free and ok with that.0 -

I've decided to go as catwoman and wear black leggings and a black top (both of which I already own) and spend a fiver on a mask and ears

Catwoman is a villain, not a superhero.

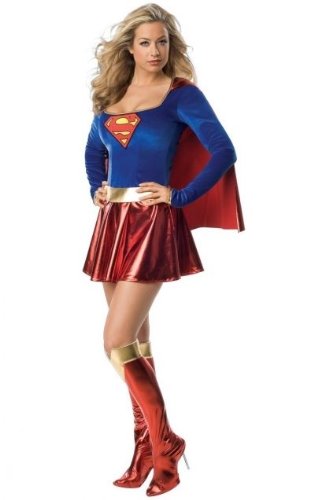

How about Supergirl, for £17?

http://www.amazon.co.uk/Ladies-Superhero-Superwoman-Costume-Supergirl/dp/B00KB18PR8/ref=sr_1_1?ie=UTF8&qid=1402430678&sr=8-1&keywords=ladies+superhero+outfits0 -

Mrscautious, that was my thinking the the holiday that the children are expecting to go now. I like the idea of looking at how much I will be saving by not being at home and will knock this off the cost of the holiday. If I decide to go, it will be through really scrimping this month but I can afford it without resorting to credit or going into my overdraft - something I never would have done before I decided to get debt free. It would have been whacked on a credit card.

Thanks Bob I'm not up to speed with my superheroes. Tbh I don't think it will matter. I've ordered a mask and cat ears for £6 saving myself £24 or more on a full outfit.

I'm not up to speed with my superheroes. Tbh I don't think it will matter. I've ordered a mask and cat ears for £6 saving myself £24 or more on a full outfit.

And in other news I got my decline letter through from Barclays. By sheer coincidence, at the same time I also got a guaranteed acceptance 0% credit card offer from my bank. I called them and I've been offered a £2500 credit limit There is a 3% fee and I can borrow 95% of my limit. The card comes in a week.

There is a 3% fee and I can borrow 95% of my limit. The card comes in a week.

So, can anyone help me decide based on my signature info which cards I should transfer? TIA.Debt free 20160 -

What are the APRs of each?at the same time I also got a guaranteed acceptance 0% credit card offer from my bank. I called them and I've been offered a £2500 credit limit There is a 3% fee and I can borrow 95% of my limit. The card comes in a week.

There is a 3% fee and I can borrow 95% of my limit. The card comes in a week.

So, can anyone help me decide based on my signature info which cards I should transfer? TIA.0 -

Cap1 apr 30.1% all the rest are 29.9% except next which is 28.9% and catalogue 0%. Min payments as follows:

Cap1: I pay £100 off a month

Barclays:£16

Next:£100

Argos:£45

Newlook:£3

DPs:£10

Catalogue:£75

I've worked out that £2500 over 29 months would cost about £86 a month so I will use the rest of my money to clear the balances that still attract interest as they won't be going on the card if that makes sense.Debt free 20160 -

Definitely clear Capital One completely.

At your current rate of payment, it's going to take you 22 months to pay it off, at a cost of £476 in interest.

With whatever credit is left, clear one or more of the 29.9%.

Depending on the remaining 0% period, and the APR after the 0% expires, you might be able to move over additional debt, as space becomes available.0 -

Cap1 and Barclays comes to £2293 so near enough the limit of the card.

What should I do next? Focus all my money at that to free space for more 0% or divide the balance by 29 payments to make sure that clears before the 0% period ends and focus all my spare cash at the other debts attracting interest?

The payments on the 0% card will come to around £80/£85 a month which frees up £36 a month alone but I also plan to increase the amount I spend a month towards debt repayment.Debt free 20160 -

Given the remaining debts are about twice the limit of the card, I'd suggest hitting them hard with any and all "spare" cash, starting with the debt with the highest APR and balance.

Otherwise you will be paying a lot of interest on them, while rushing to clear space on the 0% card.

At £86 per month, in 12 months you will have around £1,000 of space on the 0% card, by which time you won't have much left to pay on the remaining debts, meaning you can move most (if not all) of the remainder to the 0% card, and, courtesy of the freed up payments, either rapidly clear off the 0% card, or put it into a savings account and earn some interest.

About 2 years from now (give or take), your debts could be nothing but a memory. 0

0 -

Thanks Bob.

Hmm, it will be difficult to decide between next and argos which I should pay off first. They both have similar balances but the minimum payment for next is much higher so if I focused on that first I would clear it about twice as fast than if I focused on the argos debt despite it having higher interest.

At least I'm in the position to choose Debt free 20160

Debt free 20160 -

If you haven't, cut the cards up (I think I read you had), it removes all temptationI'm Debt Free :j 2/09/2013

Debt at LBM 30/04/2010 £24,109.38,0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards