We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Campaign for debt free money, stable house prices, pension still worth something...

Comments

-

whilst the meaning of words do still have a value the contend has lost value

I don't really understand what you're trying to say?

To recap; I was simply responding to the comment that "Building societies never have" (indulged in fractional reserve banking), and simply pointing out that under any definition of fractional reserve banking, fractional reserve banking is exactly what they have done, are currently doing, and will always do. Since the whole point of a Building Society is to provide finance for the purchase of property, it's difficult to see how they could do so without indulging in fractional reserve banking.0 -

Money is all an illusion and how, why, what, where it goes, how it's made etc.... is all made to be as confusing as possible.

So that Joe Public keeps paying their taxes and therefore keeping the money men in the life style that they are accustomed to.

http://www.youtube.com/watch?v=n-fyOgG2RGo

Money is Debt.Helping the country to sleep better....ZZZzzzzzzz0 -

Not true: the majority of money used by industry already exists. We only need enough new money to match economic growth, 1-2%. What we have at the moment is private companies creating as much as they can because they make a profit on it. The surpluss predominately goes into housing, creating property bubbles, increasing the cost of everyone's mortgage, and creating an affordability crisis.indeed so

but such mechanisms allow the system to create great (real ) industries and create employment, create medical services, build houses, create MRI machines, provide beer in pubs etc.

A bit like post 2008? This is exactly why we should remove the power to create money from private companies. Parliament already legislated against banks creating money in 1844 and the UK did not crash and burn.alternatively we could have a different system with massive unemployment and poverty everywhere no medical services etc

Yes. Do nothing and sooner or later have another crash, or bring back control of creating money to the Bank of England for the benefit of society.it's a difficult choice.

http://epetitions.direct.gov.uk/petitions/64050In favour of banks that serve society rather than society serving banks! If you agree, please Google epetitions 64050 and sign.0 -

Mike4DebtFreeMoney wrote: »Not true: the majority of money used by industry already exists. We only need enough new money to match economic growth, 1-2%. What we have at the moment is private companies creating as much as they can because they make a profit on it. The surpluss predominately goes into housing, creating property bubbles, increasing the cost of everyone's mortgage, and creating an affordability crisis.

A bit like post 2008? This is exactly why we should remove the power to create money from private companies. Parliament already legislated against banks creating money in 1844 and the UK did not crash and burn.

Yes. Do nothing and sooner or later have another crash, or bring back control of creating money to the Bank of England for the benefit of society.

http://epetitions.direct.gov.uk/petitions/64050

in truth I don't really know what you are proposing so can't assess it's relevance.

because you make absurd claims like your reference to post 2008, it undermines (in my mind) whatever else you have to say.0 -

Mike4DebtFreeMoney wrote: »Not true: the majority of money used by industry already exists....

Well of course it does. Industry could hardly use money that doesn't exist.Mike4DebtFreeMoney wrote: »....We only need enough new money to match economic growth, 1-2%. ...

So you're a monetarist.Mike4DebtFreeMoney wrote: »...

What we have at the moment is private companies creating as much as they can because they make a profit on it. The surpluss predominately goes into housing, creating property bubbles, increasing the cost of everyone's mortgage, and creating an affordability crisis....

At the moment there is no evidence that is happening. Secured lending to individuals is growing at slighly over 1%Mike4DebtFreeMoney wrote: »...

A bit like post 2008? This is exactly why we should remove the power to create money from private companies. Parliament already legislated against banks creating money in 1844 ......

No, the Bank Charter Act 1844 was an "Act to regulate the Issue of Bank Notes". It didn't mention money as such, since whilst one might these days regard a bank note as 'money', that wasn't necessarily the case in 1844. A bank note was simply a promise by a bank to pay the specified sum of money on demand, i.e. hand over the necessary gold sovereigns when presented. Not that this promise means anything ever since we abandoned the gold standard.Mike4DebtFreeMoney wrote: »...

and the UK did not crash and burn....

So you're not aware of the 'Crisis of 1847'?

It is interesting to note that on July 19, 1844, under the auspices of Peel, England had adopted the Bank Charter Act, which represented the triumph of Ricardo’s Currency School and prohibited the issuance of bills not backed 100 percent by gold. Nevertheless this provision was not established in relation to deposits and loans, the volume of which increased five-fold in only two years, which explains the spread of speculation and the severity of the crisis which erupted in 1846.

http://mises.org/books/desoto.pdfMike4DebtFreeMoney wrote: »...

Yes. Do nothing and sooner or later have another crash, or bring back control of creating money to the Bank of England for the benefit of society.

http://epetitions.direct.gov.uk/petitions/64050

The Bank of England has never had "control of creating money" in the sense in which you're deploying the phrase. There is nothing to bring back.0 -

It's here:in truth I don't really know what you are proposing so can't assess it's relevance.

http://epetitions.direct.gov.uk/petitions/64050

In what way is it absurd to link unemployment and poverty with the the global financial crash of 2008? The outcome of a drop in living standards for hundreds of millions is that tens of millions of people globally have been pushed into poverty. In the UK we saw long standing businesses pushed into bankruptcy by the unwillingness of the banks to lend, causing unemployment. I reproduce the graph from #27:because you make absurd claims like your reference to post 2008, it undermines (in my mind) whatever else you have to say.

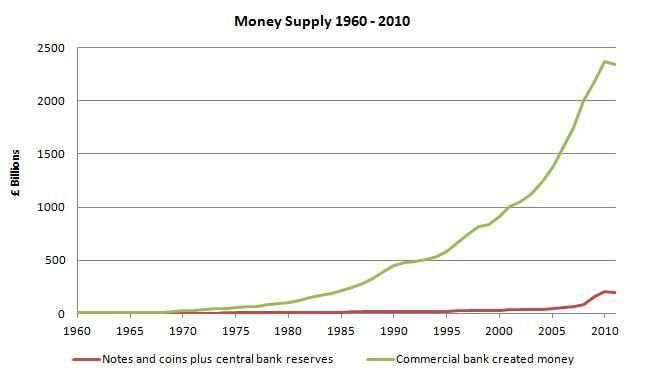

The green line is private banks massively inflating the money supply, doubling and trebbling the relative cost of houses and deflating in relative terms pensions, savings and wages. Then post crash we see the green line dip, worsening the recession, in-spite of £375bn of QE in the red line.

We need the amount of money in society set by an independent accountable committee that does not benefit financially or through votes. Having banks set the amount commensurate with whatever maximises profit has been very damaging. Specious arguments such as 'if you get an IOU from a friend and think it's money, then it is money' are detached from everyday reality and only serve to belittle the debt problems of the many, and distract from the important task of reforming money so that it serves society and not private companies.

There is actually research behind what I say, along with support from the likes of the Financial Times and members of the IMF; also precedent for Parliament removing the power to create money from private banks. This will only happen again when people generally connect the debt they have and the incentives of the banking industry to get them into debt: AND then decide they want it changed and support a campaign to do so.In favour of banks that serve society rather than society serving banks! If you agree, please Google epetitions 64050 and sign.0 -

Here's one for you Generali and in particular princeofpounds: Lord Adair Turner, previously worker at Chase Manhattan Bank, Director-General of the CBI, Vice Chairman of Merril Lynch, Chairman of the Economic and Social Research Council, and chairman of the Financial Services Authority explaining in very clear terms at 8 mins that banks create money from nothing. No reserve consideration, no attracting deposits: just creating money by typing numbers into a computer.

https://www.youtube.com/watch?v=68l1vJJUb4c

He then goes on to explain the social problems this creates. And will continue to suffer both up to and after the next crash, which will happen until legislation changes to stop banks printing their own electronic money. If anyone is actually bothered by this, please follow the link in previous post #97 and call on HMG to reign in the banking industry.In favour of banks that serve society rather than society serving banks! If you agree, please Google epetitions 64050 and sign.0 -

Mike4DebtFreeMoney wrote: »He then goes on to explain the social problems this creates. And will continue to suffer both up to and after the next crash, which will happen until legislation changes to stop banks printing their own electronic money. If anyone is actually bothered by this, please follow the link in previous post #97 and call on HMG to reign in the banking industry.

You are well behind the curve. Lessons were learnt from the GFC. Unfortunately takes a long time to unwind positions held in a controlled manner. No quick fixes.0 -

Hi Mike

Please don't be put off by some people on here.... many are self claimed experts who have biased views (many are residential property investors, buy to let in particular). They are also very happy to remain 100% anonymous and will not give away even minor vague personal information to substantiate their self proclaimed expertise, such as education, career background....

Just look at historical posts and you can read between the lines to work out where they are coming from.... and also the clique of people on here that thank each others posts.Peace.0 -

Mike4DebtFreeMoney wrote: »In what way is it absurd to link unemployment and poverty with the the global financial crash of 2008?

It's disingenuous at best. Living standards in 2007 were at levels far higher than they would have been had we not had the banking and monetary systems extant at the time. In the UK, in particular, we'd seen very free lending to businesses, a government able to raise debt at very low levels of interest, and public coffers swollen with the tax receipts of a rampant banking sector.

This lead to a heady atmosphere where everyone lived like tomorrow may be their last day.

Comparing these times to a sensible return to reality, and blaming this inevitable bumpy landing on the money system just makes no sense at all. It's equally dishonest to blame the banks for the (minor) reduction in some people's living standards, and to give them little or no credit for facilitating the growth that allowed us to live as we did in 20007.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards