We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Should inheritance tax be scrapped?

Comments

-

I think it is one of the better places to tax.

If they didn't tax you when you died, that would have to be found while you are alive so income tax would go up,

At some points in my life higher income tax would be very hard to meet. I think the current exceptions of children under 18 (posibly should be 21 to allow higher education support) and spouses getting more (especially as if one partner does not work to bring up children) are aceptable. For the rest (ie 50 somthings whose 80yo parents die) they do not need the money as hopfully they are on their own two feet setting a precedent for the future lifestyle and by the age of 60 would have been paying the higher income tax mentioned earlier anyway if it was scraped.

That said it does not work properly if there are so many loopholes for the very rich.0 -

My father made something out of himself from near poverty. It was only by the kind gesture of a family friend that he managed to go to university. He eventually became a very well respected doctor. He earned every penny of his money and was scrupulous about paying tax.

His wealth was entirely of his own making - why can he not dispose of it without a good chunk being taken in death taxes? My brothers and I have always worked and contributed to society in a positive way. We have never expected Dad's money however, with the exception of some family bequests, the bulk of his estate (around £650k) was left to the three of us. Yes, it has changed our lives and has enabled us to enjoy our lives and work without worry.

What really concerned me about the whole process after he died was that the IHT must be paid before probate will be granted. You cannot gain access to the money until probate has been granted - so you have to pay tax on the money you cannot get access to until you have paid the tax on it?

Dad actually had an extra insurance policy just for paying the IHT so we were lucky. What about people who do not have this? Inheriting a couple of hundred thousand is certainly life changing - it does not throw you headlong into the lifestyle of the rich and famous though. There is a huge difference between inheriting enough money to have security and inheriting millions.ENFP - AssertiveOfficially in a clique of idiotsSmoke me a kipper; I'll be back for breakfast0 -

On my reading listFrom the book everyones talking about, Thomas Pikettys Capital in the 21st Century, a review by Paul Krugman in the New York Review of Books

“Why does inherited wealth play as small a part in today’s public discourse as it does? Piketty suggests that the very size of inherited fortunes in a way makes them invisible: ‘Wealth is so concentrated that a large segment of society is virtually unaware of its existence, so that some people imagine that it belongs to surreal or mysterious entities.’ “

Quite so. And there’s nothing like offshore secrecy jurisdictions to wreath these assets in mystery. And people aren’t just imagining it; these assets genuinely are owned by surreal, mysterious entities, via offshore companies and trusts and their like.

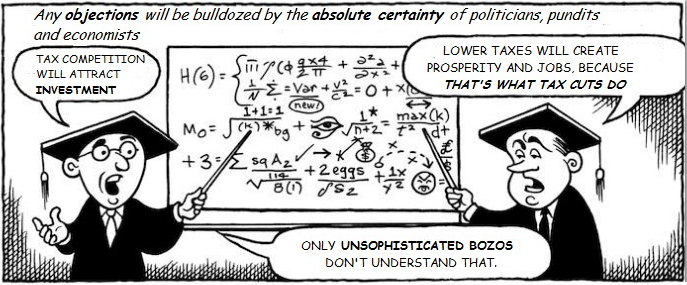

We are currently in the process of reading the book. It has enormous implications for a wide, wide range of tax justice issues, and we’ll be writing plenty more about it. Piketty’s recommendations – more wealth taxation, international co-operation on tax, and more – are core tax justice campaign themes. And we also share his cynicism about the economics profession’s “childish passion for mathematics.”

If you haven’t read the review, take a look Piketty's book Capital is being acclaimed as the most important work of political economy to be published in decades. It has certainly caught the attention of Ed Miliband's inner circle. --Nick Pearce, New Statesman, April 20140

Piketty's book Capital is being acclaimed as the most important work of political economy to be published in decades. It has certainly caught the attention of Ed Miliband's inner circle. --Nick Pearce, New Statesman, April 20140 -

You can't spend it when it's the house you live in.I would like to see a smaller state with lower taxes all round. But we will always need some taxes and IHT is surely the least painful tax. It is in a sense voluntary because you can always spend your money before you die and if you want to leave it to your kids they will be getting an unearned windfall. Surely it is better to tax that than to tax their wages. BTW if I die tonight my estate will pay IHT.

In France, the tax threshold is determine per inheritor (with the relation to it also factored in i.e children pay far less tax than distant relations or strangers, who pay a punitive rate.. though I don't agree with that). So the more people inherit the less tax there is overall, which would be an incentive to spread it around (not happening in france but it's because 75% goes to your children whether you want it or not, you can only chose for 25%)

Inherited money can also benefit the not so well off, especially now that children don't systematically get better income than their parents, unlike previous generations.

I know that without my grandparents inheritance, I'd NEVER have be able to buy a house (I earn far less than the average wage), and would have spent the last year when I was unemployed taking benefits instead of living of my own money (and might even have ended up homeless).

And for older people, being able to pass on their hard earned money to their children/grandchildren (a natural wish) is an incentive to continue working (and pay income tax).

Anyway, it's mostly the middle class that end up paying it (and more and more as the average property price in London is now higher than the threashold) as the rich use schemes to avoid it that people who only have a house and a little bit of cash can't use.

So I'm not necessarily saying it should be scrapped completely but at least the main home should be exempt.0 -

I am of the working class, I have been working since I was 17, but still struggle to make ends meet with that age old problem of too much month at the end of the money.

I have never claimed or sponged a single penny from the government or any benefits.

Mum died in january leaving me, my 2 sisters and 2 brothers the family home, this is the house we have all been born in, and 1 sister and the 2 brothers still live there, this sister tried to make it on her own, but couldnt make ends meet, so ended up having to move back in with mum and both my brothers are minors and still in education (yes, mum has passed away at a young age, leaving behind children not old enough to pay their own ways and we have no dad to help us, he died years before).

If the house has to be sold, to pay iht, not only would we no longer own the house which has so many sentimental values and memories to us as a family, this is THE meeting place for us all for any special occasion or family gatherings, and would sadden us all even more having lost both parents as such young ages, but also there will not be enough money left over for my sister to buy her own house, not to mention the fact that both brothers are under age and cant buy their own houses even if they did have enough money left from inheritance.

by increasing the ith thresholds or by making family/residential homes exempt, this would ensure that my younger brothers and sister still have a roof over their head and the same for others in this same or similar situation. Even if there was an exemption in the likes of 'if the deceased had children under the age of 18 or 21, then the estate is exempt from iht', since any iht that would have been paid could go towards the upkeep of the children left behind, eg: school fees.

As you can see iht can affect anyone, rich, poor and even under age children.

Any sob stories aside, its my younger brothers who are going to suffer at the hand of iht and its a bit unfair to tax a child who has not even had the chance to try and make their own way in life.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards