We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Got 10k to invest in 2014 for 12 months, idea's ?

padington

Posts: 3,121 Forumite

Hi everyone! I would like to invest in some companies but just for months ideally but no real deadline and could roll over for a year or two more if necessary and would like to aim for maximum reward but also looking for companies that are not total outsider bets, something that's a pretty good bet for 2014 so to speak.

Any idea's welcome. Ideally a mix of five or ten to spread my risk. A little thought behind why you think they are a goer would be great too.

Thanks in advance.

Any idea's welcome. Ideally a mix of five or ten to spread my risk. A little thought behind why you think they are a goer would be great too.

Thanks in advance.

Proudly voted remain. A global union of countries is the only way to commit global capital to the rule of law.

0

Comments

-

12 months isn't a timeframe for investment, you want 5-10 years. Just put it in a high interest account (3%-ish) and be happy.0

-

-

Eh..? Why?0

-

Remember the saying: if it looks too good to be true it almost certainly is.0

-

I'm happy for it to be a punt, I've made it clear in my post. Just looking for shares that might do well in 2014.Proudly voted remain. A global union of countries is the only way to commit global capital to the rule of law.0

-

Look through the miners listed in the FT. One is a bet on gold & silver, and also on Russia & Kazakhstan. Enticing, eh??Free the dunston one next time too.0

-

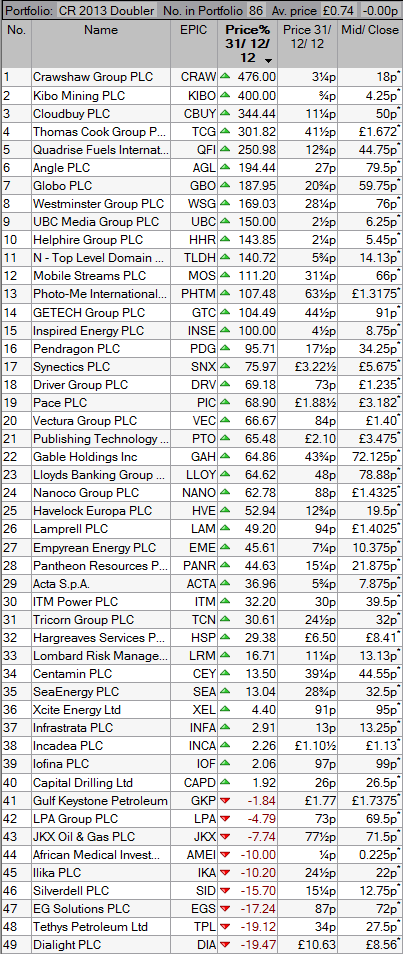

If you're looking for inspiration, you could do worse than check Cockney Rebel's "stocks which may double in 2014" thread on the UK ADVFN forums. He runs one every year and this time there's about 80 suggestions with people's reasons for suggesting them.I'm happy for it to be a punt, I've made it clear in my post. Just looking for shares that might do well in 2014.

Below is the results from last year's equivalent thread. All of the suggestions had an element of logic to them according to the people proposing them ; however only just over a third - about 30 of the 86 picks - delivered a capital return in the +30% range during the course of 2013 (i.e. beating not just the FTSE but also the even better performing S&P500 index).

Meanwhile a similar number LOST 30%+ ... i.e. not just failing to beat the strong benchmark in 2013, but actually losing a third or more of your investment (or nearly all of it in some cases) in the face of significant free money on the table from simple index tracking.

The remaining 25-30 either made or lost money at lower multiples than the main indexes so could perhaps be considered failures ; but if you go all in on a punt which doesn't come off, but then DON'T lose all your money, perhaps it's not a failure after all. Depends on what you mean by a punt and how much you like to gamble. If you compare it to going down the bookies - then if the stake from any non-winning bet isn't actually lost but is still mostly around to reinvest another day, it's not all bad. Obviously there are not many 100-1 outsiders that deliver in under a 1-year timescale so it's not the same level of risk/reward as betting on the horses or the footie, but still a form of gambling if you're not an insider.

Unfortunately what you can probably pick out from the statistics from last year, if you had picked 5 or 10 of those to 'spread your risk' as you suggest, the aggregate of the returns on those 5 or 10 would on average have lost to the index. But invariably you might have had a fun ride watching the charts and reading RNSs as your portfolio moved dramatically all over the place from month to month.

FWIW, my top picks in 2013 were a couple not in the list (BLNX and MONI up 200%+ and 100% respectively). Perhaps one of those could do 50-100% again from here. Or VOG which was one of mine that lost 50% Jan to December last year but gone back up 25-30% in the last couple of weeks already (obviously needs to go up 100% to recover going down 50%).

AIM stocks can give pretty potent returns and these days are all ISA-able. However it's far from easy to find the next rising stars and I had three or four down 40-60%+. I have plenty of appetite for risk in the 'punt' part of my portfolio but still wouldn't usually try and hold for just 12 months, all of my Jan-Dec snapshot returns are just one slice of longer intended hold periods.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards