We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

NS&I 5 year index linked saving certs 2011 issue - half way point!

Comments

-

-

I think HardCoreProgrammer is actually referring to "house price inflation" as stated (i.e. the rise in house prices themselves), rather than housing costs, and suggesting that house prices should be accounted for in the inflation figure. However, this is misguided for a number of reasons.AnotherJoe wrote: »Perhaps you are confusing it with CPI?

http://www.telegraph.co.uk/finance/economics/9792480/Inflation-RPI-CPI-and-RPIJ-explained.html

RPI is currenly used to index various prices and incomes including tax allowances, state benefits, pensions and index-linked gilts.

Like CPI, it looks at the prices of items we spend money on, but it includes housing costs - such as council tax - and mortgage interest payments.

Clearly if you do not own a home and intend to buy one in the future, then house price inflation is a factor in your future cost of living, albeit one that will normally be spread out over many years of home ownership. But arguably, even then, you wouldn't expect to see the price of something that would best be categorised as an investment or commodity being included in an index of consumer goods and services.

Of course, if you don't own a home and will never do so, house price inflation is an irrelevance. In both cases, the RPI is perhaps a less accurate measure of your personal inflation rate than it is for others, but given that there may be many other things missing from the RPI basket of goods and services that you consume, and there may also be many things included that you do not consume, RPI can only ever be a broad generalisation at best and is not intended to be representative of any particular individual or minority group.

If you happen to own your home, even if you don't yet own it outright and are renting part of it from the bank, then house price inflation ceased to be relevant to you the moment you agreed a purchase price. From that point onward the price of your home is a sunk cost. In the future you might choose to trade up or trade down, sell up and move into rental accommodation or give away some or all of your property. A house price index will give the average change in house prices, The average homeowner will see their house price change by that average and the average property that is bought and sold will also change by that average. So, on average, the net effect of house price inflation will be zero. Whether or not trading one home for another has a positive or negative impact for you personally is therefore down to your own personal circumstances. No house price index could be blended into the RPI figure in order to account for such changes.

So, rather than being some devious form of manipulation by the Government, as HardCoreProgrammer suggests, it would seem to me that leaving house prices out of the RPI calculation would seem to be adequately explained by the desire to keep the measure relevant to the majority of UK households, who have already purchased a home and for whom future changes to house prices cannot be meaningfully correlated with their cost of living.0 -

Am still leaning towards cashing mine in and putting some in ratesetter, etc instead.0

-

My DH and I will be cashing in our Certificates (along with our Premium Bonds). I am Main Executor of my B-I-L's will and everything else has been paid quickly with very little work on my part. Santander were wonderful. There was a total of approximately £100k to deal with (a 123 account, ISAs and Bonds) and all it took was an appointment at a branch where I showed a Death Certificate and a copy of the will. Cheques were received quickly. There was also a Life Assurance Policy for under £6k and the company took the details over the phone and presumably checked out what was required from the info I gave them and they paid out within 3 weeks. However, attempting to get the very small figure of £109 from NS&I for Premium Bonds involved sending an original Death Certificate and the Original Will along with the Premium Bonds and a completed form. I expected that this would result in a bank transfer as they had asked for bank details. No such luck - they sent an ambiguous letter asking that I return the Premium Bonds (already sent) and complete another form (similar to the first form) but requiring the signatures of all 3 Executors. The £109 cheque is still awaited. I am going to spare our Executors this inconvenience.0

-

Still boils down to the fact CPI is 1% lower than RPI (at present), and always will be higher than CPI.

grab RPI, whilst it's still around,, because ,it will be CPI before you know it.

Just when you think it cannot get worse, it does.0 -

still waiting for my letter0

-

-

Of course, if you don't own a home and will never do so, house price inflation is an irrelevance. .

I'd argue this is not so, because house rental prices are related to house prices, so a rise in house prices is factored in since housing costs are included in RPI.

What that means though is hard to determine since house price inflationis so regional. One has only to look at the differences between various regions and even parts of towns across the UK.

You have people "oop north" complaining here about being in negative equity when they bought ten years ago, which is totally at odds with the experience down here in the "softy south", prices are rising at a ludicrous rate (and I say this as someone with no mortgage but still concerned what it means for the younger generation).0 -

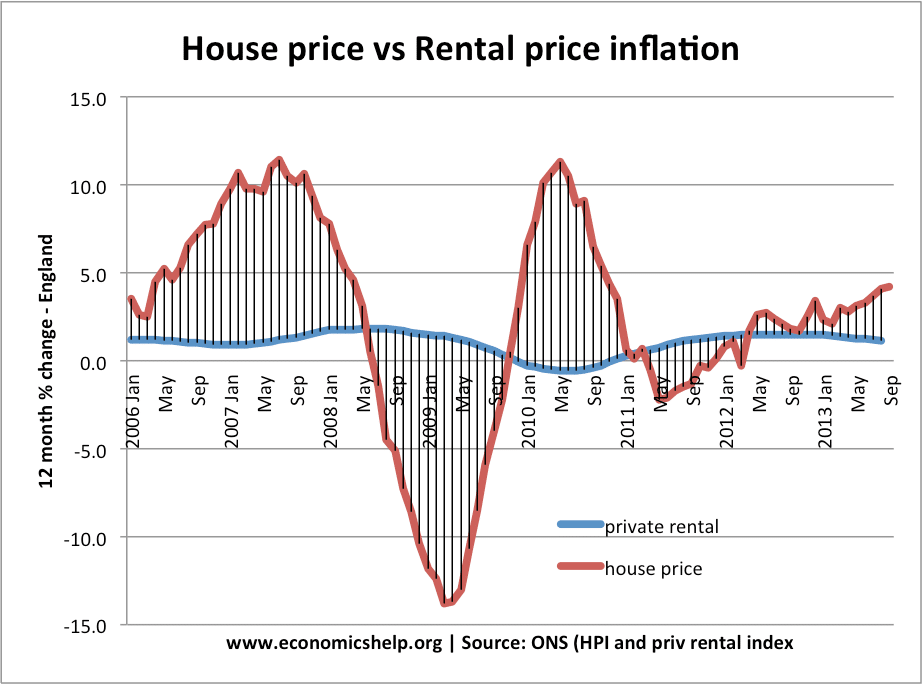

I'd argue that rental prices are not correlated with house prices and in fact house price inflation is much more volatile than rental price inflation, the latter being relatively stable.AnotherJoe wrote: »I'd argue this is not so, because house rental prices are related to house prices, so a rise in house prices is factored in since housing costs are included in RPI.

More discussion here: http://www.economicshelp.org/blog/9465/housing/factors-affect-cost-private-renting/

Of course, while mortgage interest costs are factored into RPI, rental costs are not, so even if rental costs and house prices were correlated, this wouldn't factor house prices into RPI.0 -

AnotherJoe wrote: »Wife and I took one out each same day. My letter arrived Saturday, no sign of wife's (and post has been today)

Ditto here that no sign here too.

Mine was take out on the 25/5/11 so maybe its in calendar order.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards