We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Mighty Titan Overdraft will crumble!

Comments

-

Ooh good luck on the decluttering. I like how you forecast ahead even using YNAB. I wish I could but I haven't even shifted my wages into categories from this months pay yet as I am trying not to look at the money until the 1st lol. I've already spent part of the grocery budget today mind you but aside from some minor basics it was all stuff to add to piles and allow me to use the stuff in the fridge without wastage.

Always so impressed with your budgeting without a fixed income!

Happy New Year if I don't see you before then xx Total Debt: -£5,029.17/£11,220

xx Total Debt: -£5,029.17/£11,220

A black belt only covers 2 inches of your a$$ - You have to cover the rest yourself - Royce Gracie0 -

Ooh all this crossing over of posts!!

Yay on the token. She sounds like a fab lady! I am glad you have her beads. I have my mama's old jewellery box and her bits of jewellery, just earrings that are worth nothing but I see her in them everytime I look and she died 15 years ago! xx

P.S SuperDave it isn't stalking. It is appreciating the same people xx Total Debt: -£5,029.17/£11,220

xx Total Debt: -£5,029.17/£11,220

A black belt only covers 2 inches of your a$$ - You have to cover the rest yourself - Royce Gracie0 -

Soooooo

We keep on keeping on. ThedebtaccordingtoYNAB this month is £746. This may shift slightly but I do love seeing that total go down

And

Had an offer accepted on the house we liked! Eeep. Broker is moving forward with making offer in principle an actual mortgage offer, and I'm getting quotes for solicitors. And needing to chat to plasterers I think!

Apparently what we can do is get a declaration of trust done at time of purchase, which will mean that on sale of property it can be split equally, or as we choose. As we will end up putting similar amounts of money into the house, I think that is fairest.

Still early days, house is not off market yet (might need to chase estate agent as I forgot to ask her to do that, and she didn't ask to see arrangement in principle. Could just be waiting for actual offer. To be fair, I'd want to see some kind of indication of intention before I took house off).

I have added up roughly how much I think we will spend on just fees for purchase, now I have a quote in for conveyancing. £2995! That's with a top end request for searches which could end up not being necessary, a slightly expensive basic homebuyers report, and assuming lender charges some kind of valuation fee. We have it (part of gifted moneys), but daymn.

So all you people saving for deposit, add £3k on top of that in fees. Ow.

I also need to do some weird crystal ball forecasting to do with exchanges and completion, giving notice on this place, and co-ordination of getting the messy jobs done before we move in. Like plastering. I also had this thought that widening a doorway between living room/ kitchen could be really nice but if it's a load bearing wall do I think it will be a couple of grand nice? If I do decide to do it, I will need to do so before we get that room reskimmed and plastered.... And do we tackle the bizarre-o wood panelling in the bathroom (who puts wood as a shower splashback? I ask you) before we get the plasters in as who knows what's behind that panelling? Whichever way, I suspect I will not be getting the rather lovely glass shower splashback I was eyeing.

I will however, not be retiling in those big coffee/buff coloured tiles. I don't know who sold a job lot off cheap to tilers and builders of Yorkshire, but someone did and the madness needs to stop!0 -

My boyfriend continues to surprise me. Honestly, I've known him for 17 years and still I am surprised!

He was away when offer was accepted. We'd agreed our upward limit, I was negotiating. As part of the deal I stipulated that I wanted the garage cleared. The garage door is faulty so I haven't had a brilliant look but it's full of misc DIY equipment, leftover bottles etc. the rest if the house is empty but I can see that being an oversight and us having to clear someone else's crap.

Boyfriend is sad because he would have liked to have had a good rummage.

I think he must be insane. Or maybe he doesn't think things through? So after moving alllllll our crap, then doing all the jobs that will need doing on the house, he wants to spend more time sorting through someone else's junk in case he finds something interesting. Tha would then sit in the garage, I imagine.

This is after I suggested he take the second bedroom and make it his room. I freely admit that the look of a lot of the rest of the house will be down to my taste. He thought this was ok, but only initially until we can do work on the garage. Then he will move stuff in there. The unheated, uninsulated garage. I truly cannot fathom him sometimes.

Anyway, I think my total incredulity means that he retracted the interest in clearing crap out of the garage. And now I feel bad,! Goddamit. Not enough to phone and request stuff is left in though...0 -

LMAO

So glad you didn't phone and ask for it to be left. If there was anything worthwhile in there it would be gone. You do not want a hoarder of carp for a housemate! My dad has a BUS garage as part of his property and he fills it with rubbish. My mum stipulates that a few old bangers and several washing machines etc that he has picked out of skips must be removed every 10 years or so. Seriously... I went in there looking in the racks for some screws once. Found SIXTEEN house keys... in a little pot. Those will be the keys I kept 'losing' as a kid then, which he continually went off one one at me about but never changed the door locks, just kept getting more cut... He must have found them and thought he was teaching me a lesson by hiding it. I think after the 5th new one was cut he was definitely out of pocket on that idea... lol

Yay for things moving forward and offer being accepted!! As for the room for him... then say fine have the garage and decorate it how you would like but I am decorating the house

then say fine have the garage and decorate it how you would like but I am decorating the house  leave him to his unheated uninsulated hovel. My FiL escapes to his shed every waking hour until 1am most nights. A shed... with a wind up radio and a leaky roof. Sometimes men need their man place... :rotfl:

leave him to his unheated uninsulated hovel. My FiL escapes to his shed every waking hour until 1am most nights. A shed... with a wind up radio and a leaky roof. Sometimes men need their man place... :rotfl: your debt is going down so quickly!!! Total Debt: -£5,029.17/£11,220

your debt is going down so quickly!!! Total Debt: -£5,029.17/£11,220

A black belt only covers 2 inches of your a$$ - You have to cover the rest yourself - Royce Gracie0 -

Ugh. Poor diary being neglected.

I've posted elsewhere but basically we are STILL waiting for a mortgage valuation to be arranged, despite them having taken the damn money. It is doing my head in, as is my broker who is not exactly covering himself in glory with regards to response times.

We are in better financial shape then we ever have been! Apparently, they think I have been existing on fairy dust for the last 10 years as apparently the security of my income is a concern because company started last year. I'm doing the same damn job as I did when I was self employed, I still had to secure clients when I was self employed, I don't see how me having a ltd company suddenly means I am unable to generate income from clients. Also I am so. over. people thinking because our company is in the creative sector I don't know how to run a business. Or that because our goals are not profit, that I don't now how to break even. Is there any other sector where people would tell me how to run my business, and think it's acceptable to 'not understand' our income generating activities? It's very simple. We have clients. We provide services to clients. It is business to business not customer facing. We also raise money through fundraising for particular projects. Grant income does not create profit and will be a straight in/ out proposition. Unfortunately grant aided projects run across financial years so in order not to get landed with a big corporation tax liability for money that we are holding and haven't spent yet, we have to put the money in the profit and loss account and report a loss.

And yet I still have people say 'so what do you actually do' and 'how do you generate income'? It's not some magical mystery. Artists and creatives are also businesses and funnily enough, even arty people like to eat and have a home life.

UUUaaaaaargh :mad: :wall:

I have managed to structure my life so in the main part I wander around in a happy little bubble where my normal is completely unremarkable. Then everything so often I am reminded that apparently it's not. Plus of course financial institutions/ form really can't cope with anything not standard structure. It's not their fault but it is YAWNSOME.

Now I have that off my chest, in financial / net worth news:

Theoverdraftaccordingtoynab is currently at £685. It has stalled a bit this month because apparently I bought all the things. I can't even bring myself to type what my spending money is. I think I may have been having some kind of rebellion but I'm not sure why.

It may be linked to realising that actually, I don't need to hold over a grand in my current account and that money would be better off in an interest generating account. I then realised that our 123 account pays interest of 1% which is better than I get in my old saver accounts. So transferred it over. We have over £1k just sat in a bank account. If I had said this to me a year ago I would have laughed my behind off. I should probably transfer more over to it but I'm not quite ready to let go of a very safe surplus in the current account. So maybe the spendy lady persona is to do with feeling more secure, even though I know it's all earmarked for various purposes.

The other spendy lady feeling could possibly be to do with mortgage app stalling. Part of the impetus to sort out our financial situation was that house purchase became remotely possible. Now I feel less confident that it is, I am more detached from goal? Perhaps?

Lenders have taken the damn valuation fee even though they've not booked it. as we went for the offer they do on homebuyer survey, it was £485. Which I was able to cover with a combo of our emergency fund plus what I had thought was a very sorry £90 I'd saved up in that category. I will not discount small amounts again, I was very happy that I had put that money aside!

I might...just...be about to start saving for retirement, given that I was glad of the £90. I have previously thought 'I'm completely screwed so why bother'. But maybe small amounts are better than nothing. Plus, if it all goes in a cash ISA initially there's no reason that I can't re-purpose the money if I decide that saving is completely futile. And blablabla compound interest or something. Although TBH the interest that we would be getting initially is so small I'm not sure it needs to be in a tax efficient wrapper.

I originally though I should pay off theoverdraftaccordingtoynab before I started saving for retirement. But I think as I am not paying interest on the debt, maybe just having the category and the savings pot will be an important mindshift. A great comment from my Mum recently: are you taking advice from a much younger woman? That woman being myself. Her point being that priorities change, and it's actually necessary to shift and adapt. Otherwise you may trap yourself in a situation that does not adequately meet the needs of who you are now, and what you will need in the future.0 -

Your mum sounds like a very wise lady. As do you, so you obviously take after her.

I am sorry about the house stalling and the awful institutions of lenders. I hate mortgages. Lets forget the fact I have one on a house I don't own for a minute and do a calculator to figure out how much they will lend me. Oh... £21k? Gee whiz. I'll buy a caravan shall I. Appearances can be deceiving but some things are just so plainly wide open.. I live; I live well. I support a family. I have savings which accrue monthly. I have rent and every last bill is paid every month. So why exactly can I afford £750 rent a month, but can't afford the £150k mortgage that would require those type of repayments? :mad:

IN short, I feel your pain.

I hope things are well with BF... house buying is stressful! And all of my savings is stretched across 5 current accounts and a regular saver

house buying is stressful! And all of my savings is stretched across 5 current accounts and a regular saver  best way to earn interest right now for me!!

best way to earn interest right now for me!!

Hugs! Nice to see you back!! xTotal Debt: -£5,029.17/£11,220

A black belt only covers 2 inches of your a$$ - You have to cover the rest yourself - Royce Gracie0 -

liltdiddylilt wrote: »Your mum sounds like a very wise lady. As do you, so you obviously take after her.

I am sorry about the house stalling and the awful institutions of lenders. I hate mortgages. Lets forget the fact I have one on a house I don't own for a minute and do a calculator to figure out how much they will lend me. Oh... £21k? Gee whiz. I'll buy a caravan shall I. Appearances can be deceiving but some things are just so plainly wide open.. I live; I live well. I support a family. I have savings which accrue monthly. I have rent and every last bill is paid every month. So why exactly can I afford £750 rent a month, but can't afford the £150k mortgage that would require those type of repayments? :mad:

IN short, I feel your pain.

I hope things are well with BF... house buying is stressful! And all of my savings is stretched across 5 current accounts and a regular saver

house buying is stressful! And all of my savings is stretched across 5 current accounts and a regular saver  best way to earn interest right now for me!!

best way to earn interest right now for me!!

Hugs! Nice to see you back!! x

Well how can they know you are a saving ninja?

We have been knocked back by lender over concerns of the sustainability of my business. A business that is in the sector I have made a living in for a decade, doing a very similar role. They got hung up on the fact that we received grant and private trust income in first financial year.

If the money were a loan that I had to repay with interest, or venture capital, they probably wouldn't bat an eyelid. Broker may have heard a lot of swearing from me this morning.

To add insult to injury, they have concerns over me being able to pay £240 a month but they took £465 for valuation from my account and have held on to it for two weeks. I must have been living on fairy dust during that time because according to them, that's twice what I can afford. :mad::mad::mad::mad::mad::mad:

The fact is I could cashflow it quite happily but they really better give me my money back sharpish. £465 to not understand how my business works and say it's not sustainable....errr screw you.

0 -

Dang right!! The rules are ridiculous. whilst I don't agree with Northern Rock giving 125% mortgages, they could at least take a look at peoples I&E for the space of 2 years or something and figure out whether they are a good bet or not!!Total Debt: -£5,029.17/£11,220

A black belt only covers 2 inches of your a$$ - You have to cover the rest yourself - Royce Gracie0 -

Oh my gosh has it been a month?

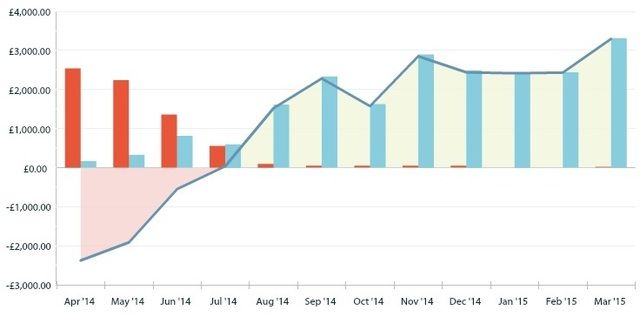

Well we are coming up to 1 year using YNAB and according to bank statements I'm debt free. YNAB and I know that there's still another £500 or so to go until we're actually officially debt free. But take a look at this:

The red is our debt, the blue is our assets (cash, mostly).

Once again rainy days fund saves our behinds - we were travelling back from a weekend away after going down a very, very steep bendy hill (Sutton Bank if anyone knows it). About 10 mins later check engine light comes on. We were standing in traffic and debating where to pull over - as we made the turn, we discovered the power steering / alternator belt had gone :O. Fortunately we have breakdown cover and only had to wait 40 mins before a breakdown truck arrived. We established it wasn't fixable at the roadside and got a lift home. Very, very glad that didn't happen 10 mins earlier. Two days later and £230 we have a new alternator fitted. Which has wiped out half of our MOT category, but still I'm really glad to have that sat there.

I keep wondering why March is just sucking up more money, and I realise it's because I am also doing weekly lessons in run up to my driving test. Not sure I feel ready :O

I am not in the mood for scrimping at the moment and it's showing in our spending money. Not crazy but certainly not super save either. Being busy is also kicking my behind re lunches out. Vicious cycle of late back/only prep tea. Weekends don't feel like batch cooking when it's my one day off as still working one day a week in cafe. So close to ditching it, but at the moment it basically covers my driving lessons. Still. Days are numbered for that job, I think it has a detrimental effect on productivity etc as I just resent being there. But £120 a month or so is not to be sniffed at.

Boyfriend's big earning months start nowish. We have weathered his down months, now I'm quite looking forward to getting rid of the paper debt. Last year we used that money plus my wage increase to haul ourselves out of the hole. I'm actually quite looking forward to seeing what happens with that income spike now we have stabilised things.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards