We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Monthly income

Comments

-

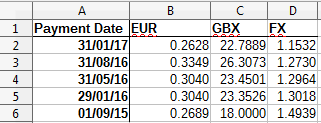

It was the August payment that seems to have incurred a consistent high FX conversion cost. The EAT dividend announcement in January this year states the price point for dividend conversion aims to be 'as close as practicably possible to the payment date'

I've used payment dates as price point which is obviously wrong, perhaps payment date minus one or two is accurate. However it's the historic August costs that the posts was about.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

I hold EAT with HL and have received the following divis.

GBX column is calculated by (Total Dividend received/Units held)

FX rate is calculated by dividing declared EUR dividend per share by my received GBX dividend per share. "If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

This method gives a transactional FX rate.

It doesn't help to determine the effective cost of the transaction itself, in terms of the difference between what the dividend payment FX rate they've used is, as you've calculated, and what the real world GBP/EUR FX rate was at the time of dividend calculation.

For this I'll need to know the FX price point date used for each dividend transaction, which is not available AFAICT

* From a dividend payment perspective, given the complete lack of internal conversion timing data, I suppose all that matters to me is the dividend payment EUR/GBP rate received (as per above post) versus the real world EUR/GBP FX rate on the day the GBX dividend payment lands, in order to determine the net benefit/cost of the internal dividend FX conversion.

I started off thinking that adding this element would be a simple process that added a useful cost analysis column.. it'll probably turn out to be a futile exercise.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

Hi John, did you consider using the iWeb platform or have any particular reasons against it?0

-

Nothing against iWeb, I have an account with them and hold my speculative shares there.

They'd certainly be cheaper for this portfolio but I've not used them because at the time I started this endeavour I wanted access to retrievable and detailed account information which CSD provide in spades.

I knew when I started iWeb was the cheaper option but as well as the above, decided sixty quid a year in extra fees ( now nearer eighty) wasn't going to make that much of a difference and probably worth it for the customer service.

CSD isn't perfect but I don't feel any need to chase around for lower fees at this point.

I was also and still am half expecting iWeb to up their transaction commission at some point but it hasn't happened yet.

--

** Might as well include a quick update for those interested. Recent performance has been relatively strong. I'll post some pictures in April.

Added to JEMI for this month's purchase with dividend income sat on account.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

How come you have 29 funds? o:Mortgage (Nov 15): £79,950 | Mortgage (May 19): £71,754 | Mortgage (Sep 22): £0

Cashback sites: £900 | £30k in 2016: £30,300 (101%)0 -

28 investment trusts.. and one ETF

As explained here and elsewhere, i have chosen to hold regionally 'three of a kind' with a view that if something catastrophic happens at any one, the net effect will be muted to a much larger extent than if I only held one in each category.

It's not a strict rule as can be seen. I'd like another EM and Japanese income trust but that'll have to wait for future years and/or suitable candidates.

Likewise I see the specialist list expanding at some point.

As a long term, buy and hold forever portfolio, the effect of holding this many lines of stock is cost neutral. With a rebalancing spreadsheet the admin is no more difficult either.

The only added cost associated with holding so many arises if/when having to pay for a transfer which hopefully won't ever be required.

I'll post some squiggly lines in April.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

Nothing against iWeb, I have an account with them and hold my speculative shares there.

They'd certainly be cheaper for this portfolio but I've not used them because at the time I started this endeavour I wanted access to retrievable and detailed account information which CSD provide in spades.

I knew when I started iWeb was the cheaper option but as well as the above, decided sixty quid a year in extra fees ( now nearer eighty) wasn't going to make that much of a difference and probably worth it for the customer service.

CSD isn't perfect but I don't feel any need to chase around for lower fees at this point.

I was also and still am half expecting iWeb to up their transaction commission at some point but it hasn't happened yet.

--

** Might as well include a quick update for those interested. Recent performance has been relatively strong. I'll post some pictures in April.

Added to JEMI for this month's purchase with dividend income sat on account.

What a fabulous spreadsheet!!

I NEED THIS SPREADSHEET!!!! :rotfl::rotfl::rotfl:2024 Challenges- Grocery Budget (January £0/£300)

- Decluttering (Underway!)

- Frugal Living (January £0/£500

- 24 in 2024 (0/24)

0 -

** Might as well include a quick update for those interested. Recent performance has been relatively strong. I'll post some pictures in April.

Wow, you broke the 100k barrier... Congrats! :T

(Apparently the first 100k is the hardest, e.g.: http://www.dividendmantra.com/2015/07/is-the-first-100k-the-hardest/ )Goals

Save £12k in 2017 #016 (£4212.06 / £10k) (42.12%)

Save £12k in 2016 #041 (£4558.28 / £6k) (75.97%)

Save £12k in 2014 #192 (£4115.62 / £5k) (82.3%)0 -

I can relate to a lot of what that article describes.

It's a strange thing though, a bit of a conundrum really, the higher the valuation gets the more costly it becomes to generate the new added income this endeavour is all about and where my focus is.

I can plug in any amount to the spreadsheet and see what current valuations and yields will buy me in terms of income, as an absolute and percentage, and how that changes over time.

In recent times it has been getting lower but of course the income stream helps to offset that to varying degrees.

By this time next year I'm projecting an annual income of approx. £5,600 give or take, contrasted with this year which is set to return about £4,600 give or take.

So that's what a new £20K ISA allowance and another years worth of dividends will get me... an extra £1K a year, £20 quid a week.

Patience..'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards