We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Obsessed with investments?

Comments

-

Has anyone ever got obsessed with their investments?

Yes I do. Partly as extremely expensive hobby and for thrills and bitter disappointments.However I find I am obsessed with my funds and am checking fund prices daily.

I enter all the share price and currency exchange rate in my nice spreadsheet showing their returns daily.I get nervous with anything that might cause a drop in the market e.g. Cyprus / possible N Korea war etc etc.. I also find that I keep switching between funds all the time because I obviously cant make my mind up. (NB all my funds are aggressive, equity based.

Not ideal to get nervous with investments. All I can say that what is done is done and there is nothing you can do about it. There is a reason why you should only invest money which you can afford to lose. Likewise with switching. I find it easier to invest rarely. So far, I have invested in just four companies since the start of 2012 and maybe two companies next month. Results are... Disappointing but that is part of the fun.Has anyone else got like this and is there anything that can help. I'm just wondering if some people do not have the right sort of personality/temperament for investing and whether I should just encash all of it and stick it in my offset mortgage account for an easier life!

If they do worry you then, maybe you should sell them all for the sake of peace of mind. At very least, make you get large saving buffers to take a hit if necessary. I tend to follow a simple rule on amount of investments. My combined investments are less than 25% of my cash savings [Currently, it is 5%, slowly in more companies in coming years]. Thus, you won't lose everything. That is what I called peace of mind.

Cheers,

Joe0 -

The switching is probably costing you money,

I'd bet on it. Seriously.

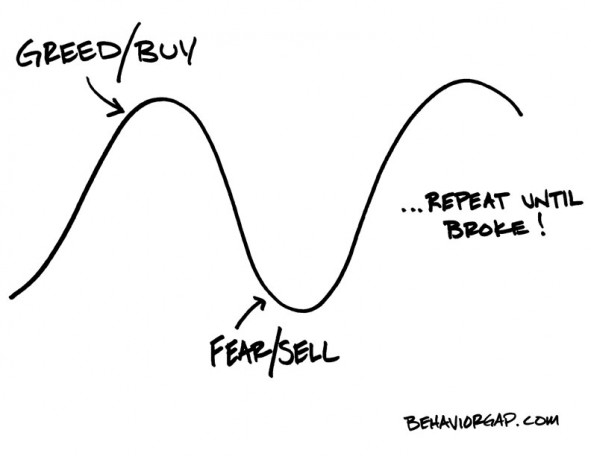

Human nature being what it is, we tend to sell the funds that have performed badly (i.e. are cheap) and buy the funds that have performed well (i.e. are dear) thus achieving the opposite of a profitable trading strategy, which would be to buy cheap and sell dear

Add to that 'regression to the mean'. The fund that has lagged may well move back to its trend, as may the one that has performed relatively better than expected.

People who like to dabble in shares mostly make this sort of mistake at least some of the time - they hold or buy shares that have done well so as not to miss out (Greed), and avoid or sell those that have done badly to avoid perceived risk of a greater loss (Fear).

When Greed & Fear drive your trading, you are doomed. Doomed.:("Things are never so bad they can't be made worse" - Humphrey Bogart0 -

I'm obsessed but not in the way you're asking, I'm not too interested in fiddling about with the investments themselves, more obsessed with finding all the clean class funds I want in one place at the moment, on a platform that charges the least or close to it, with a high quality web interface and good account portal features, oh and a back office staff that just get the job done in a timely fashion. Is it really too much to ask?

So far I've accounts with Best Invest, Cavendish (Fidelity), Charles Stanley, Iweb and TD direct. Already dumped iii last year.

They all have their irritations. Charles Stanley is the latest addition and I haven't traded anything there yet, next years ISA is going with them. So far they're looking like the least worst compromise to allow me to consolidate and get the web access to my investments I'm looking for.

Best Invest are hopelessly slow at dealing just like there web site, Cavendish account portal detail is awful, Iweb ought to be a contender but from memory their available fund list is hopelessly inadequate. TD are reasonable (until August) unless something goes wrong, then it's been like pulling teeth. I think if TD dropped their annual fee to 0.25% I'd have to consider staying there though.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

two schools of thought

* put your eggs in many baskets - then really you should only worry about the initial choice of baskets and checking that they are still suitable (eg don't put things in a paper bag if its forecast rain (or don't put it in gilts if you expect interest rates to go up)

* put your eggs in a small number of baskets then watch those baskets

I am in the latter camp - I have 4 big baskets at the moment (concentrated portfolio of UK equities, half my DC pension in Japan and Asia, kids university money in Banking PIBS and Preferences, and my get rich quick money in recently distressed euro banks.

Prior to doing this I was exactly like you I got through about 10% of my SERPS Pension pot before I worked up which way was up (and that was in a benevolent no switching fee environment) - but I did lots and lots of reading - "Smarter Investor" (Hale), "The intelligent investment" (Graham) -moneyweek, Bloomberg, 100's of blogs puts you in a better state of mind. The very real risk you face is this:

I would note in my first 18 months (switcheroo-yime) my growth return was 3%, over the 3 years to now its up to 13% CAGR - and I know its been benign but I am now positioned and aware of how to maximise this with enough focus to reconsider and rebalance. Rebalancing is important as it tells you to sell high and buy lowI think I saw you in an ice cream parlour

Drinking milk shakes, cold and long

Smiling and waving and looking so fine0 -

Thanks for all the advice, which I will heed. I think I knew what I needed to do, but just think I needed telling!

I'm going to sell some of my high risk funds and put into 'safer' funds (I know no fund is safe of course).

I'm also going to set up reg savings to drip feed into all of the funds.

I may rebalance after a while, but overall i'm going to leave them alone.

If I can't manage this then I will sell the lot and offset the mortgage.

Will see how it goes....This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

I may rebalance after a while, but overall i'm going to leave them alone.

If I can't manage this then I will sell the lot and offset the mortgage.

I have a portion of my savings/investments set aside as a play fund - think it's only 5-10% of the whole, but on this I've been setting up google alerts and checking exchange rates and looking at the price daily and entering it on a spreadsheet [STRIKE]and dreaming about it[/STRIKE]. If I get itchy feet on a fund, I can switch it to another with no additional fee, and this keeps me entertained, especially watching the comparison with the money that is in my normal savings accounts - for now, at least...

This distracts me enough to leave the other 90% in low-fee trackers without touching them. So maybe you could work out a way of getting your fiddling-fix while keeping the rest of your funds protected?0 -

Has anyone ever got obsessed with their investments?

I have a small amount of money in S+S ISAs, however most of my money is in cash ISA/offsetting my mortgage.

However I find I am obsessed with my funds and am checking fund prices daily. I get nervous with anything that might cause a drop in the market e.g. Cyprus / possible N Korea war etc etc.. I also find that I keep switching between funds all the time because I obviously cant make my mind up. (NB all my funds are aggressive, equity based.

Has anyone else got like this and is there anything that can help. I'm just wondering if some people do not have the right sort of personality/temperament for investing and whether I should just encash all of it and stick it in my offset mortgage account for an easier life!

Its possible to become obsessed about anything if you are that way inclined. I had a colleague who did not like travelling by train . He used to spend the whole journey worrying about whether he would get to the destination.

Why not switch to some low risk investments and leave them be. There is no sense getting worked up about investments.Few people are capable of expressing with equanimity opinions which differ from the prejudices of their social environment. Most people are incapable of forming such opinions.0 -

I had quite an agressive portfolio, bought in the summer last year. I was tracking it daily and I ended up deciding to sell the majority of the funds around christmas at a profit of approx 8/9% and I put my money in cash. Now I look at the funds I had and they are up 25-30% (one was Japan!) on when I bought them originally. Nevermind, hindsight is a wonderful thing.

Anyway, I've learnt two things 1) my attitude to risk is not as high as I thought and 2) just invest and forget (well only check every month or so).

I still have one of my agressive funds (JPM Morgan Natural Resources) but the lions share of my money is now in Troy Trojan, less volatile and hopefully providing steady returns that I am struggling to get with my cash.

My problem is once I'm in the market I stay in too long riding the boom and lose out because I don't get out early enough. And on the other side once I go into bear mode I stay out for too long and miss a lot of the up.0 -

MiserlyMartin wrote: »My problem is once I'm in the market I stay in too long riding the boom and lose out because I don't get out early enough. And on the other side once I go into bear mode I stay out for too long and miss a lot of the up.

Which is why it's best keeping funds that you've no short term plans for invested at all times, regardless of where you think the market is heading - perhaps lowering your monthly additions when you think the market is high.

This is the strategy I take with my pension - and am lowering my contribution levels from next month as I think the market is high (but keeping the current investments in place because markets can go 20-30% further than you expect in either direction).

If I were to withdraw the funds, markets would probably rise another 10% and I'd end up getting back in at a higher price out of fear of missing future returns.

By keeping the funds invested indefinitely, you reduce the amount of decision making you have to be involved with.0 -

marathonic wrote: »Which is why it's best keeping funds that you've no short term plans for invested at all times, regardless of where you think the market is heading - perhaps lowering your monthly additions when you think the market is high.

This is the strategy I take with my pension - and am lowering my contribution levels from next month as I think the market is high (but keeping the current investments in place because markets can go 20-30% further than you expect in either direction).

If I were to withdraw the funds, markets would probably rise another 10% and I'd end up getting back in at a higher price out of fear of missing future returns.

By keeping the funds invested indefinitely, you reduce the amount of decision making you have to be involved with.

I really like this approach, this might feed my tinkering habit by adjusting monthly contributions rather than whole funds.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards