We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cyprus surprise - Cypriot depositors to take a 'haircut'

Comments

-

A quick question

I thought various lenders to a bank had a 'pecking' order in terms of who loses money if the bank is insolvent even before any consideration of state gaurentees.

And I thought that depositors basically were 'first in line' for any payout above bond holders and shareholders. And yet it appears that in Cyprus by calling it a 'tax' and not a bailout that bondholders (hedge funds, other banks etc) have been rescued at the expense of depositors. Surely this is very like Argentina, arbitarily tearing up contracts as suits.

The IMF and EU supervising such a deal implies that these organisations are happy to see contract law usurped if it suits them. where does that leave any other financial transaction under their supervision?

Basically, yes. But the problem is if the banks went bankrupt the government couldn't afford to bail out depositers, even if bondholders and other loans are written off.

But their decision to ONLY hit depositors just stinks tbh.Faith, hope, charity, these three; but the greatest of these is charity.0 -

EU is happy for law, democracy, for the very fabric of life to be trampled on and destroyed as long as it keeps their inept corrupt jaunta running for another few months. this is nothing but THEFT and people need to wake up and smell the coffee.0

-

umop_apisdn wrote: »All this indignation over the bank deposit confiscations in Cyprus, righteous as it is makes me smile, when one considers that a 7 or 10% annual haircut on cash and savings is routine in many if not most nations. This is due to the nature of our fiat, paper money, and resulting government-induced currency depreciation, aka "inflation". It was not long ago that UK inflation was at 4-5% in 2011 with interest rates on savings being close to zero. Instant 5% haircut. Any riots? No. Who cares about just rising prices?

Not instant at all, you had the opportunity to re-invest or spend the money instead, it become 5% less valuable over the year, not overnight.

This is really going to hurt people who have short term savings i.e. it's been accumulated to buy something (new car, house repairs, house deposit) that's potentially already been provided before discovering that they are potentially hundreds or thousands short and risk penalties or missing offers. Maybe a banking tax is fair, but the instant way it's being done will just hurt those with least money most. If they'd instead added a 1% levy every month over 6 months it'd allow people to budget better for it, but then it'd also allow more people to avoid it.0 -

I was in Cyprus a couple of weeks ago, seems unbelievable this could happen. It would have affected almost everyone I met. Shocking.

Well as long as bankers don't lose out thats what counts, so I guess stealing money from ordinary people is fine.0 -

The President is now saying that Shares in the banks that people will get in return for their haircut will be guaranteed from future natural gas revenues

Meanwhile Russian Investors are hovering over the banks waiting to pick then up at bargain prices

Fact is for every loser there is a winner!!0 -

A quick question

I thought various lenders to a bank had a 'pecking' order in terms of who loses money if the bank is insolvent even before any consideration of state gaurentees.

And I thought that depositors basically were 'first in line' for any payout above bond holders and shareholders. And yet it appears that in Cyprus by calling it a 'tax' and not a bailout that bondholders (hedge funds, other banks etc) have been rescued at the expense of depositors. Surely this is very like Argentina, arbitarily tearing up contracts as suits.

The IMF and EU supervising such a deal implies that these organisations are happy to see contract law usurped if it suits them. where does that leave any other financial transaction under their supervision?

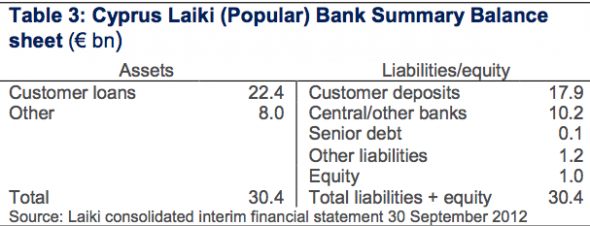

Cypriot banks don't really issue much in the way of bonds. For example:

So bonds = EUR100,000,000 while customer and bank deposits = EUR 28,000,000,000.

Money owed to bondholders is even dwarfed by 'other liabilities' which will include things like accounts payable (tea bags and biros yet to be paid for), holidays accrued and not yet taken and required contributions to the pension fund.0 -

Graham_Devon wrote: »Let's hope they do.

Not that they have much of a voice in this you understand.

No voice? - aren't they a sovereign nation? Bailouts are an agreement between those needing the bailout and those providing it. No agreement = no bailout.

They do have a choice. As they've been over reliant on Greek tax evaders, Russian criminals and have run their economy badly they've got to a point where their choices are limited and unattractive either way.

Expect more Greek and Russian house hunters in London.0 -

No voice? - aren't they a sovereign nation? Bailouts are an agreement between those needing the bailout and those providing it. No agreement = no bailout.

They do have a choice. As they've been over reliant on Greek tax evaders, Russian criminals and have run their economy badly they've got to a point where their choices are limited and unattractive either way.

Expect more Greek and Russian house hunters in London.

Are you for real Cyprus has nothing - not even a whisper

If they did - they would have asked the UK to pay for the rent of the land of the military bases

If they did they would speak up about Greece and UK being the guarantors of peace back in 1974 when they were invaded by the Turks

What voice will they have when the natural gas is extracted and the Turks want 50% of the profits - and a Turkey that by then will be in the European Union

Get real - Cyprus has no voice0 -

Graham_Devon wrote: »Let's hope they do.

Cyprus is asking the EU for a large amount of money. They are playing chicken if they decide to refuse to the things the EU is asking it to do; if the EU calls its bluff the Cypriot banks would fail, the government would not have the ability to protect peoples savings and instead of losing 6.75% normal Cypriots could lose the lot.

All of that doesn't mean that we should be in this position; but it isn't a case of some poor 'unlucky' country being bullied.Having a signature removed for mentioning the removal of a previous signature. Blackwhite bellyfeel double plus good...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards