We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is the Stockmarket in a bubble?

Comments

-

The next big bubble could be beer

- personally I like Grolsch .

- personally I like Grolsch .

At its best alcohol can be refined towards a fuel, seriously possible to be a great british industry if petrol keeps going up like it has.

See biodiesel, rape seed, fertiliser and fracking for ideas Dart energy is about to float on LSE, big (potential) player apparently 0

Dart energy is about to float on LSE, big (potential) player apparently 0 -

The weak pound won't be a problem for my tipple of choice - unless the Scots go their own way of courseI think I saw you in an ice cream parlour

Drinking milk shakes, cold and long

Smiling and waving and looking so fine0 -

With their own currency, like the Fiji pound or something?

I love the idea but I dont think they will because they have a bad idea about large government. They cant finance it, I believe the people are not for it either.

You dont want Salmond in charge of money imo though he is a Economist by profession? maybe he'd surprised everyone with monetary marvels0 -

One more from my internet trawls - Its happy 4th birthday for the bull run (from www.thereformedbroker.com :-)

I think I saw you in an ice cream parlour

I think I saw you in an ice cream parlour

Drinking milk shakes, cold and long

Smiling and waving and looking so fine0 -

Came across this referenced on motley fool

http://www.businessinsider.com/dow-jones-idiot-maker-rally-2013-3?op=1

All the famous commentators caught making badly wrong predictions from 2009 - 2012. It seems they take it turns one puts themselves up froont and centre every month - then one day one of them will be right (this year but not soon IMHO) - and they will get the plaudits and be flavour of the month

Interesting link, Thanks.

The thing they all failed to see coming was the money printing, which has turned their conventional wisdom on its head for the moment.“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

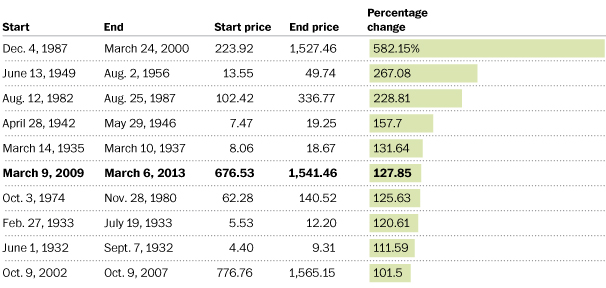

One more from my internet trawls - Its happy 4th birthday for the bull run (from www.thereformedbroker.com :-)

Interesting Graph, Thanks for posting.

As far as I can see, all the problems that caused the fall in March 2009 are still with us. Nothing has been solved. Assets are still worth the same as they were then. The big difference is that cash is worth less because they have been printing it like lunatics - something that many of us without inside knowledge failed to predict.“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

should have posted the link http://www.thereformedbroker.com/2013/03/09/the-impossible-rally-turns-four/ as the article is quite entertainingI think I saw you in an ice cream parlour

Drinking milk shakes, cold and long

Smiling and waving and looking so fine0 -

Looking at P/E values the S&P is on 18...20-25 is getting into very high range.

If companies can manage to grow earnings then the P/E won't be as demanding...hopefully higher the market goes.

http://www.multpl.com/

Looking at percentage change we're around 127% up since the bottom 4 years ago....theres not that many runs higher.

The next two periods higher lasted 2 and 4 years in the 1930-40's.

We then go into 5-10 year runs and the figures will please most investors if it comes off.. 0

0 -

"money" and "printing" are words that need to be taken into account before one gets to looking at basic indicators such as P/E ratios. Look at interbank lending in Europe........most banks prefer borrowing almost free money from the ECB.....

In the current context one cannot look at history for many pointers I am afraid.

I guess we will find out what will happen when QE is taken out of the equation.....

Good luck all.

J0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards