We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Index Tracker Funds

Comments

-

However, given how bad this period was in historical terms, it's not too shoddy. And we're also going from an unusual peak and only the truly cursed would have invested everything at just that one moment in time.I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

gadgetmind wrote: »However, given how bad this period was in historical terms, it's not too shoddy. And we're also going from an unusual peak and only the truly cursed would have invested everything at just that one moment in time.

No idea why those two earlier charts should run 1984 and 1986 as its just the way they came out from the website...but we can see the picture with dividend boost.

Again the total return link was just taken from a site which showed 1999...but it looks like its showing around 30% gain despite the sideways movements of the market..

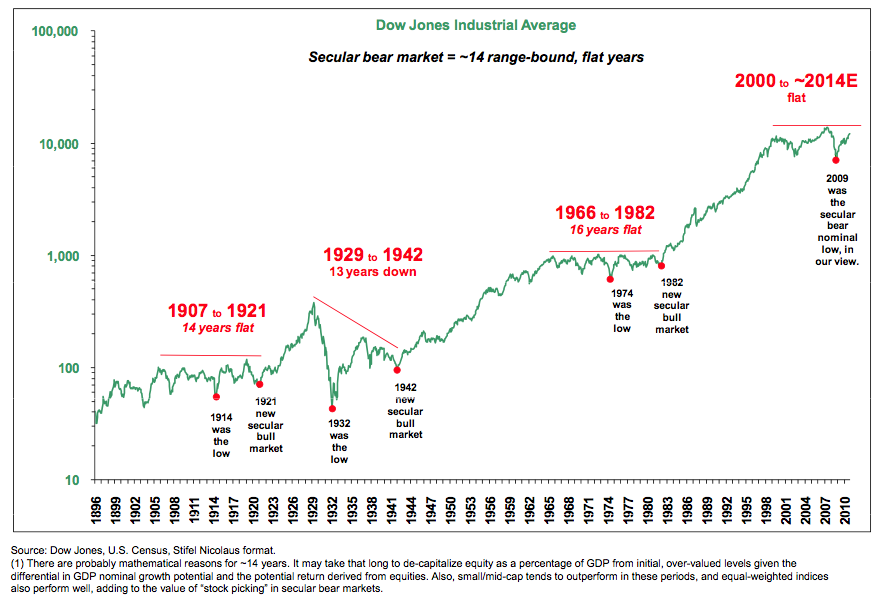

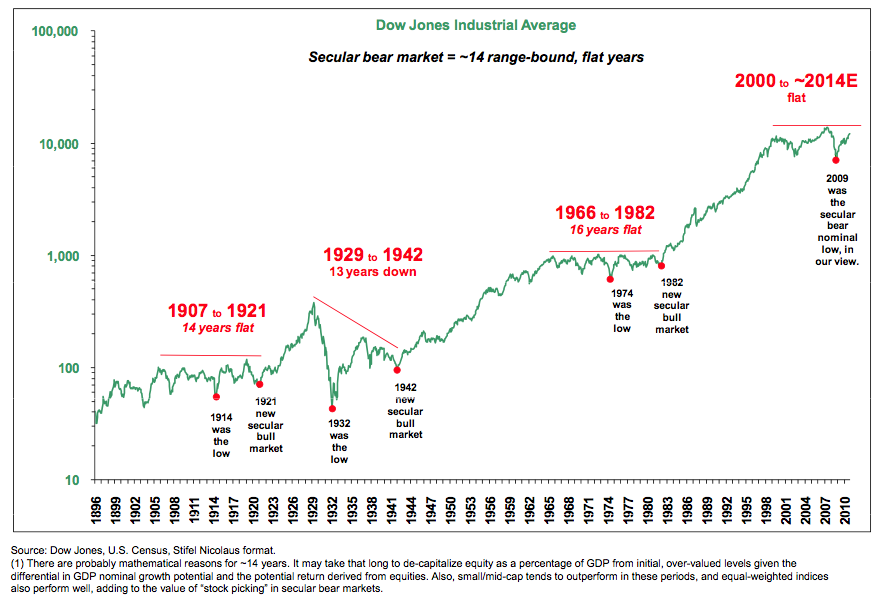

The link below shows the Dow history which has done better than the Ftse since its launch 1984...even without dividends.

A breakout of the sideways move could well be in sight...boom times ahead..:D 0

0 -

No idea why those two earlier charts should run 1984 and 1986 as its just the way they came out from the website...but we can see the picture with dividend boost.

Again the total return link was just taken from a site which showed 1999...but it looks like its showing around 30% gain despite the sideways movements of the market..

The link below shows the Dow history which has done better than the Ftse since its launch 1984...even without dividends.

A breakout of the sideways move could well be in sight...boom times ahead..:D

Interesting graph. Makes more sense as a log-linear scale. It puts the recent crash into perspective. The crash looks like it could be seen to be more a final unwinding of the bull market of the late 1990s rather than a fundamental failure in the world economy.0 -

A breakout of the sideways move could well be in sight...boom times ahead..:D

But I don't mind sideways. My ongoing investments and dividends buy me more shares, so more future dividends, which is all good stuff. High prices might be great if you intend to sell and buy, errr, something, but not for an going investor.

However, as Buffett said, "emotions cause most people to shun such common sense and root like heck for any stock they own, like “a commuter who rejoices after the price of gas increases, simply because his tank contains a day’s supply.”"I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

gadgetmind wrote: »But I don't mind sideways. My ongoing investments and dividends buy me more shares, so more future dividends, which is all good stuff. High prices might be great if you intend to sell and buy, errr, something, but not for an going investor.

However, as Buffett said, "emotions cause most people to shun such common sense and root like heck for any stock they own, like “a commuter who rejoices after the price of gas increases, simply because his tank contains a day’s supply.”"

Sound stuff but I think one should never forget the amount of joy and excitement many get from their investments.

My brother cares for a 95 year old living on his own. If it wasn't for the joy of watching his shares (he has enough that at least one each day will be doing something positive) I'm sure he would have been long gone. For sure he will never appreciate the gains :cool:

But great thread guys and the multiple graphs are so informative :T I vote this my thread of the year - and we are still in January :rotfl:I believe past performance is a good guide to future performance :beer:0 -

I will admit that I get a buzz at times from seeing capital values climb, but then I look at the fresh cash I need to invest and everything falls back into place.

Low prices mean low p/e, which means more income for your buck, so more low p/e shares can be bought, and compounding then does what it does.

However, I suppose that higher equity prices mean that I can rebalance into those nice cheap bonds with tasty yields ... :eek:I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

An article ...three pages...here on the importance of fees over a 10 year period.

http://www.trustnet.com/News/381589/cheap-tracker-funds-thrash-expensive-rivals/1/0 -

Interesting graph. Makes more sense as a log-linear scale. It puts the recent crash into perspective. The crash looks like it could be seen to be more a final unwinding of the bull market of the late 1990s rather than a fundamental failure in the world economy.

When you look at the P/E values around that time there was a clear case for unwinding...

Think I can remember our own BT on a P/E of 30 +..

http://www.multpl.com/0 -

There seems to be a frenzy on at the moment, maybe fuelled by poor cash returns. Is the FTSE going to continue rising, when is the big sell off coming? The economy isn't getting better, less money around and it's likely to get worse. The FTSE is rising despite this. It's a mad world. When it drops again, it will drop, won't it?0

-

A 95 year old share investor? that is awesome :laugh:

Whats his fav now

They want you to sell, that is the grand plan. Higher prices, sell and buy some consumer goods and pay VAT. Buy a house, buy the cheap stuff and save the economy with your QE bloated money, sweet successto sell and buy, errr, something, but not for an going investor 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards