We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

It's kind of fun to do the impossible

Comments

-

I'm with NatWest and what bubblycrazy has said is absolutely right. They'll always see the term as the same length, but if you OP enough and keep within the limits you'll eventually run out of money to pay back. Anything £1000 or above and they'll recalculate the monthly payment, £999.99 and you're absolutely fine 😀

Just make sure you space out the payments, so you don't accidentally pay more than £1000 in a short space of time as they'll count it as one payment (they were taking ages to credit mine in the run-up to Christmas, so I got in the habit of sending the next one when I saw the previous one had credited - then they caught me off-guard by crediting one really quickly, so I sent the next one, not realising it had only been 5 days and they've recalculated my monthly payment to £61.90 for the next 20 years 🤦♀️ A week apart each time and you'll be fine!)Mortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!1 -

Just as an extra comment on the above, make sure you don't pay any big amounts close to your standard payment date, so it doesn't get seen as one payment - if your standard payment is £580, don't manually send them any more than £400 a week either side of that payment dateMortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!1 -

Oh thank you! I was going to add the £999.99 to my regular payment thinking that the £580 would be kept separately to the £999.99 - so much to think about!! I'll wait at least a week then and check online that the figures have changed before paying the next one. How do you pay your extra payments? Just on the lump sum overpayment part of their website? I noticed it said it accepts credit cards so I was hoping to use my Amazon card for the points - if I use it to pay the £7.5k, I'll get 1,875 points - 1,000 gives me a £10 Amazon voucher - and every time I pay £999.99 I'll get 249 points so I'll be earning a £10 voucher every 4 months (I'll easily make up the missing 4 points!) - it's all adding up! Off to check my Amazon T&C's...!South_coast said:Just as an extra comment on the above, make sure you don't pay any big amounts close to your standard payment date, so it doesn't get seen as one payment - if your standard payment is £580, don't manually send them any more than £400 a week either side of that payment date2 -

Ooh, I didn't know you could do it by credit card - I could be earning Nectar points 🤣!

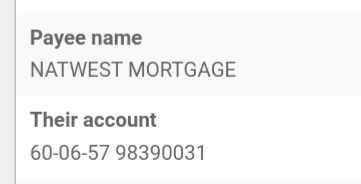

I always do it by Faster Payment from my internet banking:

(use your account number as the payment reference)Mortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!1 -

I bet the Faster Payment would be far more convenient than paying by credit card! The credit card option is on the payments section of the dashboard - there's an option to pay by credit/debit card or from a NatWest account if you have one. They don't accept Amex though unfortunately - I have an Amex and that would've given me £9.99 per month in cashback.2

-

Yes mine is set up as a payment on my online banking making it really easy to OP small amounts as well as large.

What a good idea to use a card to earn points.

I knew I'd read it happening to someone recently but I couldn't remember who @South_coast, that must have been frustrating!

MFW -

House purchase £62500

Original mortgage balance 28/08/2014 £52850Original MF date: 2049:eek: Aiming for: 2025

Balance 27/07/2016 £49990

Balance 08/07/2017 £47999

Balance 30/07/2018 £44500

Balance 01/08/2019 £40700

Balance 03/09/2020 £37619

Balance 30/09/2021 £33983

Balance 18/01/2023 £28940

Balance 06/10/2024 £22168

Balance 08/10/2025 £18417

Mortgage free 09/10/2025!! Mortgage paid off in 11 years, 1 month, 11 days 🥳

2 -

Yep, especially as the interest is still the same and is now 1/3 of the monthly payment 🤣! Just makes me more determined than ever to OP!Mortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!1 -

I'm not completely sure that the points will work, but I can't see anything in my T&C's that says it won't. I'll give it a go next week and report back!bubblycrazy said:

What a good idea to use a card to earn points.1 -

It must be an amazing feeling to see that outstanding mortgage at 4 figures! I've subscribed to your diary to keep me motivatedSouth_coast said:Yep, especially as the interest is still the same and is now 1/3 of the monthly payment 🤣! Just makes me more determined than ever to OP!1 -

Blimey, now I feel like I need to post something motivational....😮🤣!Mortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards