We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING

Hello Forumites! However well-intentioned, for the safety of other users we ask that you refrain from seeking or offering medical advice. This includes recommendations for medicines, procedures or over-the-counter remedies. Posts or threads found to be in breach of this rule will be removed.📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Preparedness for when

Comments

-

Bedsit_Bob wrote: »There's also the matter of private contractors running over their quote, then the Government paying the difference.

Excuse me, but a quote is a quote.

If it ends up costing more than you quoted, tough!

Perhaps, if you have to cover the difference yourself, you will give a realistic quote in future.

I wasn't aware that was happening. If it is - then it should be publicised heavily that some private contractors are finding excuses to help themselves to some more of "our" money after the event.

I am surprised at the thought anyone would let them get away with it I must admit. Isnt it supposed to be a point in law that a firm can issue an "estimate" of how much something is supposed to be and then legitimately charge more because it was an "estimate". On the other hand - if its a "written quotation" then the contractor HAS to stick to the given price.

I know that the very first firm that quoted for the very first job on my starter house had been asked by me to give a "written quotation" price (as I had already read about that little excuse). They did the job (re-wiring the electrics) and then gave me a bill for a higher amount than the "written quotation". They very quickly had it pointed out to them that it had been a "written quotation" and not an "estimate" and I would be paying precisely what the quotation said and no more. He came up with a feeble excuse of having had to do more lights than he quoted for - and got the reply "I was watching you counting them - all of them - as you walked around. Nice try....".:rotfl:. I paid the originally-quoted amount:)0 -

Evening all.

Evening all.

A tip which might be useful is to own a long-handled plunger which goes nowhere near a toilet - these serve very handily as agitators in tubs of water to scoosh soapy water through dirty clothes and likewise the clean rinse water. Heck, if nothing else, you could even use them to unblock the sink.

I'm thinking of the one that SuperGran has, with about a 2 ft wooden handle. Trad hardware stores should be able to provide these.

Have had my nose stuck in a history book for a couple of hours. As in the history of my city. Cruelties which would make isil blush, religious persecutions, burnings at the stake, hanging, drawing and quartering, dungeons, whipping people at the cart tail, plague, all sorts. Plus a pretty endless effort on behalf of the ordinary folk, struggles over the centuries, to drag themselves up from the gutter, greatly hampered by the oppression of the rich and powerful. Sobering stuff. We must never get complacent about the ever-present risk of cruelty from the powerful towards the weak. And keep our pitchforks shiny and sharp in readiness. Every increased possession loads us with a new weariness.

Sobering stuff. We must never get complacent about the ever-present risk of cruelty from the powerful towards the weak. And keep our pitchforks shiny and sharp in readiness. Every increased possession loads us with a new weariness.

John Ruskin

Veni, vidi, eradici

(I came, I saw, I kondo'd)

0 -

Anyone seen this:

http://www.moneysavingexpert.com/news/savings/2015/07/chancellor-called-to-prevent-absurd-savings-protection-cut?_ga=1.121606927.603080509.1401908274

He's right of course. It is absurd for the UK protection level to be linked to the Euro. If the Euro crashes, everyone in the UK loses their deposit protection!

Makes the protection pretty pointless I think.0 -

Anyone seen this:

http://www.moneysavingexpert.com/news/savings/2015/07/chancellor-called-to-prevent-absurd-savings-protection-cut?_ga=1.121606927.603080509.1401908274

He's right of course. It is absurd for the UK protection level to be linked to the Euro. If the Euro crashes, everyone in the UK loses their deposit protection!

Makes the protection pretty pointless I think.

This is a good web-site that lists all the banks and who is linked under the same banking license. http://moneyfacts.co.uk/guides/savings/depositor-protection-schemes-if-a-bank-goes-bust180112/

This second article from April on ZH also makes you wonder if the UK will also lower the protection limit as reported for Austria...at some point in the near future.

http://www.zerohedge.com/news/2015-04-09/bank-deposits-no-longer-guaranteed-austrian-government0 -

I'd question whether the grubbyment could honour the payment protection scheme, or honour it in a timely manner, should a major bank or even several, fail.

I'd question whether the grubbyment could honour the payment protection scheme, or honour it in a timely manner, should a major bank or even several, fail.

I think it quite probable that they couldn't and large deposits might be wholly or partially converted into bank stock.Every increased possession loads us with a new weariness.

John Ruskin

Veni, vidi, eradici

(I came, I saw, I kondo'd)

0 -

I think it quite probable that they couldn't and large deposits might be wholly or partially converted into bank stock.

I've not had my first cup of coffee of the day yet ....so brain not up to speed for the day...

.....but what exactly would that mean to "convert large deposits into bank stock"?

Would that mean = they could grab £x,000 of someone's money and tell them that instead they owned a certain number of shares in the bank? and the person would then have to hope those shares would actually be saleable at some point for the amount of savings they represented to that share-holder?

My head hurts...trying to think first thing of a morning...:p0 -

Relax, you've got it exactly right. Although what stock in a failing institution is worth is anyone's guess. My bet would be slightly less than a pkt of Andr*x. Every increased possession loads us with a new weariness.

Relax, you've got it exactly right. Although what stock in a failing institution is worth is anyone's guess. My bet would be slightly less than a pkt of Andr*x. Every increased possession loads us with a new weariness.

John Ruskin

Veni, vidi, eradici

(I came, I saw, I kondo'd)

0 -

I'd question whether the grubbyment could honour the payment protection scheme, or honour it in a timely manner, should a major bank or even several, fail.

I'd question whether the grubbyment could honour the payment protection scheme, or honour it in a timely manner, should a major bank or even several, fail.

I think it quite probable that they couldn't and large deposits might be wholly or partially converted into bank stock.

I think that is right, the problem is that the mainstream media really have not let the public know what will happen to their deposits. If they did I suspect that there would be bank runs as soon as they realised that all the protection that they previously had, is now gone, all because bank regulation has been inadequate and the banks are too big to save, in addition to engaging in dangerous activities.

So at some point we will have queues outside our banks again. like many Greeks who we saw queueing up at ATM's that will be replicated in the UK. Though it makes me wonder what will happen if TPTB push for a cashless society and peoples funds are trapped in insolvent banks. I suspect that the parties will be punished at the next election.

In fact I doubt that even the government or bank economists will realise what they will have done until too late.

Assuming that they bail in everyone then while the banks will be solvent again the problem is that their customers will be poorer. This will mean that they cut back spending significantly to rebuild any savings that they lost, to cover things like weddings house purchase rainy days etc. If you only think about what you will do in such a situation and you can understand what others will do.

That will mean a significant drop in spending and the debt to GDP will rise again, pushing the government to push for more austerity. Though what it will do is push the UK into the same debt deflationary spiral that devastated Greece. People may simply refuse to retire because they do not trust the government to maintain pensions and that will cause youth unemployment to rocket.

It will mean the end of the main political parties as their support will whither. I seriously do not think that any of them realise what they are doing.It's really easy to default to cynicism these days, since you are almost always certain to be right.0 -

..and on that note of "Cheery (not) or even cheery-er (ditto):(...will go off for some volunteering in one community enterprise and do some more serious thinking about whether to volunteer in another one.

"We" could be all "we" have - so to say.

....and some more gardening (ie foodgrowing) this afternoon. It doesn't matter if I end up turning out more of some foods than I actually want after all does it? It wouldn't go to waste. Friends get first dibs for any surplus obviously (on the informal sorta "swop-around" system that runs between friends of favours for favours). But I've got a couple of things in mind for any surplus that arises beyond that - I've checked out the nearest foodbank and they say they take donations of fresh produce. Also seen another place that I think would be glad of some.

So - what do other gardeners do with their surplus food? Who do you give any to - after you've had what you need and given some to friends etc?0 -

I wonder how many people have not realised that they may have deposits in a number of institutions that are all covered by the same license and so would be aggregated in a bail out?Ryanna2599 wrote: »This is a good web-site that lists all the banks and who is linked under the same banking license. http://moneyfacts.co.uk/guides/savings/depositor-protection-schemes-if-a-bank-goes-bust180112/

While this article was written by a gold marketer it has relevance up to a point. Banks are no longer safe. Counter party risks are considerable but not apparent. It might not be the bank that you think that is the problem, it could be one over the border who imposes big losses on a counter party which might be a couple of connections away but enough to make all interbank transfers high risk and so create another credit crunch, as no one will trust the others accounts or state backing.Ryanna2599 wrote: »This second article from April on ZH also makes you wonder if the UK will also lower the protection limit as reported for Austria...at some point in the near future.

http://www.zerohedge.com/news/2015-04-09/bank-deposits-no-longer-guaranteed-austrian-government

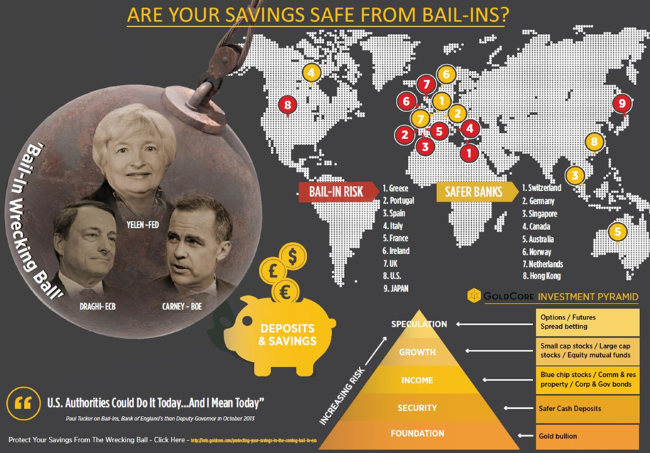

Also look at this image,

Guess who the Austrian banks have a lot of dealings with? Swiss and German banks. German banks could be easily wiped out by derivatives and counter-party risks. This list also includes Singapore, Canada and Australia who are currently undergoing big write downs as their property bubbles collapse. Which will mean big losses in the future.

Gold has some benefit as a hedge but it also has risks. While many think that there is large gold manipulation there is also a lack of demand especially industrially that could account for the lower price. Remember iron is at levels nearly a fifth of the price it was a few years ago, and no one is suggesting that there is iron ore manipulation going on. Gold is a commodity like iron and so its demand is reflected in the price. If you allow for the fact that gold is priced in dollars and the exchange rate for some currencies is showing gold at a high levels in local currency can explain why the price is falling. Gold has an advantage in that there are no counter party risks which is also why many rich have being buying artwork classic cars land etc. There is no counter party risk in these assets either. Though most of these markets are not every liquid and if there is a downturn then these prices will fall just as much as any other. Property requires someone to buy it to realise its worth. So a million pound is only worth it if you can find someone to buy it at that price.

So prepping wise bail ins will be irrelevant to 80% of us unless they bail in depositors well below the deposit protection limit. You should be concentrating on debt clearance so that when deflation hits the real value of those debts rising against falling wages does not make it worse for you. Then boost food and other preps that will make your life easier. A years supply of food and big roll will minimise any expenses that you may need to make during a bank holiday.

Then get your bank balances to no more than £6000 so that if you lose your job you would still qualify for benefits. You should also keep cash at home rather than in a bank so maybe £3000 at home and £3000 in the bank. I am finding that while I am in house move mode I am barely needing my cash so am spending less than £5 a week, in that case £3000 would last me years. I am still taking cash out of the banks but increasing my cash holdings.

With the government planning cuts of 40% of spending then prepare for cuts in income of 40% and how would you cope with that. Once my credit card debt is cleared I will be able to cope with such a drop. Not many can say that.It's really easy to default to cynicism these days, since you are almost always certain to be right.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards