We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Newton Real Return fund

koru

Posts: 1,546 Forumite

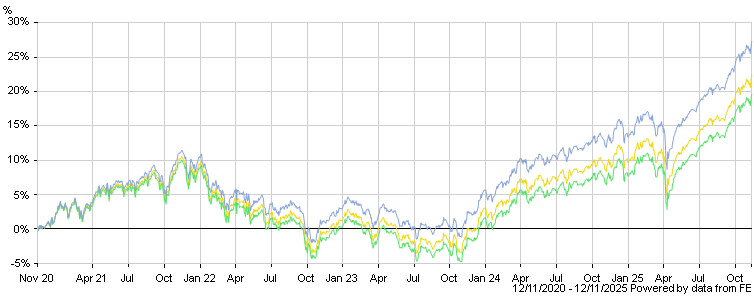

According to Hargreaves Lansdown, the A shares of Newton Real Return fund (which is the one available on most platforms, including HL and Alliance Trust Savings) massively underperform the X shares and the Inst shares. I can understand that there might be classes of the same fund with a lower AMC of perhaps 1.0% or even 0.75%, but this would only explain a small part of the difference in performance, which is between 4.5 and 5.5% per year. The green line in the following chart is the A class and the blue is the X class. The chart shows total return.

Can anyone explain the difference in performance? Or has HL simply got it wrong? If this difference is genuine, are the X class and Inst class only available through advisers or is there another way?

I have noticed that the green line seems to start at about -2%, whereas the other two start at 0%, as you would expect. Therefore, it would appear there is a glitch in the software producing this chart, which makes me wonder whether the rest of the chart is reliable.

Can anyone explain the difference in performance? Or has HL simply got it wrong? If this difference is genuine, are the X class and Inst class only available through advisers or is there another way?

I have noticed that the green line seems to start at about -2%, whereas the other two start at 0%, as you would expect. Therefore, it would appear there is a glitch in the software producing this chart, which makes me wonder whether the rest of the chart is reliable.

koru

0

Comments

-

To answer my own question, according to Morningstar the difference in total return is more like 1.5% per year. So, HL's information is wrong.

Morningstar says the AMC on the X class units is zero, so I assume this is a special class that is only available in situations where Newton gets some other reward.koru0 -

The HL chart has now corrected. (The chart in my first post is a dynamic link, not a snapshot of what I saw when I posted.) It shows a difference of ~1.5% performance per year, which is explained by no AMC. But lesson learned: HL charts are not reliable.koru0

-

Glad I could help.

(:D)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards