We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Clueless about how to manage my debts

apollo11_2

Posts: 9 Forumite

Hi there,

I’m new to the forum and unfortunately far too naive when it comes to finances. I tend to bury my head in the sand and just ignore the situation, which I realise is the worst possible thing to do.

I’m trying desperately to be more proactive and to clear my outstanding debts, not least because we’re hoping to move to Australia in the near future.

I have a current account with the HSBC and still run a formal £1500 overdraft (about £20 per month interest). Beyond that I also have two credit cards, a HSBC card with £2300 on it at 23.9% APR and a Barclaycard with £4700 on at 21.9%. The payment on the credit cards are really killing me. I took the Barclaycard out about 2 years ago with a 12 month 0% balance transfer. My intention was to clear the debt within 18 months but due to some employment issues this didn’t work and I stupidly started using the card and actually increased the balance owed! I’ve cut both cards up now and am just making repayments on them, but I’m barely managing to cover the minimums, and the balance is going nowhere fast.

Last month I looked at consolidating the two cards onto a new 0% balance transfer to clear the debt. I checked my credit rating through Experian and it came back as ‘excellent’ with no issues noted. I decided to apply for the Halifax 22 month 0% card but was rejected online.

I’m now paranoid about applying for other cards because I don't want to damage my rating further (although a subsequent check of Experian still shows my rating to be ‘excellent’ with no issues). To be honest I don’t really know the best way to move forward. Is my strategy of looking for 0% balance transfer options to clear the debt valid or are there better ways i.e. loans? I’ve started trying to research the options but my brain has exploded and I'm now more stressed than ever because I feel like I understand the situation even less.

Any help or advice would be very gratefully received.

Thanks,

MarkA

I’m new to the forum and unfortunately far too naive when it comes to finances. I tend to bury my head in the sand and just ignore the situation, which I realise is the worst possible thing to do.

I’m trying desperately to be more proactive and to clear my outstanding debts, not least because we’re hoping to move to Australia in the near future.

I have a current account with the HSBC and still run a formal £1500 overdraft (about £20 per month interest). Beyond that I also have two credit cards, a HSBC card with £2300 on it at 23.9% APR and a Barclaycard with £4700 on at 21.9%. The payment on the credit cards are really killing me. I took the Barclaycard out about 2 years ago with a 12 month 0% balance transfer. My intention was to clear the debt within 18 months but due to some employment issues this didn’t work and I stupidly started using the card and actually increased the balance owed! I’ve cut both cards up now and am just making repayments on them, but I’m barely managing to cover the minimums, and the balance is going nowhere fast.

Last month I looked at consolidating the two cards onto a new 0% balance transfer to clear the debt. I checked my credit rating through Experian and it came back as ‘excellent’ with no issues noted. I decided to apply for the Halifax 22 month 0% card but was rejected online.

I’m now paranoid about applying for other cards because I don't want to damage my rating further (although a subsequent check of Experian still shows my rating to be ‘excellent’ with no issues). To be honest I don’t really know the best way to move forward. Is my strategy of looking for 0% balance transfer options to clear the debt valid or are there better ways i.e. loans? I’ve started trying to research the options but my brain has exploded and I'm now more stressed than ever because I feel like I understand the situation even less.

Any help or advice would be very gratefully received.

Thanks,

MarkA

0

Comments

-

Hi Mark,

I didn't want to read and run - I'm sure someone will be along with some excellent advice soon.

Stay positive in the mean time FTB:A Saving for my first deposit :A0

FTB:A Saving for my first deposit :A0 -

Hi Mark,

It might be worth applying for one or two more 0% deals as each bank/company uses different criteria, so you may get accepted on another card. However more than a few applications for credit in (I think) a 6 month period can look bad, so I wouldn't try too many places.

When you checked your credit rating did you look to see if you have any defaults or late payments recorded? Even if you haven't defaulted a debt or had a CCJ against you, a series of late payments can make you look unattractive to lenders. Unfortunately those will stay on for 6 years as will any marks against your credit.

As for a consolidation loan, it can work for some people. However you have to be VERY sure that you will not be tempted to use those credit cards again and just run up more debt - it happens way more often than you'd think - and actually you have admitted doing the same yourself! The same could happen if you transferred all your debt to one other card and didn't close down your old ones.

It may be that you have reached the limit of the amount of credit lenders are willing to give you, and will have to reduce some of it first before getting accepted for a new balance transfer deal.

A 0% deal is probably the way to go if you can find one but it's probably worth posting an SoA (statement of affairs) up here, there are loads of people with great advice about reducing your outgoings and getting that debt paid off asap Savings target: £25000/£25000

Savings target: £25000/£25000

:beer: :T

0 -

You might be wiser to apply for a low-life-of-balance card. Banks have wised up to people credit card tarting, and they know they can't make money off it. LLLB cards reduce your losses but allow some gains for them.

Just be disciplined and don't use the cards again!

Good luckSome days, it's just not worth chewing through the leather straps....

LB moment - March 2006. DFD - 1 June 2012!!! DEBT FREE!

May grocery challenge £45.61/£1200 -

Thanks for the comments and advice guys. It feels a bit better already just talking about it.

I may try applying for another 0% or a LLoB card then, but I'll do some research on here before making the next application. My existing cards are now inaccessible (my very sensible other half is taking care of that for me) and I'd hand over any new card to her too.

What sort of details would you include in a SoA on here? Had a quick look through the forum but a bit confused as to what would be helpful in this situation.

For a start:-

My monthly take home is approx £1600 (which includes a student load deduction)

My current account has a £1500 overdraft which I pretty much hit the bottom of every month and incur charges (approx £50-£100 usually) + about £20 of interest.

As I said the HSBC credit card has a balance of £2300 with a limit of £2800. APR is 23.9% which gives approx a £60 minimum payment, which is all I make.

Barclaycard has about £4700 balance with 21.9% APR, limit of £5500. Monthly repayment turns out to be about £210.

I used to have a professional studies loan but I just managed to pay that off recently after 8 years (!) (final settlement was steeper than calculated at opening though so the past two months have been very very tight).

No other credit lines apart from those (and the student loan I alluded to earlier. I think the monthly pre-tax deduction is about £90, but not much I can do about that one!).

Is there any other important information which would help to give a clearer picture of my situation and change the payment approach I'm looking for?

Cheers again,

Mark0 -

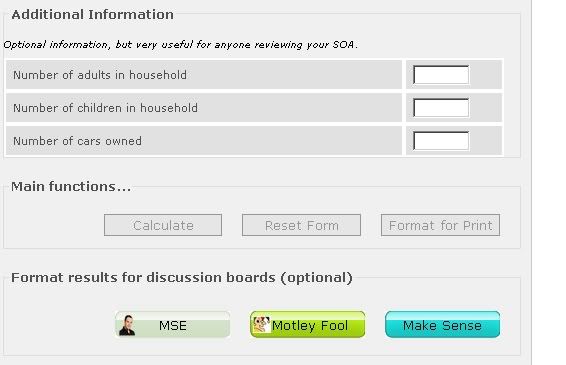

A link here to the complete SOA you can fill out and post for some helpful feedback

http://www.makesenseofcards.com/soacalc.html)FTB:A Saving for my first deposit :A0 -

Hi Again,

I filled out a SoA form but unfortunately when I include the formatted link the forum won't allow me to sumbit my post because I'm a new user.

Either way the result showed my total outgoing to be less than my total incoming by about £270. According to this I should be well clear of my limit each month but in practice I'm not (going over my overdraft each month and getting hefty fines). I think I need to look at where else I'm spending, but I don't exactly have a crazy lifestyle and I thought the form pretty much covered everything.

Either way, I'd really like to clear this debt and start putting some money away for emergencies. Trying to reduce the credit card re-payments would be a good start I think.

I'm also wondering how to handle my overdraft though. Some people have suggested opening a new current account and treating the old HSBC account like a credit card and just paying a bit off the overdraft each month. Does this work in practice? Would another bank really allow me to open a new current account in this state?

So many questions. Sorry if they're stupid but I think I'm starting to come towards some sort of plan.

Cheers,0 -

Hi Mark - the full SOA would be really helpful to see.

When you've finished completing it, click on "calculate" and then choose "MSE" as below

It will then open the info in a separate window, which you can copy & paste into here.

If it shows you should have a surplus but don't - a spending diary is a really great way of seeing where the money disappears to. You need to write everything down and do it for a few weeks - the odd £10 here and there quickly adds up. HTHGrocery Challenge £211/£455 (01/01-31/03)

2016 Sell: £125/£250

£1,000 Emergency Fund Challenge #78 £3.96 / £1,000Vet Fund: £410.93 / £1,000

Debt free & determined to stay that way!0 -

As a new user I believe there is a link on it near the bottom that you will have to delete when you copy the results across (it used to say something like posted with permission of makesenseofcards website).

dfMaking my money go further with MSE :j

How much can I save in 2012 challenge

75/1200 :eek:0 -

Thanks for the tip dancingfairy, works like a charm now.

Here's my current SoA. Does this look right?

Statement of Affairs and Personal Balance Sheet

Household Information

Number of adults in household........... 2

Number of children in household......... 0

Number of cars owned.................... 1

Monthly Income Details

Monthly income after tax................ 1780

Partners monthly income after tax....... 750

Benefits................................ 0

Other income............................ 0

Total monthly income.................... 2530

Monthly Expense Details

Mortgage................................ 0

Secured/HP loan repayments.............. 0

Rent.................................... 825

Management charge (leasehold property).. 0

Council tax............................. 115

Electricity............................. 45

Gas..................................... 40

Oil..................................... 0

Water rates............................. 40

Telephone (land line)................... 25

Mobile phone............................ 45

TV Licence.............................. 11

Satellite/Cable TV...................... 0

Internet Services....................... 18

Groceries etc. ......................... 300

Clothing................................ 60

Petrol/diesel........................... 120

Road tax................................ 12

Car Insurance........................... 45

Car maintenance (including MOT)......... 25

Car parking............................. 0

Other travel............................ 0

Childcare/nursery....................... 0

Other child related expenses............ 0

Medical (prescriptions, dentist etc).... 20

Pet insurance/vet bills................. 0

Buildings insurance..................... 0

Contents insurance...................... 10

Life assurance ......................... 0

Other insurance......................... 0

Presents (birthday, christmas etc)...... 20

Haircuts................................ 15

Entertainment........................... 60

Holiday................................. 0

Emergency fund.......................... 0

Total monthly expenses.................. 1851

Assets

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 500

Other assets............................ 0

Total Assets............................ 500

No Secured nor Hire Purchase Debts

Unsecured Debts

Description....................Debt......Monthly...APR

HSBC Overdraft.................1500......20.........18.3

HSBC Credit Card...............2300......57........23.9

Barclaycard....................4700......210.......21.9

Total unsecured debts..........8500......267.......-

Monthly Budget Summary

Total monthly income.................... 2,530

Expenses (including HP & secured debts). 1,851

Available for debt repayments........... 679

Monthly UNsecured debt repayments....... 267

Amount left after debt repayments....... 412

Personal Balance Sheet Summary

Total assets (things you own)........... 500

Total HP & Secured debt................. -0

Total Unsecured debt.................... -8,500

Net Assets.............................. -8,000

Thanks0 -

Thanks for the tip dancingfairy, works like a charm now.

Here's my current SoA. Does this look right?

Statement of Affairs and Personal Balance Sheet

Household Information

Number of adults in household........... 2

Number of children in household......... 0

Number of cars owned.................... 1

Monthly Income Details

Monthly income after tax................ 1780

Partners monthly income after tax....... 750

Benefits................................ 0

Other income............................ 0

Total monthly income.................... 2530

Monthly Expense Details

Mortgage................................ 0

Secured/HP loan repayments.............. 0

Rent.................................... 825 first problem - your rent is a third of your total income - this will always cause you problems - if you add your council tax you are at 30% of your total income. Can you consider moving to something less expensive? Other option is you will need to increase your income or your partners.

Management charge (leasehold property).. 0

Council tax............................. 115

Electricity............................. 45 Utilities also quite expensive - have you shopped around for these? Or are you tied into these suppliers by your landlord? If you are, try making simple energy saving efforts e.g. nothing left on standby, lights off in daytime or when not in room - makes a huge difference!

Gas..................................... 40

Oil..................................... 0

Water rates............................. 40

Telephone (land line)................... 25 This is very expensive - who with? BT is £19 at their most expensive - cheaper monthly if you prepay.

Mobile phone............................ 45 Is this for 2 mobiles? You say there are 2 adults at home.

TV Licence.............................. 11

Satellite/Cable TV...................... 0

Internet Services....................... 18 Why so expensive? You need to shop about for this - I've had very good broadband service from £7.50 a month when I was an o2 customer.

Groceries etc. ......................... 300 Way too much to spend on groceries for 2 people. You will need to reduce your grocery spend by at least £100 a month. Start off with £50 and work towards saving £100. You can cook in bulk, freeze portions etc. Take lunches to work - DON'T BUY!

Clothing................................ 60 Whilst you are finding it difficult to make ends meet this needs to go. Recycle by listing old clothes on ebay and use any profits from that to buy new if you must.

Petrol/diesel........................... 120 Fairly expensive - are you able to claim any of this back from work?

Road tax................................ 12

Car Insurance........................... 45 You need to shop around for this - try using a price comparison site to find out who is cheapest then see if the provider is listed on any of the cashback sites e.g. Quidco. This is fairly expensive unless its to do with your age, convictions or the area you live in. Consider changing.

Car maintenance (including MOT)......... 25 Have you saved some of this for car repairs? How do you get to this figure?

Car parking............................. 0

Other travel............................ 0

Childcare/nursery....................... 0

Other child related expenses............ 0

Medical (prescriptions, dentist etc).... 20 What does this cover? Are you on regular prescriptions if so consider a pre-payment certificate to save money.

Pet insurance/vet bills................. 0

Buildings insurance..................... 0

Contents insurance...................... 10 Fairly reasonable - but wouldn't do any harm to shop around using a price comparison site.

Life assurance ......................... 0

Other insurance......................... 0

Presents (birthday, christmas etc)...... 20

Haircuts................................ 15

Entertainment........................... 60

Holiday................................. 0

Emergency fund.......................... 0

Total monthly expenses.................. 1851

Assets

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 500

Other assets............................ 0

Total Assets............................ 500

No Secured nor Hire Purchase Debts

Unsecured Debts

Description....................Debt......Monthly...APR

HSBC Overdraft.................1500......20.........18.3

HSBC Credit Card...............2300......57........23.9

Barclaycard....................4700......210.......21.9

Total unsecured debts..........8500......267.......-

Monthly Budget Summary

Total monthly income.................... 2,530

Expenses (including HP & secured debts). 1,851

Available for debt repayments........... 679

Monthly UNsecured debt repayments....... 267

Amount left after debt repayments....... 412

Personal Balance Sheet Summary

Total assets (things you own)........... 500

Total HP & Secured debt................. -0

Total Unsecured debt.................... -8,500

Net Assets.............................. -8,000

Thanks

Not including the rent (which is really too big a chunk of your total income), I reckon the points I've suggested could save you £200 a month minimum. If you chucked that £200 at one of your credit cards - it could be gone in just over a year then you could start saving towards paying off the next one.

I know the comments seem harsh, and I'm not doing it to be unfair. The truth is there are savings to be made, and you will need to put some groundwork and research into how to cut back ie. ploughing through the price comparison sites etc. They are mostly pain free savings I've suggested believe it or not!

Good luck, but there are easily savings to be made. A spending diary is a must for you - as you have cash spent which is unaccounted for at the end of the month. It's tough, but start with a small notebook for you and one for your partner and after a week it will be fairly apparent where the cash goes! Then you know where to tackle! Good luck!:D

PS Before you ask, been there, done that, made way more painful savings than I've suggested for you and at the end it feels great!:TLBM 30/6/9 Unsecured debts [STRIKE]£25,323.48[/STRIKE] £0 :T Debt free

Left for life Down Under 4th August 2012 - living frugally and have learned my lessons :j:j:j:j0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.5K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.8K Spending & Discounts

- 244.5K Work, Benefits & Business

- 599.7K Mortgages, Homes & Bills

- 177.2K Life & Family

- 258K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards