We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

2020 vision. VoucherMan's MFW diary

Comments

-

Another month, but this time the balance has dropped by £657. Love those overpayments.

Unfortunately not only will I be unable to make any extra op's until the back end of September, but due to a bit of an overspend in the last couple of weeks I may have to juggle the finances a bit to avoid going overdrawn. But with the price of groceries these days I might as well stock up while there's a good offer on. Food other non perishables seem a better investment than banking these days.

Two things for certain though. I won't be reducing my regular £200 a month op, and definitely won't be making use of the arranged overdraft. Not with the fees the Halifax charges.0 -

Someone started a thread a few weeks ago asking what people were going to do once their mortgages were paid off. Well I've decided. I want a house with a garden. Not just a patch of grass either. Needs to have a tree or two.

Visited the parents at the weekend. Sat in the conservatory waiting for the rain to start watching all the birds coming and going.

I've got the back yard filled with various shrubs, trees and flowers which is better than staring at concrete while I'm at the kitchen sink, but a decent garden would be much better.

Had a look at the websites of a few local estate agents to help put the silly idea out of my head but was pleasantly surprised at the number of properties locally that I'd consider if I was thinking of moving now. Looked mainly in the local area as I enjoy not having to travel far to work, but if I increased the search to 5 miles there are some even better properties.

The only downside is that most of the properties I looked at had smaller rooms and you get used to having the space. But to turn a negative to a positive - smaller rooms = easier to heat = lower bills. More importantly - less to clean.

Had a look at the finances since these are likely to be affected. MF date of 2020 still looks good with the planned overpayments. I'll hopefully get a bit more put away in ISAs since there's not point spending money on the house if I'm not staying. Still going to get some stuff done. Cupboard under the stairs / cellar door is next years plans.

Decorating the landing will have to be done some time, especially now that I've managed to suck off some of the wallpaper with the vacuum cleaner. Is it seriously un-MSE to get a decorator in to do it? I'd have to buy / hire some ladders so maybe put that towards paying someone who's already got some. But re-doing the bathroom is now off the to-do list. I don't think any bathroom would increase the value by more than it cost so might as well leave it.

Moving again would make a major difference to the finances. If I went for a place at the top end of those I'd been looking at I'd probably need a mortgage of about £50000 (one of the joys of living in the Northwest. Any southerners reading this can probably only sit and dream:D) which I'd then hope to pay off in about 8 years leaving only about 5 years of 'normal' working life to build up the savings. But I reckon I'll be okay with my pension arrangements. the savings are just a bonus.

All this is based on today's prices though. Who knows what's going to happen in the next few years. I'm hoping for a fruitful visit from the pay-rise faerie but I'm not getting my hopes up. Just need to keep up the payments while interest rates are low. They're not going to stay like that forever. Another 15 years or so would suit me though.0 -

A mortgage does seem like such a long time doesn't it! I'm 1.5 years into my first ever mortgage. The mortgage itself has only gone down by £6000, and that's including overpayments!!!

23.5 years seems such a long time. I'm hoping to be mortgage free by 40! That's still 17 years away though. My God daughter would be the age i am now by then :OMortgage 1: May 2012 £90,000 April 2020: £47,000

Mortgage 2: £270,000😱 Jan 2019 £253,000 April 20200 -

Hi VoucherMan

I am with the Halifax too and recently received a letter saying they are going to be improving the way we view our mortgage statement online. I called for more details only to be told that it will happen before the end of the year and that the overpayment I make by direct debit will be knocked out by the change and I will have to call to re-set it.

I recommend trees! I have planted two apples, a plum and a cherry. I plan to make cider when I am old and MF :beer:0 -

Hi VoucherMan

I am with the Halifax too and recently received a letter saying they are going to be improving the way we view our mortgage statement online.

I've had the letter. As my overpayment is done by standing order it wont be affected.

I'll be watching closely though to make sure they don't try to adjust the normal monthly direct debit payment though.0 -

This game sure has it's ups and downs. Today's lesson - stop when you're on one of the ups.

Spent a while feeding my spreadsheet junkie addiction. The latest idea being to cut back on the op's next year and concentrate on saving. I'd leave the £200/month standing order so would still make some progress.

By 2014 I'll have enough savings to keep me happy for a while so can throw everything at the mortgage. Similar to the idea I had last week. An extra £4000 a year in op's but keep it going to the end would pay off the mortgage towards the end of 2018.

I then decided to to a bit more property searching. Yesterday it was estate agents websites. This time I decided to look at properties already sold to see what sort of prices they'd gone for in the past. Not so easy this way. First looked for a promising looking area on Google Maps. Then looked on one of the house price sites at all the properties in the area. Only some of the addresses had detailed listings so I couldn't always find room sizes & garden details.

My mind started to wander a bit then. I noticed the current estimated house prices and decided to see what they valued mine at.

25% down on 5 years ago:eek:

Luckily I tried another site which only had the value 7-8% down on what I paid. I was happier with that. One of my neighbours has had their house on the market for a couple of years now. They were asking for more than mine sold for (all similar houses in the terrace so would expect similar prices) I noticed it's since been dropped. Don't know how long ago. Be interesting to see if they manage to sell it and, if so, how much they get.

Managed to finish on an 'up' after all. Staring at my OP target I've miscalculated somewhere. Still 4 months of standing orders to go this year. Plus I'm planning to pay another £1000 towards the end of the year. Unless I decide to go on a pre Christmas spending spree (and that just ain't gonna happen) I look set to beat this year's target.

As for the house searching. I think I'll give it a rest for a year or three, hopefully by then things will have started to improve. There definitely look to be potential properties out there so I'm sure if and when the time comes I'll find somewhere.

I might just pop into an estate agent for a nosey next time I'm passing one though.0 -

VoucherMan wrote: »25% down on 5 years ago:eek:

Luckily I tried another site which only had the value 7-8% down on what I paid. I was happier with that. One of my neighbours has had their house on the market for a couple of years now. They were asking for more than mine sold for (all similar houses in the terrace so would expect similar prices) I noticed it's since been dropped. Don't know how long ago. Be interesting to see if they manage to sell it and, if so, how much they get.

Don't pay too much attention to the predictor websites. It's worth what someone will pay for it and you won't know till you come to sell.MFW: Nov 2008 £156k, Jun 2015 £129k, Jun 2017 £114k.0 -

That's it. Signed up to the MFiT-T3

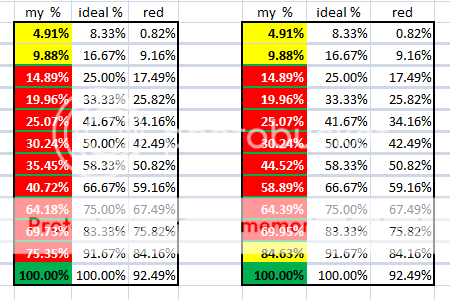

And just because I can, and there's never too many charts and spreadsheets

Based on the figures in the chart update schedule I will probably be spending much of the journey in the red.

Both assume I'll be overpaying £200/month with an extra £4000 in 2014 & 2015 (as post 27. Three days & I haven't changed my mind yet!) The only difference in the left hand chart I've added the payments towards the end of the year. In the other I've split it £2000 in May, £2000 in November.

Whichever way I try to work it I'll struggle to keep out of the red as I don't plan to make any extra payments next year. But it should make it all the more satisfying in 2015 when I do catch up.0 -

Made a nice saving last weekend.

Visited parents who declared that since their mortgage was paid off they've got money burning a hole in their pockets. If any of us are thinking of borrowing some money we should ask them first. I asked if this would include short term mortgage help in the unlikely case of redundancy.

Yes.

So as soon as I got home I cancelled my mortgage payment protection. Saving just over £200 a year. Possibly more as it was due for review in the next couple of months. Had a reply from them today. they've waived the 28 days notice as well so don't need to pay another months premium.

I see financialbliss has put the first chart up. £617 a month. :eek: Well it wouldn't be a challenge otherwise.

Had a nosey at the estate agents. Three of them actually. Shame I don't have the finances now. Looks like a good time to move. Still not sure how realistic the prospect of a future move is. I'm sure I could afford it. But would I want to? All those extra years of throwing money at the bank instead of collecting pocket money for retirement.

Smaller house but with garden.

but with garden.  Lots of time to think about it. You have been warned!

Lots of time to think about it. You have been warned!

Still I reckon I've got about six years before I'd want to do anything. Mortgage to get rid of first. I know, it's got to me now. [STRIKE]If[/STRIKE] When I succeed in the MFiT-T3_Challenge I should easily be able to pay off the remaining mortgage in 3 years. I'm looking forward to the MFiT-T4_Challenge.:D

Wanna bet?VoucherMan wrote: »I'd love to be MF by 2018 but unless there's a major change in the income department that's unlikely.0 -

Had a minor let down last weekend. Plasterer was due Monday but had to put start back a month after a couple of setbacks.

No point in leaving the money in the bank gathering dust so I brought forward one of the overpayments.

An extra £500 this month :j0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.6K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards