We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Northerners at greater risk of mortgage arrears

Comments

-

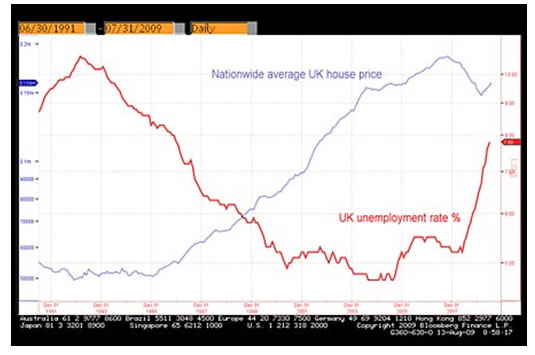

Graham_Devon wrote: »This graph proves your theory completely and utterly wrong...

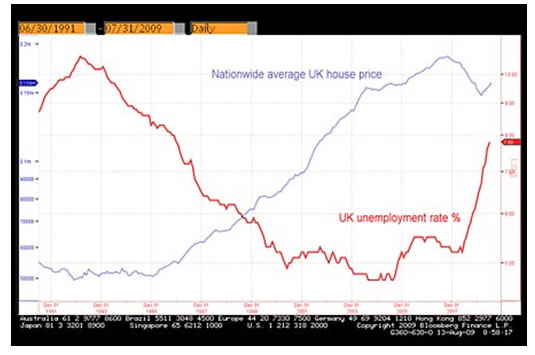

Yet this one proves it completely and utterly right... “The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Yet this one proves it completely and utterly right...

No it doesn't.

What happened in the first part of the graph? Rising employment saw house price falls.

What happened right at the end with rising unemployment and rising house prices?

All you have achieved here Hamish is to narrow the timeframe to give you a better stab at it. As I stated, we don't know the goalposts you are setting the parameters in, all we do know so far is that you are changing them as you go along. From falls to crash. To "any period" to 1991-2009 and so on.

You are just wrong.0 -

Graham_Devon wrote: »What happened right at the end with rising unemployment and rising house prices?.

Seriously?

Is that the best you can do?

I've given you a graph which clearly shows the correlation between the two over a long time frame, and you want to nit pick about the odd year or two here or there where it doesn't match up?

For that matter, even your graph clearly shows the correlation over multiple decades and the best you can do is muddle on about 2 years here or there. :rotfl:

I've never said one may not recover before the other.... Or that one may not lead the other in falls/rises. Given the opportunity for lag between cause and effect in any complex economic system, you'd fully expect that to be the case.

But you can't have significant and sustained falls in house prices without a significant increase in unemployment. And nothing you've presented here today contradicts that fact. Nothing at all.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Seriously?

Is that the best you can do?

I've given you a graph which clearly shows the correlation between the two over a long time frame, and you want to nit pick about the odd year or two here or there where it doesn't match up?

I gave you a graph with an even longer timeframe. You completely ignored it. Safe to assume therefore, that it proved you wrong.

I've shown you on your graph that the start of the graph doesn't match your analogy. Of course, you'll just state "thats not a significant period of time". But who know's what's significant to you if "an odd year or two" are just ignored. House prices static or falling while unemployment increases proves your theory wrong.

The other graph proved your theory wrong.

You are wrong.I've never said one may not recover before the other.... Or that one may not lead the other in falls/rises. Given the opportunity for lag between cause and effect in any complex economic system, you'd fully expect that to be the case.

"Significant" AND sustained is it now?0 -

HAMISH_MCTAVISH wrote: »For that matter, even your graph clearly shows the correlation over multiple decades and the best you can do is muddle on about 2 years here or there. :rotfl:

I've never said one may not recover before the other.... Or that one may not lead the other in falls/rises. Given the opportunity for lag between cause and effect in any complex economic system, you'd fully expect that to be the case.

But you can't have significant and sustained falls in house prices without a significant increase in unemployment. And nothing you've presented here today contradicts that fact. Nothing at all.

See above,

Yet again Graham, you're wrong. And you simply can't claim otherwise. The evidence is crystal clear.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

I'm wrong now, I'll agree.

Afterall, your specification has moved from "house price falls" to "crash" and now to "significant and sustained falls" over a 20 year period instead of "in history". Even if I found a period in history over 5 years that went against your theory, you'd just state something new.

2 years is a long time Hamish. If 2 years of house prices falls with increasing employment is something you can ignore to prove your own theory correct, then yes, I'm wrong. Alas, I always will be, it's you're theory and you will massage it whicehever way to suit.0 -

Graham_Devon wrote: »2 years is a long time Hamish.

You posted a graph that covers 33 years.

In that time you found just 3 short periods of a couple of years each where there was not a direct correlation between the two.

And even then only because of lag, ie, one happened before the other but you can't credibly claim it still wasn't related ...

!!!!!! Graham, must you really resort to such desperate pedantry to try and defend the indefensible?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »...It's self evident. And indeed, it's the basis on which the IMF are suggesting further mortgage relief, if you bother to read the whole article. Because economies and house prices are deeply interlinked...

Nononononononononono.

The IMF has been saying that high household debt depresses spending.

It's the vast mortgage debt that's the problem in Ireland, not the fact that prices are lower than they were five years ago.

As for your correlation 'analysis' yes of course they have been correlated but the causation is very much that GDP growth pushes house prices up, not vice versa. Pumping lots of debt into housing does not cause any kind of sustainable economic growth.

My last word on the subject for today but you don't half talk some rot.FACT.0 -

the_flying_pig wrote: »The IMF has been saying that high household debt depresses spending.

It's the vast mortgage debt that's the problem in Ireland, not the fact that prices are lower than they were five years ago.

No, completely wrong.

It's the mortgage debt without a correspondingly valued asset, compounded by economic contraction and thus lower incomes as house prices fall, that is the problem.

Or in the words of the IMF....

“policies can help avert self-reinforcing cycles of household defaults, further house price declines, and additional contractions in output” and made a case “for government involvement to lower the cost of restructuring debt, facilitate the writing down of household debt, and help prevent foreclosures”As for your correlation 'analysis' yes of course they have been correlated but the causation is very much that GDP growth pushes house prices up, not vice versa. Pumping lots of debt into housing does not cause any kind of sustainable economic growth.

Oh right.

So rising unemployment, recession and house price falls are correlated.

Good to know.My last word on the subject for today .

I do hope so.

Having to constantly correct you is really becoming quite tedious.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »...So rising unemployment, recession and house price falls are correlated...

Inflation correlated with [un]employment, well, likely enough. It's hardly the first time I've heard it suggested.

http://en.wikipedia.org/wiki/Phillips_curve

But what you're risibly implying is that something external pushing up house prices will push up real GDP. Just absurd.

If it were true then every government in the world would be pursuing pwoperdee-inflationary strategies such as printing squillions of $ in the form of vouchers that could only be spent on housing & then dropping them from helicoptors, making it illegal to sell houses for less than peak prices, etc.FACT.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards