We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Can you remove this advertisement twaddle on Halifax online?

Nine_Lives

Posts: 3,031 Forumite

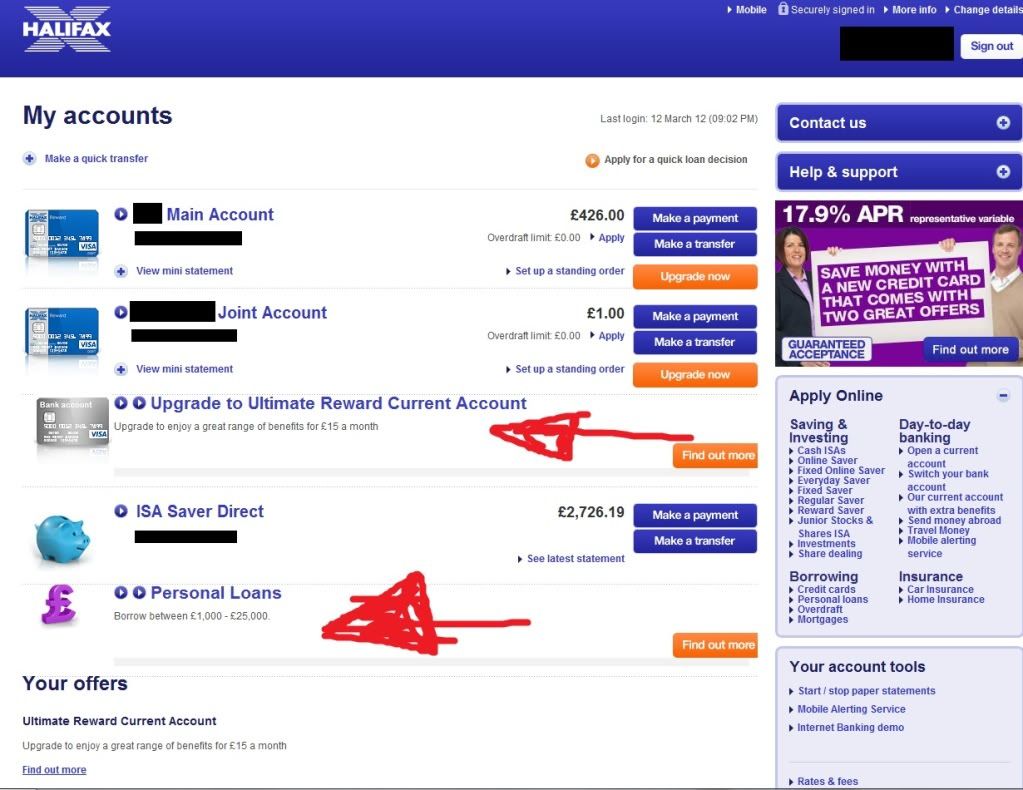

I don't have this on mine, but the missus has it on her online account & wants it removed if possible. I've arrowed the offending articles...

0

Comments

-

Click on change details (top right) and then change marketing preferences.0

-

Unless it takes 24hours to action the change, it doesn't seem to have made a difference, plus i don't remember having to do that for mine.0

-

...but be aware the "guaranteed credit card" offers may also disappear from the right hand side too?0

-

The offers on the right hand side aren't the annoyance, it's the stuff in the middle separating the accounts - specifically the upgrade notice.0

-

Unless it takes 24hours to action the change, it doesn't seem to have made a difference, plus i don't remember having to do that for mine.

You have to Logoff and then back in again for it to take effect. Doesn't take 24hrs - and it does work, provided you select the right options.If you want to test the depth of the water .........don't use both feet !0 -

correct, logging back on again worked

0

0 -

-

Aye i think so.0

-

-

Not really IMO.YorkshireBoy wrote: »So that's a downside then

My gf doesn't really like credit cards as she knows she doesn't have the willpower to make it work most effectively. She has 2 i think, which are used for big payments only (car tax, insurance, wedding ring was just purchased). All little spends are on her debit card as she feels she can control her spends better that way.

Whatever stops her spending as much works for me!!

As far as it goes for me - i have a sainsburys C/C which has been maxed. I have a Santander C/C which offers their 1%2%3% which the family use. Mainly my mum, but it only gets used on what the offers are - supermarkets & petrol stations. We have no dept stores here. It gets paid back instantly.

And i have a M&S C/C with a 4k limit which should see me right for some time, as unlike the missus, i'm not a big spender.

There is also enough in the bank to comfortably pay all cards off today if we wished. but they'll be paid off just before the 0% ends.

So in short, my missus doesn't want any more cards & i don't need any more, even if they're guaranteed.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards