We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

long term investment

Comments

-

Why do you present manufactured evidence, with no source.Meanwhile, global stock markets would have risen from 1 to over 12,000.

That's why gold was grim.

Global stock markets today are only made up of the survivors, not the bankrupts.

Anyway, there was no comparable structures 100 years ago.

..._0 -

If we take the worst price for gold in 2000, that makes the Soverign coin about £50 or 60 price at the time. So thats 4% compound gain over the twentieth century. Stocks probably can beat that especially in 2000 there was a boom just then.

Gold is purported to be cash not an investment, its obviously just a block of metal. No good reason for it to gain value really, unless it was getting used up which it is isnt. The price rises because cash becomes worth less, thats why you hold it instead especially in times of chaos.

This is where we are, sorry the movie special effects suck theres not much to see but the politics and finance especially is in turmoil. Hence the rapid appreciation is totally justified, its the reflection of a bubble.

Price rising from 1900-2000 wasnt a random mistake, it was an accumulation of cash deprecation. The acceleration since 2000 is also a reflection of increased deprecation of cash notes to any asset of tradable worth

For the last fifteen years Warren Buffet has lost money vs gold. Considering his skills, thats a strange thing to happen. If he cant choose productive companies to rise faster then gold that makes me cautious

[WB gained 550,000% since 1965

If you took an ounce of gold and invested it with him, you'd now have 19m $ or if you had kept it as an ounce of gold it would be 1,636 $

So gold is soundly trashed as an investment long term by the worlds best investor but I do not think any bank interest gained could make gold worse off then holding plain cash.

In case Im sounding too reasonable , in future I'd put my top estimate for gold ounce at $42k unless Ben proves me wrong and raises rates to 20%]0 -

Sorry just rechecked, the drop in September was more like 16% and in November/December around 14%.

Would it make any difference to your plan to sell if the drop was 20% vs 16%?0 -

Global stock markets today are only made up of the survivors, not the bankrupts.

True, but trackers hold everything.

The annualised 10-year (to June 2011 as that's the latest factsheet I have) total return of the FTSE All Share with dividends re-invested is 4.8%.

http://www.ftse.com/Indices/UK_Indices/Downloads/FTSE_All-Share_Index_Factsheet.pdf

4.8% is *well* below long-term results as a rule-of-thumb is 4% above RPI, but considering that the FTSE All Share has done that during the "lost decade" shows that equities can still do their job during even difficult times.

I haven't modelled what ongoing drip-feeding of money into the FTSE All Share versus gold would have done, but it would be interesting to perform this exercise.

Of course, 10 years is a short period for investing, and the results will often depend on which peaks and troughs you hit.I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

Why do you present manufactured evidence, with no source.

Global stock markets today are only made up of the survivors, not the bankrupts.

Anyway, there was no comparable structures 100 years ago.

..._

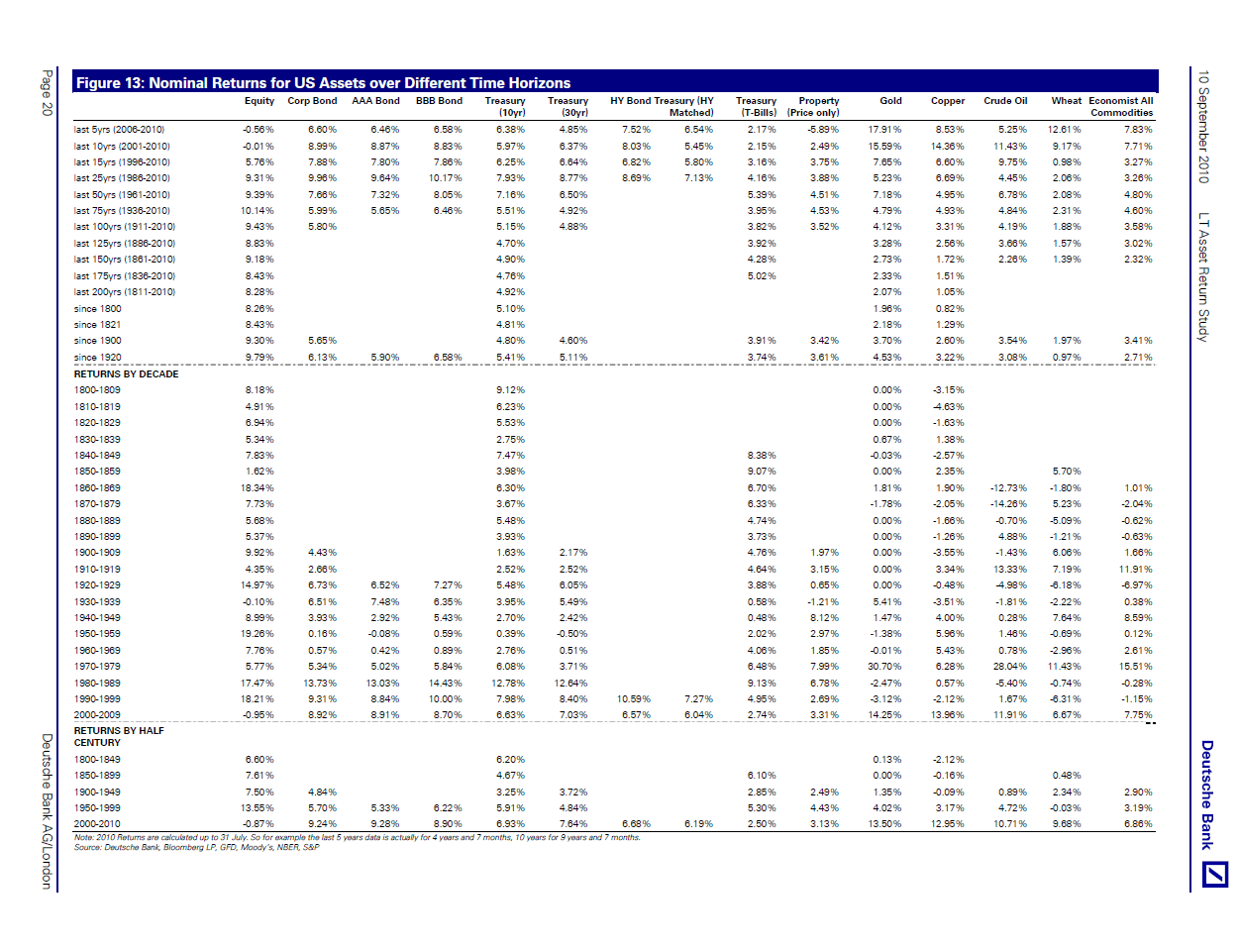

Sorry, I thought someone who understood the nature of long-term investing would already know and take as a given the well-known and generally agreed upon expected returns of different asset classes. Clearly I was wrong. Here are US asset class returns for all sorts of stuff, the UK ones aren't hard to find and are broadly similar:

See how gold has lagged behind everything except for the last decade or so. I find it deeply amusing that someone can argue that gold works as a long term investment, and then post only short-term returns as evidence of this 'fact'.

Also, it was much more likely to be the effect of interest rate hikes that fixed inflation during the time of the last gold bubble, nothing to do with 'quantitative easing working', so I have no idea how you came to that conclusion.0 -

sabretoothtigger wrote: »I do not think any bank interest gained could make gold worse off then holding plain cash.

Then you ignore the facts. Cash has a positive real return over the longer term, as I posted previously. Gold over the long term keeps pace with inflation, with perhaps a very slight positive real return, though this may be skewed by the recent ramp in gold prices.

Of course, you are ignoring the fact that nobody is proposing that someone 'invests' in cash over the long term. You are arguing against a ridiculous strawman of your own creation.0 -

Slight tangent but if gold is a one-way bet, why aren't gold miners rocketing upwards? I have Blackrock Gold and General and it has basically gone sideways over the last 6 months.0

-

Slight tangent but if gold is a one-way bet, why aren't gold miners rocketing upwards?

Because they suffer from being in volatile territories, having questionable corporate governance, and not having a great reputation of returning the spoils of their labour to their shareholders.

I ditched Gold and General last spring, and bunged the cash into Troy Trojan, and am mighty glad that I did!I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

Slight tangent but if gold is a one-way bet, why aren't gold miners rocketing upwards? I have Blackrock Gold and General and it has basically gone sideways over the last 6 months.

It goes in cycles, if you look at gold miner funds you will see they have done very well in the past, better than physical gold in fact. Eventually they are seen as overbought and investors switch to gold. Gold miners are relatively cheap again now and there has been some talk of investors switching again but it doesn't look like it is happening to any great extent yet.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards