We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Santander & their FORCED overdraft??

Comments

-

Yes, i will moan when people don't answer the question & instead stray off point because they simply can't be bothered to answer the question.Rupert_Bear wrote: »It seems to be you are just a moaner and your subsequent replies confirm this.

Yes you are.Not sure why you are so bitter.

People coming in with an attitude (namely ses6jw) for no reason. People not bothering to answer the question. You know full well why. Don't act like you don't.

PerhapsPerhaps something you ate perhaps!

Likewise. Answer the question in future. If you can't, then leave. Simple.Grow up!0 -

They also gave me a £700 overdraft, when I specifically ticked "no" on the online form, I just reduced it to £100 online. Im the same as KP83, I'll never use it as Im just using it for the incentives and the 5% interest, but I do think that if you tick "no" on the form, they shouldnt just put one on there.

KP83, how long ago did you open the account? It could be that its a bit too new to reduce it online? Just a thoughtDebt free and staying that way! :beer:0 -

IrishGypsy wrote: »I think the point the OP's trying to make is that even when he specifically didn't want an OD when applying, the system gave him one regardless (hence the 'forced' part of the post and title).

I'm not sure how the online applications are processed, but it does seem strange that it'd give you an OD when you've ticked that you didn't want one.

OP is not the only one this has happened to. jen245 has confirmed the same thing, and I'm a third.0 -

Could it be just to run a credit check?

For example they can run a more comprehensive Credit check if you take credit with them.0 -

Millionaire wrote: »Could it be just to run a credit check?

For example they can run a more comprehensive Credit check if you take credit with them.

See that's the thing, they didn't even do a full credit search with me. Only a soft search, listed as an "unrecorded enquiry" on Experian, and a money laundering search on Equifax. Checked my call credit file, nothing on thereDebt free and staying that way! :beer:0 -

Rupert_Bear wrote: »I have an overdraft facility with Lloyds of £10k.

:eek: That's like 4 months salary for me. I'm happy with £500 and never use it, it's there just in case.0 -

I went through the same procedure and as far as I could tell, an 'advanced' overdraft was in addition to the regular overdraft granted.

I think that it's strange to call it a 'forced' overdraft, it's a bit like saying they 'force' you to have a debit card if you open an account with them. Technically true, but the use of emphasis makes it seem as if you view an overdraft as a bad thing.

I have tons of bank accounts with overdrafts, some a hundred quid, some over a grand.

The only time I've ever used them is to pay bills without loss of interest, which I suppose is only useful in contrived situations with a 5% interest bearing current account.

If you have £2.5k in the account the following isn't much of an issue, but picture the following:

You make a spend via debit card, bill charged twice by mistake (assume it's something expensive like rent).

If the company refunds you later and you had an interest free overdraft, all is well.

But if you didn't have that overdraft, you'd now be chasing your bank for charges. Yes, you'll probably get them back, but it's hassle that would have been avoided.

Likely to happen? Not very. I don't spend on my debit card anyway. But overdrafts are useful for the financially sensible, and I'm not sure that they affect credit rating negatively.Said Aristippus, “If you would learn to be subservient to the king you would not have to live on lentils.”

Said Diogenes, “Learn to live on lentils and you will not have to be subservient to the king.”[FONT=Verdana, Arial, Helvetica][/FONT]0 -

As i've already bagged the £100, the only reason i'm using it is for the 5% as you say. I don't particularly like Santander, but 5% is 5% ATEOTD.They also gave me a £700 overdraft, when I specifically ticked "no" on the online form, I just reduced it to £100 online. Im the same as KP83, I'll never use it as Im just using it for the incentives and the 5% interest, but I do think that if you tick "no" on the form, they shouldnt just put one on there.

KP83, how long ago did you open the account? It could be that its a bit too new to reduce it online? Just a thought

I only applied yesterday. You make a very good point that it could be "too new" perhaps.

In the case of my gf - she couldn't reduce it at all online. EVERYTHING "exceeded" her limit, months after opening. I think in my brothers case, he couldn't reduce it one day, but the next day he could.

I'm not making a special trip for them, i'll call in when i'm in town for other things. That should give me time to test it out.

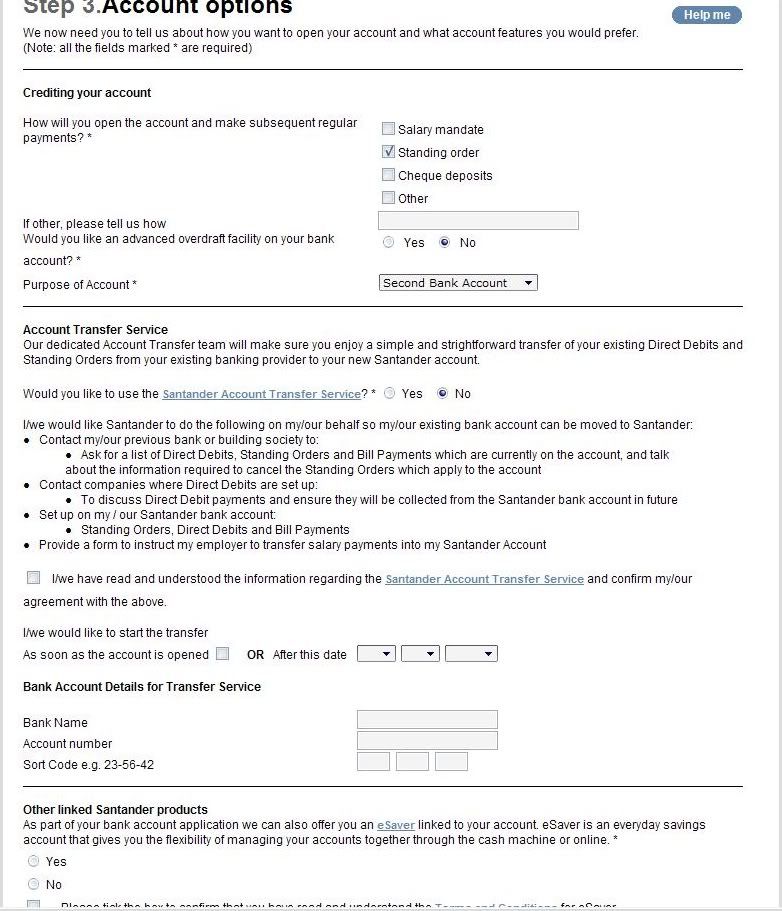

Here's the screenshot anyway:

I don't mind an overdraft on an account i "use", as i can see the benefits, even though i don't go overdrawn.MoneySaverLog wrote: »:eek: That's like 4 months salary for me. I'm happy with £500 and never use it, it's there just in case.

For example - my Santander accounts don't get "used". I dump money in them & then leave it. Cycle £1k through & job done.

However i use my Halifax reward account, so i can see the advantages of having an overdraft on THAT (& only THAT) account.

Thanks.Derivative wrote: »I went through the same procedure and as far as I could tell, an 'advanced' overdraft was in addition to the regular overdraft granted.

I disagree (& i'm right because i'm the one who said it) ... i'll explain:I think that it's strange to call it a 'forced' overdraft, it's a bit like saying they 'force' you to have a debit card if you open an account with them. Technically true, but the use of emphasis makes it seem as if you view an overdraft as a bad thing.

It's not strange to call it forced. It's forced because i don't want it, i've asked for no overdraft, yet they've given me one.

That's like being offered cake, saying no i don't want it & yet you're given it anyway. It's being forced on you.

So the use of emphasis isn't to make it sound like a bad thing, it's to make it sound like a why the hell are they ignoring me thing.

Something that Santander have done in the past a good number of times (ignoring).

"Just leave" would be the comment. Ah yes, but unfortunately, they offer some of the best rates. Top rates are top rates. When i took the ISA out - they were top. When i took the eSaver out - they were top. When i took the preferred CAs out - they were top.

I know you said that the above is pretty irrelevant, but you said it anyway.You make a spend via debit card, bill charged twice by mistake (assume it's something expensive like rent).

If the company refunds you later and you had an interest free overdraft, all is well.

But if you didn't have that overdraft, you'd now be chasing your bank for charges. Yes, you'll probably get them back, but it's hassle that would have been avoided.

To explain my situation again:

If i was actually using the account, my view would be different. I'm not so therefore it's not. It's just a "money dump". Apart from the initial deposit, nothing going in or out, other than a £1k cycle.

I was told otherwise by experian (i think it was). Now let's assume the person who told me otherwise was wrong - it still doesn't matter as i don't need one for the reasons i gave. Had it been for an account i would "use" then it may be different.I'm not sure that they affect credit rating negatively.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards