We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Home Equity increases by 2.7% in 2011

Comments

-

RenovationMan wrote: »How does that work? Are you saying that mortgage providers base their lending not on salary multiples but on affordability? That'd be a lot better if they did, but it kinda blows a hole in the 3xsalary multiple so beloved by a certain sector on this board.

What I think he is saying is that many people with IO mortgages cannot actually afford them, hence the reason why they have no repayment vehicle in place.

Essentially many of them are just renting from the bank as they have no way of paying off the capital in the end.

So how is that a good thing in the overall scheme of things?0 -

chucknorris wrote: »My memory might be failing me about endownment policies but as an alternative to those 'with profits' policies that turned out very poor. I think there was a cheaper policy that merely guaranteed to cover the repayment on maturity, without any hope of a cash surplus. If I am remembering correctly I think they did guarantee this, can anyone help me out here, was that guaranteed? If so it proved to be a quite a good repayment vehicle.

As the cost of guaranteeing the pay out was so expensive, i.e. a full with profits policy. The industry dreamt up low cost endowments. Where from a low base guaranteed amount. Investment returns would compound on this to meet the required amount at maturity. The only guarantee was on death, as the policies included life assurance.0 -

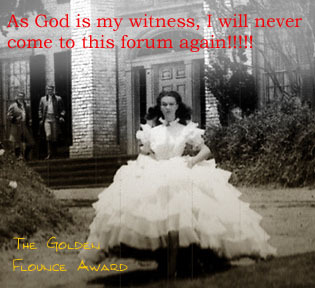

RenovationMan wrote: »Stop pressing him. In the words (kinda) of Scottie off Star Trek.. "He canna take much more Chuck, He's gonna flounce!"

Nah, I don't flounce.

Just know when I'm beat.

And at this point, there is nothing I can say or do to keep what's being said in context, as no matter what accusation is thrown, any explanation will lead to another accusation that I'm muddling or name calling.

If I leave, it'll be the same old accusation that I have lost and am hiding. If I say why I'm now leaving the convo to get around the first accusation I'm flouncing. If I try to rely on basic context I'm digging myself a huge hole ready to be told I'm muddling because pedance is the order of the day.

Therefore, I'm beat.0 -

RenovationMan wrote: »House Prices according to the Halifax fell by 1.3% in 2011, according to the Halifax Index. Given that people on a typical 25 year repayment mortgage repay 4% of their capital each year (increasing homeowner equity by 4%), the net effect of the 1.3% drop and the 4% equity gain on home owners is therefore an increase in their net equity wealth of 2.7%.

Not a bad return in these difficult times.

Following that line of argument someone who repaid 100% of their mortgage last year would have seen their an increase in their net equity wealth of 98.7%. A truly phenomenol return!!!

Of course it just might be that any increase in net wealth arising from an individual's ability to repay debt principal has more to do with what efforts they were obliged to make to earn the money to fund said repayments than anything else. But then that's just the obvious answer isn't it, so it must be wrong.0 -

Thrugelmir wrote: »As the cost of guaranteeing the pay out was so expensive, i.e. a full with profits policy. The industry dreamt up low cost endowments. Where from a low base guaranteed amount. Investment returns would compound on this to meet the required amount at maturity. The only guarantee was on death, as the policies included life assurance.

Ahh I see, so anyone with these (who didn't die) would have had an even greater shortfall then.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

chucknorris wrote: »My memory might be failing me about endownment policies but as an alternative to those 'with profits' policies that turned out very poor. I think there was a cheaper policy that merely guaranteed to cover the repayment on maturity, without any hope of a cash surplus. If I am remembering correctly I think they did guarantee this, can anyone help me out here, was that guaranteed? If so it proved to be a quite a good repayment vehicle.

AIUI, people could have taken out a full endowment policy which was guaranteed to pay out the sum assured at maturity, or a low cost endowment which was cheaper but dependent on investment returns to pay off the mortgage at maturity. People tended to go for low cost endowments, which is where all the problems arose.0 -

shortchanged wrote: »What I think he is saying is that many people with IO mortgages cannot actually afford them, hence the reason why they have no repayment vehicle in place.

Essentially many of them are just renting from the bank as they have no way of paying off the capital in the end.

So how is that a good thing in the overall scheme of things?

I guess if the above statement is true (and I dispute it, but hey ho, let's go off on this tangent because it is actually quite interesting..) then the answer to 'how is that a good thing' is...

Lets have an theoretical example, we love these on this board:

2 twins, Bill and Ted. Bill buys a house in 1995 for £40k on interest only and Ted rents the house next door. Both end up paying similar amounts and both are effectively 'renting'. Bill is renting from the bank and Ted is renting from a landlord.

Bill has security of tenure as long as he continues to pay his mortgage payments. Ted has security of tenure for 6 months as long as he continues to pay his rent. Bill has to pay for his own repairs, Ted doesn't. Bill can change the house to fit his taste, Ted can't. Bill can improve the house and increase its value, Ted can't.

Both continue to rent until 2002. Bill still has an outstanding mortgage of £40k but his house is now worth £140k. Ted is renting. Bill's mortgage payments may fluctuate with interest rates, but the capital amount is fixed at £40k. Ted pays whatever his landlord says and it increases with inflation.

I guess in this instance, the 'good thing' for Bill is security of tenure, a £120k gift from HPI and the entitlement to do whatever he likes to his house. He also has the option at the end of the 25 years (or more) to buy the house with cash because unless he MEWs, the cost price of £40k could be pocket change after 25 to 30 years of inflation.0 -

RenovationMan wrote: »I guess if the above statement is true (and I dispute it, but hey ho, let's go off on this tangent because it is actually quite interesting..) then the answer to 'how is that a good thing' is...

Lets have an theoretical example, we love these on this board:

2 twins, Bill and Ted. Bill buys a house in 1995 for £40k on interest only and Ted rents the house next door. Both end up paying similar amounts and both are effectively 'renting'. Bill is renting from the bank and Ted is renting from a landlord.

Bill has security of tenure as long as he continues to pay his mortgage payments. Ted has security of tenure for 6 months as long as he continues to pay his rent. Bill has to pay for his own repairs, Ted doesn't. Bill can change the house to fit his taste, Ted can't. Bill can improve the house and increase its value, Ted can't.

Both continue to rent until 2002. Bill still has an outstanding mortgage of £40k but his house is now worth £140k. Ted is renting. Bill's mortgage payments may fluctuate with interest rates, but the capital amount is fixed at £40k. Ted pays whatever his landlord says and it increases with inflation.

I guess in this instance, the 'good thing' for Bill is security of tenure, a £120k gift from HPI and the entitlement to do whatever he likes to his house. He also has the option at the end of the 25 years (or more) to buy the house with cash because unless he MEWs, the cost price of £40k could be pocket change after 25 to 30 years of inflation.

Past performance is no guarantee of future performance.

Doesn't help the 14.7% of total mortgage borrowers who at the start of 2007 had mortgage advances in excess of 90% LTV.

To have winners, you also need losers.0 -

RenovationMan wrote: »I guess if the above statement is true (and I dispute it, but hey ho, let's go off on this tangent because it is actually quite interesting..) then the answer to 'how is that a good thing' is...

Lets have an theoretical example, we love these on this board:

2 twins, Bill and Ted. Bill buys a house in 1995 for £40k on interest only and Ted rents the house next door. Both end up paying similar amounts and both are effectively 'renting'. Bill is renting from the bank and Ted is renting from a landlord.

Bill has security of tenure as long as he continues to pay his mortgage payments. Ted has security of tenure for 6 months as long as he continues to pay his rent. Bill has to pay for his own repairs, Ted doesn't. Bill can change the house to fit his taste, Ted can't. Bill can improve the house and increase its value, Ted can't.

Both continue to rent until 2002. Bill still has an outstanding mortgage of £40k but his house is now worth £140k. Ted is renting. Bill's mortgage payments may fluctuate with interest rates, but the capital amount is fixed at £40k. Ted pays whatever his landlord says and it increases with inflation.

I guess in this instance, the 'good thing' for Bill is security of tenure, a £120k gift from HPI and the entitlement to do whatever he likes to his house. He also has the option at the end of the 25 years (or more) to buy the house with cash because unless he MEWs, the cost price of £40k could be pocket change after 25 to 30 years of inflation.

HPI is no guarantee, particularly if you buy at the wrong time. i.e at the peak of the market.

But you make it sound all so simple RenoMan. Funny now though why banks are starting to take quite a dim view of IO mortgages these days.0 -

RenovationMan wrote: »I guess if the above statement is true (and I dispute it, but hey ho, let's go off on this tangent because it is actually quite interesting..) then the answer to 'how is that a good thing' is...

Lets have an theoretical example, we love these on this board:

2 twins, Bill and Ted. Bill buys a house in 1995 for £40k on interest only and Ted rents the house next door. Both end up paying similar amounts and both are effectively 'renting'. Bill is renting from the bank and Ted is renting from a landlord.

Bill has security of tenure as long as he continues to pay his mortgage payments. Ted has security of tenure for 6 months as long as he continues to pay his rent. Bill has to pay for his own repairs, Ted doesn't. Bill can change the house to fit his taste, Ted can't. Bill can improve the house and increase its value, Ted can't.

Both continue to rent until 2002. Bill still has an outstanding mortgage of £40k but his house is now worth £140k. Ted is renting. Bill's mortgage payments may fluctuate with interest rates, but the capital amount is fixed at £40k. Ted pays whatever his landlord says and it increases with inflation.

I guess in this instance, the 'good thing' for Bill is security of tenure, a £120k gift from HPI and the entitlement to do whatever he likes to his house. He also has the option at the end of the 25 years (or more) to buy the house with cash because unless he MEWs, the cost price of £40k could be pocket change after 25 to 30 years of inflation.

Isn't the above idea part of the potential problem? I know few people who bought as late as 2008 who could only afford the payments at interest only. Their thoughts were their house will be worth 4-5x in 25 years and as some of these don't really have a pension they are also relying the house providing a pension. Of course now we are being told on other threads that down sizing isn't really an option for a lot of the elderly at time when people's houses are worth up to 10 times what they paid so how's it going to work when people may not get even twice as much as they paid.

Also IO mortgages are normally taken out over a term ie 25 years and at the end of this the bank can demand their money back. I someone who was given 4 weeks to pay off the mortgage at the end of their term0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards