We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Home Equity increases by 2.7% in 2011

Comments

-

chucknorris wrote: »You seem to be forgetting that I am not advocating this as a desired result, in realty we own 4 houses outright and have another 5 properties with a gearing of around 50%, so very far from this position. I am merely answering your simply question which was:

Put it this way. If someone asked you a question and you got £1,000 for being correct and the question was:

Q: Do most people with an interest only mortgage have a sufficient investment / plan to pay off their mortgage at the end of the term.

A, 1. Yes

2. No.

I’m not saying it’s a good plan but I would still claim my £1,000.

I'm sorry.

I should have known better. Shouldn't have phrased the question in the way I did, expecting others to simply understand the basic context in which the question was asked.

My faux pas. Should have said "and stay living in the home" at the end of the question, just to make sure the foundations of the question were concrete and water tight.

Ultimately, I somewhat naively, assumed that others, when talking about repayment vehicles for a mortgage, (the mortgage being held and taken in the aim of buying the home), would understand the context being laid out, without it actually being spelt out. But theres a saying about assumptions. I should have thought first.

You win the internet.0 -

Graham_Devon wrote: »I'm sorry.

I should have known better.

I’m happy for you that you have learned something, although I feel you still have some way to go. What you are failing to see that in the scenarios we are exploring, being repossessed is a realistic danger, paying off the mortgage by selling is preferable (although not overall a desirable place to be) to being repossessed and going into debt.

You must always consider what the downside is in any investment.

I don’t know why you had to turn the tone of this conversation with your ‘sigh’ comment, I suppose people here just act like that for the sake of it.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

chucknorris wrote: »I can understand why others get frustrated with you on this forum now, what was your nickname? Was it Mr Muddle, seems very apt.

You go that right. It's an exercise in futility discussing anything with Devon because he'll just confuse and muddle up everything. I think another poster used to say he was a debating genius.

Well he's either muddling deliberately and in that case he is a debating genius or he's a complete ignoramus and a buffoon. I know which one my money is on....0 -

chucknorris wrote: »I’m happy for you that you have learned something, although I feel you still have some way to go. What you are failing to see that in the scenarios we are exploring, being repossessed is a realistic danger, paying off the mortgage by selling is preferable (although not overall a desirable place to be) to being repossessed and going into debt.

You must always consider what the downside is in any investment.

I don’t know why you had to turn the tone of this conversation with your ‘sigh’ comment, I suppose people here just act like that for the sake of it.

What you are failing to see is that the only person talking about reposession in any of this thread is...... you.

No one else has mentioned it. But you are arguing against it as if someone has.0 -

RenovationMan wrote: »You go that right. It's an exercise in futility discussing anything with Devon because he'll just confuse and muddle up everything. I think another poster used to say he was a debating genius.

Well he's either muddling deliberately and in that case he is a debating genius or he's a complete ignoramus and a buffoon. I know which one my money is on....

Come back geneer all is forgiven, where has he gone anyway? It's funny but I almost miss his posting now thst he's gone (weird isn't it).Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

Graham_Devon wrote: »What you are failing to see is that the only person talking about reposession in any of this thread is...... you.

No one else has mentioned it. But you are arguing against it as if someone has.

When not being able to repay a mortgage off is being discussed, the possibilty of reposession is a valid and possible outcome and as such deserves a mention.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

chucknorris wrote: »When not being able to repay a mortgage off is being discussed, the possibilty of reposession is a valid and possible outcome and as such deserves a mention.

Already answered further back on the thread here....Graham_Devon wrote: »Sigh.

Absolutely no one is talking about them being reposessed, apart from those who wish to make out all is rosier than it seems.

Why would they be reposessed when they can simply sell up and get rid of the mortgage?

The point was, how many can pay the mortgage off. Not how many will go bankrupt or be reposessed.

Yet you continue on your path of ignoring what is being talked about. Ignoring the fact I've already stated thats not what is being talked about...

....and then, as you have purposely ignored that, pretend that I'm the one confusing things.

This is pointless anyway. You've basically agreed you were going down a path of pure pedantry, only to then go on to name call and accuse others of muddying the waters. Brilliant. Win Win.

But as this is now pointless, theres not much left to discuss is there. I still don't believe most people have a repayment plan, and so far, absolutely no one has put anything forward to change that or show any evidence of anything different.0 -

Graham_Devon wrote: »Already answered further back on the thread here....

I didn't realise that I wasn't allowed to respond to your curt answer to me, I must get around to checking the forum rules one day, I seem to have missed that one when I first arrived here.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

chucknorris wrote: »I didn't realise that I wasn't allowed to respond to your curt answer to me, I must get around to checking the forum rules one day, I seem to have missed that one when I first arrived here.

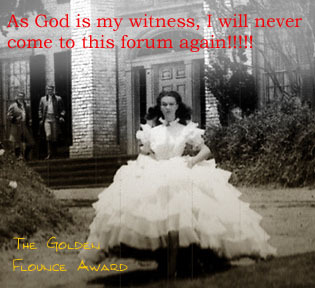

Stop pressing him. In the words (kinda) of Scottie off Star Trek.. "He canna take much more Chuck, He's gonna flounce!" 0

0 -

Thrugelmir wrote: »How many people who have endowment policies are now extending their mortgage terms to repay the shortfalls?

NR lent to anybody that was capable of putting an X on a piece of paper. Many of these borrowers believed their mortgages (and unsecured debt) would be inflated by HPI. As that's what the Daily Express said. There's still some serious sorting out to be done over the next decade.

My memory might be failing me about endownment policies but as an alternative to those 'with profits' policies that turned out very poor. I think there was a cheaper policy that merely guaranteed to cover the repayment on maturity, without any hope of a cash surplus. If I am remembering correctly I think they did guarantee this, can anyone help me out here, was that guaranteed? If so it proved to be a quite a good repayment vehicle.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards