We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

I need some sort of plan

Comments

-

I will try and start again

My Current Debts

1. Halifax Credit Card = £500

It has a £500 limit and I currently dont have a direct debit set up. Over the past 4 months it has hit £600, and I managed to get it down to £400, now it is at £500, I havnt used it for ages, I have thrown it away.

2. Capital One Credit Card = £233.65

Credit Limit

£200.00 Current Balance

£233.65 Available Credit

£0.00 Cash

Available

Amount Overlimit £33.65

Today I set up a direct debit on that card

Payment Due 14/05/2011 Min. Payment Due £19.17 Overdue Amount £18.75 Last Statement 18/04/2011 Last Payment 09/03/2011

3. Debit Card = £500 overdrawn

This is the card my wages go into, I have a £500 overdraft limit

4. Car Insurance = £500

Each month roughly £160 should of been coming out of my account to pay for my car insurance, but it was coming out of my account which I dont use and have no money in, so each time they couldnt take the payment they charged me £20.

I phoned them up the other day and they said its in the hands of the debt collectors, but I have had nothing in the post telling me what company and how I have to pay them back, so I will prob ring them sometime this week.

5. Gym Membership = £200

My old gym (David Lloyd) that I used to be a member of I owe them around £200, this is becasue I have to cancel it and have to pay I think 2 months up front, plus the 2 months I already ow them, so I think its just short of £200

I earn around £700 a month

My Outgoings Monthly

Rent = £240

Food = £20

Phone Bill = £40

Gym = £35

Hair Cut = £7.50

Going out money = £50

Total = £392.50

I get paid every 2 weeks

I want to pay the debt off asap.....but.........

I have a holiday coming up at the end of June, Magaluf

From now to then I need to save for spending money (£600ish)

Buy a passport (£90ish) and some new clothes (£100ish)

If I dont hit that £600 my mum said she will leand me £200, but thats it, she cant help with my debts.

I hope this is alot clearer and any more help would be appreciated0 -

Can you up your income? Take on an extra job? Increase your hours?

You seem to have a surplus of cash going by your SOA? Or is this not the case in reality?? If not a spending diary may be the way to go!Debt now £48,000 in the form of a mortgage 0

0 -

Can you cancel the current gym membership?

Do you have all that leftover money every month?

You haven't included anything for buying clothes, buying presents, do you buy CDs/DVDs/magazines?0 -

Will

as I see it, you need a short term plan to enable you to save enough money for this holiday THEN you need a long term plan to get you out of the mess you're in (sorry if this sounds harsh, but tough love and all that) with credit cards being over the limit, making no payment (that I can see on 1 (Halifax) plus a debt collector agency on your case about the car insurance plus another potential one for the gym (they never give up).

OK, short term:

Your outgoings are £392.50 against an income of £700, giving you just over £300 a month spare.

BUT you have set up a DD for your Capital 1 card for approx £20 per month (plus the £18.75 overdue).

This takes you down to just over £260 for the month.

Do you have 2 more pay days before you go on holiday?

If so, you should have £520 for your holiday spends, less the cost of your passport.

Do you really NEED new clothes for the holiday?

You also have the option to borrow £200 from your Mum.

To increase this amount, you could:- cut down on going out

- get someone to cut your hair for free

- check your mobile tariff to see if you are using all your minutes/texts. If not, see if you can drop down a tariff.

You appear to have a reasonable surplus (over £250 per month) - where does it all go?

If you don't have this surplus cash, you need to keep a spending diary and write down EVERY penny that you spend that isn't in your SOA i.e:- rent

- food (up to £20 per month - which sounds very little to me)

- gym

- haircut

- going out

- Capital 1 credit card direct debit

- phone

What about bus/train fares? How do you get to work?

All of these are spends and need to be in your SOA.

Then, when you know how much is REALLY left at the end of the month, you can start to tackle your other debts:- Halifax credit card

- Old gym membership

- car insurance

If you are not careful, the same will happen to the amount you owe to the gym.

And the Halifax credit card.

Just because you've thrown the card away doesn't mean you don't have to pay.

When you get back from your holiday, set up a DD for this.

Do you understand that if you just pay the minimum amount off credit cards it will take you years and years to pay it off?

Start paying more than the minimum as soon as you can.

If you get a bad credit history, it will follow you around for years.

Short term loans are NOT the answer.0 -

Will

as I see it, you need a short term plan to enable you to save enough money for this holiday THEN you need a long term plan to get you out of the mess you're in (sorry if this sounds harsh, but tough love and all that) with credit cards being over the limit, making no payment (that I can see on 1 (Halifax) plus a debt collector agency on your case about the car insurance plus another potential one for the gym (they never give up).

OK, short term:

Your outgoings are £392.50 against an income of £700, giving you just over £300 a month spare.

BUT you have set up a DD for your Capital 1 card for approx £20 per month (plus the £18.75 overdue).

This takes you down to just over £260 for the month.

Do you have 2 more pay days before you go on holiday?

If so, you should have £520 for your holiday spends, less the cost of your passport.

Do you really NEED new clothes for the holiday?

You also have the option to borrow £200 from your Mum.

To increase this amount, you could:- cut down on going out

- get someone to cut your hair for free

- check your mobile tariff to see if you are using all your minutes/texts. If not, see if you can drop down a tariff.

You appear to have a reasonable surplus (over £250 per month) - where does it all go?

If you don't have this surplus cash, you need to keep a spending diary and write down EVERY penny that you spend that isn't in your SOA i.e:- rent

- food (up to £20 per month - which sounds very little to me)

- gym

- haircut

- going out

- Capital 1 credit card direct debit

- phone

What about bus/train fares? How do you get to work?

All of these are spends and need to be in your SOA.

Then, when you know how much is REALLY left at the end of the month, you can start to tackle your other debts:- Halifax credit card

- Old gym membership

- car insurance

If you are not careful, the same will happen to the amount you owe to the gym.

And the Halifax credit card.

Just because you've thrown the card away doesn't mean you don't have to pay.

When you get back from your holiday, set up a DD for this.

Do you understand that if you just pay the minimum amount off credit cards it will take you years and years to pay it off?

Start paying more than the minimum as soon as you can.

If you get a bad credit history, it will follow you around for years.

Short term loans are NOT the answer.

Yeah, I just want to get this holiday out the way and then crack down and get the debt sorted straight away.

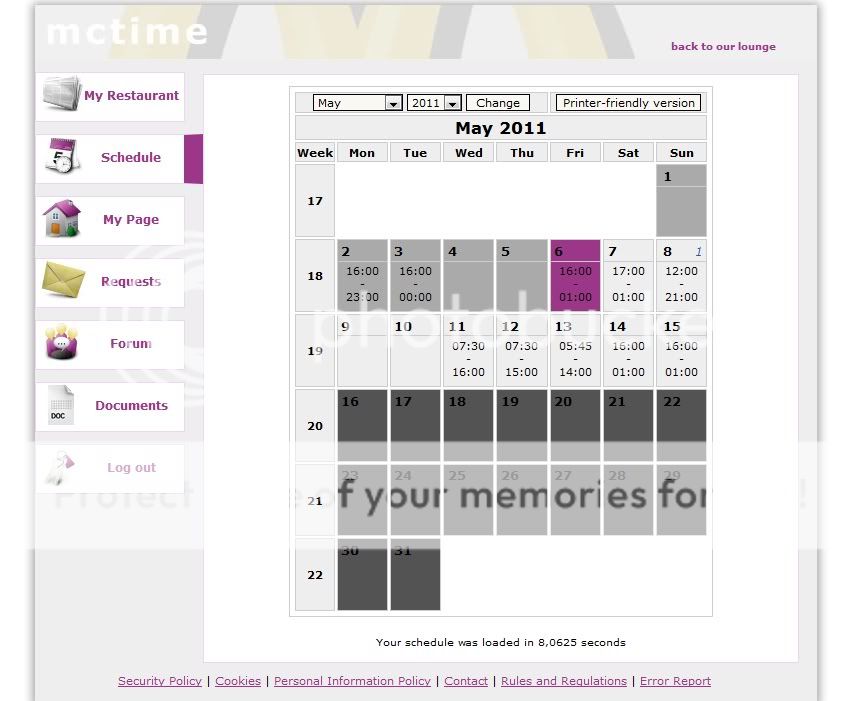

I might be able to increase my hours at work, I have 2 days off next week, I might ask if they want me to work, below is my hours, and I am on £4.94 an hour.

I dont really spend much on little things, I might buy the odd meal deal from Tescos twice a month.

And my food is about £20 a month as my sis and her bf also pay £20 so we have £60 on food a month.

Thanks for your help so far Pollycat0 -

Hi Will,

Well done for posting - it's difficult to improve on advice given but are you able to cut down youe fone bill? If you have time to spare it would be a good idea to check out the comparison websites see if you can get a better deal..

Also a lot of Debt Free Wannabee advice is all about cutting back (quite rightly) but I am a great fan of the Upping Your Income thread above in the forum section. Thanks to advice there I was able to pick up work counting votes at yeaterdays local election, £15.00 an hour, so worth looking at to get ideas.

As others have said, you need to be realistic with your Statement Of Affairs to see where every penny is going, otherwise money is 'leaking' away somewhere so you don't know where it's going so you have no control. I still keep a spending diary - maybe this sounds a bit boring but I'm

still amazed at where money goes.'Bird bird, bird is the word'Long Haul Supporter's Thread no.269The RamonesPresent debt £224365.56Debt free June 2016 0

0 -

thanks m8

0

0 -

have you asked your mum if she can leand you £2000? and pay her back monthly?0

-

-

Will

just wondering how you were doing on your short-term plan to save enough money for your holiday. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards