We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Lloyds TSB Incentive Saver

Comments

-

KirbyBirch wrote: »Depends on the different products you hold with Lloyds...

I'm assuming you have some inside information judging from your previous post (I might be assuming incorrectly). Many have posted that they only hold Vantage accounts (some hold a couple, some up to 7), and that their balances are always over £5,000. On that basis do these customers qualify?0 -

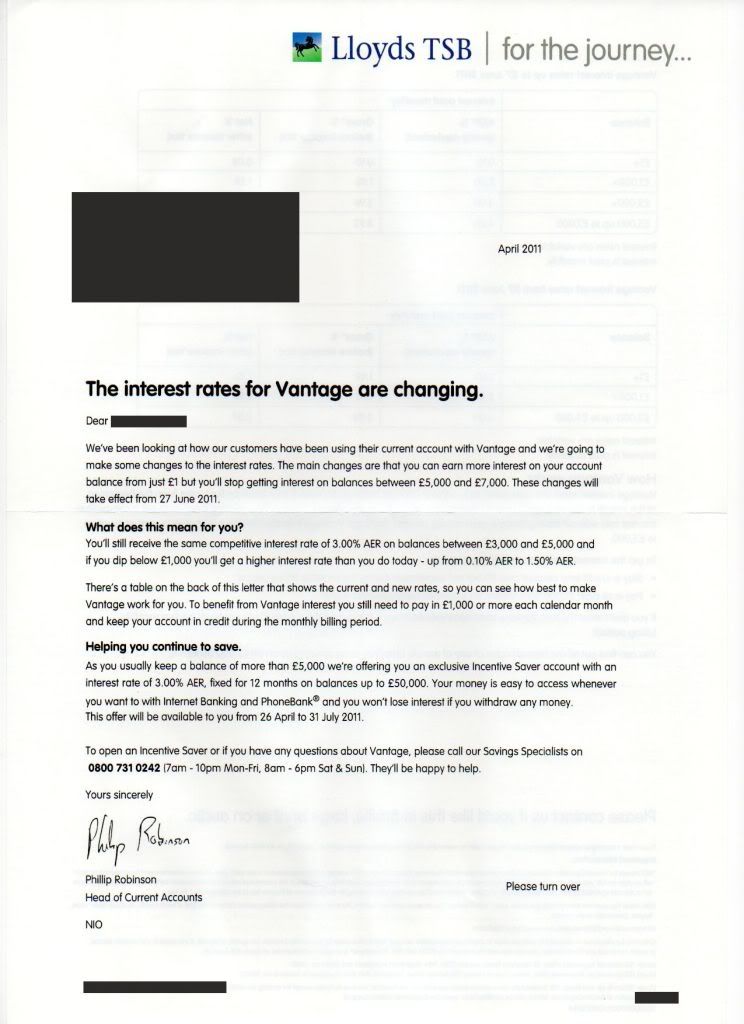

Here's a copy of the letter, received this week.

Don't know why they're being selective about who gets it.

Page 2 is just confirmation of the new Vantage rates from 27th June 2011 0

0 -

I read in the Saturday Times that Lloyds had made a statement that they would open the account for anyone with a Vantage account who requested it. (There was an article about "secret" accounts).

I had the other letter, without the offer, and with an 0845 number. I just called the 0800 number on the posted letter, and opened the account in a few minutes, with no hassle.

Thanks for posting the letter0 -

Maybe worth looking at this thread on MSE hereCan I find out my credit score?You do not have a single credit score or rating. Different organisations take different information into account when working out your credit score and may have different scores for different products. (Kindly from Experian)0

-

Just got my terms and conditions through. Despite being told on the phone it was 3 % interest fixed for 12 months and payable annually, the terms and conditions say the interest is variable and paid monthly !

I wonder if anyone has received the correct t and c's ?0 -

I got the same terms as you- variable monthly interest 3%. Maybe there's a chance the rate will increase if base rate goes up? I don't recall what I was told on the phone. If the interest rate goes down I guess we'll all be moving our money.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards