We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Shared ownership/equity is a scam.

Comments

-

Another shared ownership sad story by a MSE member.

https://forums.moneysavingexpert.com/discussion/comment/43442734#Comment_43442734

In Northern Ireland Brit, where prices have fallen over four times as much as in the mainland UK.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

I enter this thread with a sense of trepidation but I think it is important to give another positive voice. Shared Ownership wasn't a scam for me. I purchased a shared ownership flat 4 and a half years ago and in my experience it has been wonderful and worked for me. I entered into it after doing much research I was buying in Zone 2 north London on my own at 28 with a saved deposit. Nothing I could afford to buy I actually wanted to live in and then I found the flat I brought. I almost brought a flat in a new build development with the HA but then I managed to find a change of tenure flat. So I brought a one bedroom flat in a Victorian period property . Many my size have been changed into a two bedroom it is so big. Over the last four and half years I staircased twice and now I own 100% so can sell freely on the open market and can rent the flat. The price has of the flat has gone up from my original purchase price but obviously that doesn't mean anything till you actually sell but the initial value that I purchased the flat on was actually a very low value rather than overblown.

There are some negatives. Staircasing is a shag and costly. The first time I did it my legal fees and the valuation were covered because of an offer. It took a long time and was dull. However if I had brought and then sold to go up the market it would have been more costly and involved more hassle. The rent did go up, as did the service charge. The rent went up a fair bit when I staircased as they based it off the new value which I wasn't happy about and something I had missed in the small print. There are potential problems with all leasehold properties with costs for renovation being rather out of your control and you have to pay your share of the costs.

If buying think about the long term plan. I aimed to buy somewhere when you can eventually get a mortgage for the full value. My salary went up significantly over the years, as I got more experienced as I could afford more I saved more and overpaid the mortgage to show the building society that I could afford to buy more. When buying the HA seemed keen just to sell me 25% I fought and brought over 50% initially so I was buying more mortgage and less rent. Also I knew that I could be happy longterm in this flat and now i'm lucky so if I do want to leave I can rent it.Top wins in 2018: Trip to Iceland, helicopter ride over london, couples massage, £300 flight from Pringles, trip to Paris, cocktail making class and afternoon tea up the shard. .

Top wins in 2017:holiday to the Bahamas, trip to Paris, meal with champagne, a week in a manor house in France with £500 spending money.0 -

and_another_thing... wrote: »Geoffky - I was writing in response to poppysarah's message.

And please expand...

This is my third housing crash and there are still some people out there who think prices can not fall 50% and also say well London is different..its not as it has suffered more in the last crashes..thats why i said learn by history and you probably not old enough to remember the last crashes...It is nice to see the value of your house going up'' Why ?

Unless you are planning to sell up and not live anywhere, I can;t see the advantage.

If you are planning to upsize the new house will cost more.

If you are planning to downsize your new house will cost more than it should

If you are trying to buy your first house its almost impossible.0 -

This is my third housing crash and there are still some people out there who think prices can not fall 50% and also say well London is different..its not as it has suffered more in the last crashes..thats why i said learn by history and you probably not old enough to remember the last crashes...

Perhaps you'd care to point out the previous 50% UK crashes.....

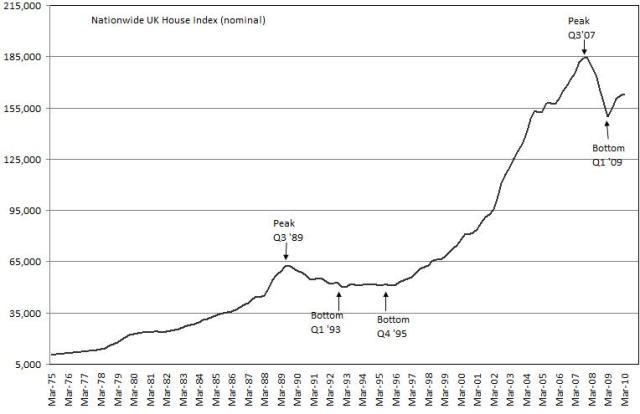

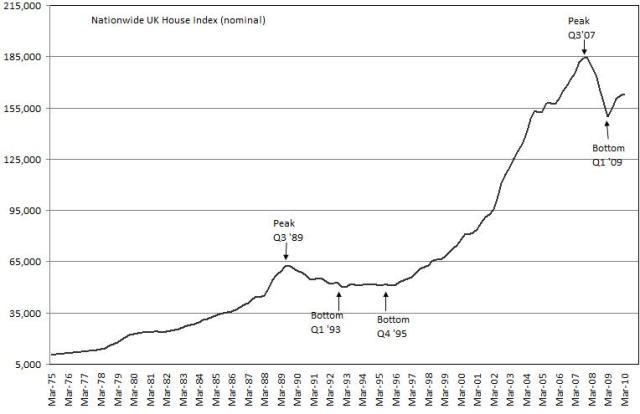

This graph encompasses the last four UK house price crashes, and you can see clearly that in actual cash terms (forget about artificial inflation adjusted indices) there has never been a crash bigger than the recent one. “The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Perhaps you'd care to point out the previous 50% UK crashes.....

This graph encompasses the last four UK house price crashes, and you can see clearly that in actual cash terms (forget about artificial inflation adjusted indices) there has never been a crash bigger than the recent one.

Forget about inflation adjusted indicies? When looking back at costs?

What are you smoking?0 -

Graham_Devon wrote: »Forget about inflation adjusted indicies? When looking back at costs?

What are you smoking?

No Graham you prize ninny, when looking back at the size of house price falls from peak as per geoffky's assertion of 50% falls in price.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »No Graham you prize ninny, when looking back at the size of house price falls from peak as per geoffky's assertion of 50% falls in price.

Yes there is absolutely no point doing it on nominal prices.

You NEVER look back, or compare rents on a nominal level. You ALWAYS use inflation adjusted figures, as it suits your viewpoint.

Stop dancing around with the figures and what you are willing to use to make your point.0 -

Graham_Devon wrote: »Yes there is absolutely no point doing it on nominal prices.

.

Graham......

If you buy a house for 200K, and want to sell it 5 years later, do you sell it in actual pounds sterling or an inflation adjusted figure?

If you buy a house, get divorced, need to sell, do you want to know if you're in negative equity in actual cash terms, or some inflation adjusted figure?

What are you on about, there's no point in nominal figures????

Honestly, what are you smoking?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Graham......

If you buy a house for 200K, and want to sell it 5 years later, do you sell it in actual pounds sterling or an inflation adjusted figure?

If you buy a house, get divorced, need to sell, do you want to know if you're in negative equity in actual cash terms, or some inflation adjusted figure?

What are you on about, there's no point in nominal figures????

Honestly, what are you smoking?

I said no point "doing it" in nominal figures (in reference to the conversation). NOT theres no point in nominal figures.

All you are doing here is giving an examble of that terrible dance you like to start doing by again, changing the goal posts within a single post to try and make your point.

The 200k in 5 years time, may, depending on inflation, get you a whole lot less, or more, than what it did 5 years previously. Hence what you are trying to do is pointless.0 -

Graham_Devon wrote: »I said no point "doing it" in nominal figures (in reference to the conversation). NOT theres no point in nominal figures.

All you are doing here is giving an examble of that terrible dance you like to start doing by again, changing the goal posts within a single post to try and make your point.

The 200k in 5 years time, may, depending on inflation, get you a whole lot less, or more, than what it did 5 years previously. Hence what you are trying to do is pointless.

Wow, the infamous Mr Muddle strikes again.

I have no idea what you're trying to say there..... I mean, I can see that you're typing in English, but the words make absolutely no sense at all.

Do you want to sober up and try again later?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards