We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

My budget wish - less FSA regulation

Comments

-

niche opportunities

Like these http://www.mrbateman.co.uk/ ?

That service seems to tick all the boxes, so you can too !30 Year Challenge : To be 30 years older. Equity : Don't know, don't care much. Savings : That's asking for ridicule.0 -

Graham_Devon wrote: »Except this time, the call is for the parent to be removed too.

And while you're at it, can you put another log on the fire please.30 Year Challenge : To be 30 years older. Equity : Don't know, don't care much. Savings : That's asking for ridicule.0 -

BUT, the taxpayer hasn't picked up the tab for any significant amount of UK mortgage or personal lending. Full stop. Because it was well managed on a risk basis.

As the FSA pointed out in their report incidentally.

But don't let the facts stand in the way of believing the contrary.0 -

Yes, yes, I'm a broker, but I earn more now that mortgages are so hard to come by, so this is not some VI plea from me.

Do you promise to speak the truth, the whole truth and nothing but the truth, so help you Conrad.0 -

Yes, yes, I'm a broker, but I earn more now that mortgages are so hard to come by, so this is not some VI plea from me.

This is about giving grown adults thier heads again. FSA regulation has severly curtailed the dreams of many a would be home owner which has a considerable knock - on negative impact on economic sentiment.

A tiny proportion of owners get repossessed, yet the curtailment of lending by FSA regulation has a hugely disproportionate effect and stops millions even get a chance at ownership. The claim made is that better regulation is about TREATING CUSTOMERS FAIRLY via prudent lending, but this takes no account of the fact millions of them are thus excluded from home ownership which creates a two tier society in this regard. In other words, in the round, far more people are not treated fairly as they don't even get shot at ownership.

I'm not going to go into all the in's and out's again, suffice to say I want to see a meaningful scaling back of FSA mortgage regulation so that millions of aspirant hard working Brits can once again follow thier dream and not be forced to rent.

For someone not making a " VI plea" you sure come across as really bothered about the FSA regulations0 -

BUT, the taxpayer hasn't picked up the tab for any significant amount of UK mortgage or personal lending. Full stop. Because it was well managed on a risk basis.

As the FSA pointed out in their report incidentally.

But don't let the facts stand in the way of believing the contrary.

Impossible to put an exact figure on it, I know, but where would we be now if the BoE had left rates where they were pre 2007, and the bank bailouts/QE hadn't happened ?

Yes, I know, the credit crunch was nothing to do with the UK, whatsoever. Our banks were doing a great job and took no part in what the Americans were up to. Personal debt in the UK was under control and everything was looking rosey. It could have continued for years like that. The average semi-detached would be around 400K by 2015, and FTBers wouldn't have the problems they have now (Ok the average FTBer would be having to pay 200K, but at least the banks would lend them that much).

You play with fire, you will likely get burned. I say put a small guard up, and don't make the fire too big. OK, the room will feel a little cooler, but nobody gets hurt.30 Year Challenge : To be 30 years older. Equity : Don't know, don't care much. Savings : That's asking for ridicule.0 -

For someone not making a " VI plea" you sure come across as really bothered about the FSA regulations

Think of the people that want to get into debt, it's all about them.30 Year Challenge : To be 30 years older. Equity : Don't know, don't care much. Savings : That's asking for ridicule.0 -

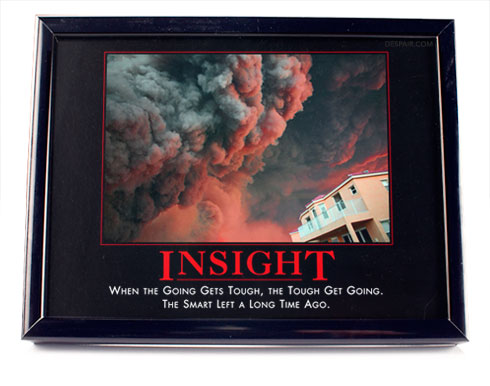

What Conrad, Hamish, me, you, FTBers ought to be asking for is more building or population control. Asking for more lending is pouring petrol on the fire. It feels lovely and warm for a while, then you pour more petrol on, then it gets a bit too hot, then.......30 Year Challenge : To be 30 years older. Equity : Don't know, don't care much. Savings : That's asking for ridicule.0

-

The whole point is that risk is best managed by assessment not rules. Rules can eradicate the possibility of risk, but they're a blunt instrument and remove niche opportunities.

The only reason there's any allowable argument about whether capitalists can take risks with their money (or their shareholders') to generate returns - and bear in mind that these returns feed through to the prudent who save, or to pensioners - is the perception that the taxpayer is underwriting the risks and has made big losses doing so because of excessive risktaking. That's a gross distortion of what happened.

The problem with basing it soley on risk assessments is that the people doing it start to beleive in their risk models too much. They place too much faith in the models correctness ignoring the facts that a model is only a guide and does not cover every scenario. Risk Managers beleive they can quanitfy every outcome when in fact the last few years have shown what the so called risk models were worth. Rules are in place to stop individuals thinking they know better than they actually do.0 -

0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards