We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Stalled auctions herald 2011 house price falls

smeagold

Posts: 1,429 Forumite

The prices of properties sold at auction slumped in December heralding falls for the wider market, according to a financial forecaster

An index, due to be published later today, will show the discount between homes under the hammer and the wider market was 26% last month, widening sharply from 20% in November....

Fathom now warns that the weak reading is close to when the collapse of the American investment bank Lehman Brothers sent financial markets into turmoil in September 2008.

'We expect to see bigger falls in house prices, as measured by the lenders' indices, as we move into the New Year. If the reading on the Fathom/Zoopla API remains close to its current level, then a double-digit fall in house prices through 2011 is on the cards.' Yesterday, an index published by Halifax, the UK's largest mortgage lender, revealed house prices fell 1.3% in December and were down 3.4% over the whole of 2010.

http://www.thisismoney.co.uk/mortgages-and-homes/house-prices/article.html?in_article_id=521083&in_page_id=57#ixzz1Brtj3BtY

Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam

0

Comments

-

But the same article quotes 'experts' Capital Economics as well.

And we all know what that means in crash code:) Hamish do you want to do it?Meanwhile Capital Economics, which has been regularly warning of property busts since 2000, predicted a fall of 10% for 2011.'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

But the same article quotes 'experts' Capital Economics as well.

And we all know what that means in crash code:) Hamish do you want to do it?

Wouldn't give it to Hamish.

If he's happy to class himself as correct because he's been predicting the price of gold will crash for around 1-2 years now, and it's recently fallen in price by 8%...

....then he'd have to accept that Capital Economics have also got it correct. Afterall, they have been saying house prices will fall for a while now...and they are falling.0 -

Graham_Devon wrote: »Wouldn't give it to Hamish.

If he's happy to class himself as correct because he's been predicting the price of gold will crash for around 1-2 years now, and it's recently fallen in price by 8%...

....then he'd have to accept that Capital Economics have also got it correct. Afterall, they have been saying house prices will fall for a while now...and they are falling.

Yes, it almost seems like they have been predicting falls from the beginning of the boom 'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0

'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

Yes, it almost seems like they have been predicting falls from the beginning of the boom

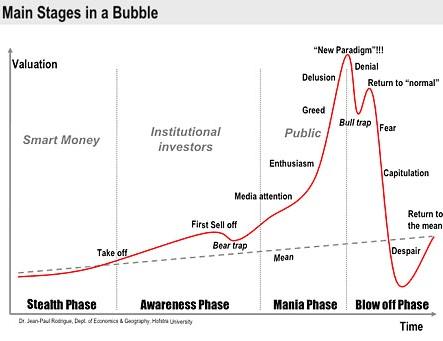

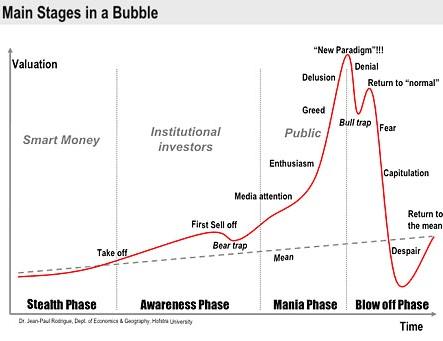

and many have been prediciting the crash of the metals for many years now also and some day they may be correct. I rather think housing will crash long before the metals though. Why? because the UK housing market has already been through its mania phase and is now rapidly deflating. The metals on the other hand are yet to experience the mania phase, we have to get through that first before we can crash. Study the history of bubbles and learn to realise where we are in the various stages of a bubble and then you will also realise where we are in the cycle of the 2 different markets we are discussing here.Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

and many have been prediciting the crash of the metals for many years now also and some day they may be correct. I rather think housing will crash long before the metals though. Why? because the UK housing market has already been through its mania phase and is now rapidly deflating. The metals on the other hand are yet to experience the mania phase, we have to get through that first before we can crash. Study the history of bubbles and learn to realise where we are in the various stages of a bubble and then you will also realise where we are in the cycle of the 2 different markets we are discussing here.

Tell you what, why don't you show me that chart again You know the one with no time scale. 'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0

You know the one with no time scale. 'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

I like this one

Stone Age geniuses Ook and Mook invent money, wealth and Taoism in one fell swoop. Demonstrating Humankind's remarkable ingenuity with financial and philosophical innovation, Non Sequitur's Stone Age geniuses Ook and Mook invent money, wealth and Taoism with only sticks and stones.

Stone Age geniuses Ook and Mook invent money, wealth and Taoism in one fell swoop. Demonstrating Humankind's remarkable ingenuity with financial and philosophical innovation, Non Sequitur's Stone Age geniuses Ook and Mook invent money, wealth and Taoism with only sticks and stones.

http://www.oftwominds.com/blogjan11/ook-and-mook01-11.html'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

Tell you what, why don't you show me that chart again

You know the one with no time scale.

You know the one with no time scale.

if you insist:):

where are we in housing? where are we in gold? have a think, something might just click.Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

Graham_Devon wrote: »he's been predicting the price of gold will crash for around 1-2 years now, and it's recently fallen in price by 8%...

A bit more than 8%, GD:

"Managed-money funds held net-long positions, or wagers on rising prices, totaling 134,473 contracts on the Comex in New York as of Jan. 18, U.S. Commodity Futures Trading Commission data showed on Jan. 21. The gold holdings have plunged for three straight weeks, dropping 21 percent since the end of December, while net-long positions in silver are down 24 percent."

For anyone who bought into the hysteria of the Gold and Silver bugs on here and bought at the height, a 21% and 24% drop would be painful to bear.

It might be the case that metals go back up, but my experience of Joe Public is that they see a market tumble like this and sell. Buy high, sell low. Its tragic really, and the main reason I rather despise these rampers, convincing the foolish to invest in something they dont understand, kidding themselves that a comodity 'only ever goes up'.0 -

RenovationMan wrote: »A bit more than 8%, GD:

"Managed-money funds held net-long positions, or wagers on rising prices, totaling 134,473 contracts on the Comex in New York as of Jan. 18, U.S. Commodity Futures Trading Commission data showed on Jan. 21. The gold holdings have plunged for three straight weeks, dropping 21 percent since the end of December, while net-long positions in silver are down 24 percent."

For anyone who bought into the hysteria of the Gold and Silver bugs on here and bought at the height, a 21% and 24% drop would be painful to bear.

It might be the case that metals go back up, but my experience of Joe Public is that they see a market tumble like this and sell. Buy high, sell low. Its tragic really, and the main reason I rather despise these rampers, convincing the foolish to invest in something they dont understand, kidding themselves that a comodity 'only ever goes up'.

Thats long positions, not price, they have dropped far more than price, amazingly resilient aren't they even in the face of fund liquidation.

I rather despise these bubble callers also who have been claiming the end of the bull for years convincing people not to invest in a commodity that has done nothing but gone up for 10 straight years, being the consisitent best returning asset for a decade. Handing out this kind of advice for a while now have you?Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

if you insist:):

where are we in housing? where are we in gold? have a think, something might just click.

We certainly have had the bull trap (return to normal) in the house prices. Now we looking over a cliff.

We also had the big sell off bear trap in silver in 2008. Now we are getting near the media attention stage (but its not front page yet) and the line is about to go straight up. :T0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards